Why ETFs are not having positive effect on Bitcoin price, yet Liam 'Akiba' Wright · 9 months ago · 7 min read

Why ETFs are not having positive effect on Bitcoin price, yet Liam 'Akiba' Wright · 9 months ago · 7 min read Why ETFs are not having positive effect on Bitcoin price, yet

It's time to HODL, now more than ever. A supply crunch is coming if ETFs can't continue to get Bitcoin OTC.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Despite the influx of substantial capital into these new spot Bitcoin ETFs, with CoinShares reporting $1.18 billion in inflows into digital asset ETFs globally last week, the expected positive impact on Bitcoin’s price hasn’t materialized. This raises questions about the underlying mechanics of these ETFs and their influence on Bitcoin’s value.

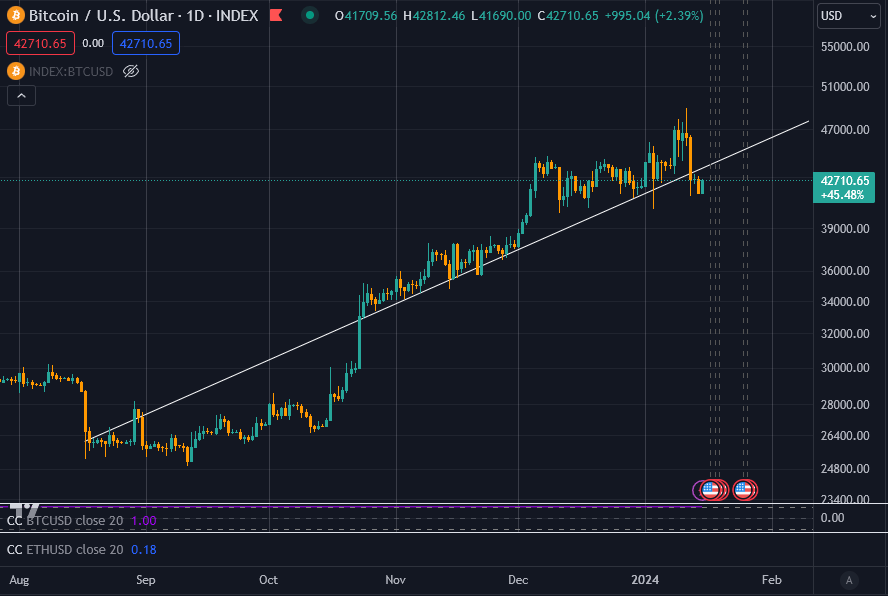

Let’s first ensure we correctly frame the situation. The recent price run-up picked up steam when BlackRock announced their filing for a spot Bitcoin ETF on June 15, 2023. At that time, Bitcoin’s price was around $25,000. Subsequently, there was a 70% increase to around $42,000, where it essentially traded sideways.

As the ETFs launched, Bitcoin spiked to $49,000 but sold off rapidly to around $42,000. Looking at the chart, it’s rational to suggest that perhaps Bitcoin was overbought at above $44,000 for this point in the cycle.

With that in mind, let’s look at how Bitcoin purchases work in relation to the recently sanctioned spot Bitcoin ETFs.

How Bitcoin is valued for ETF purposes.

The operation of spot Bitcoin ETFs is more complex than it appears. When individuals buy or sell shares of an ETF, like the one offered by BlackRock, Bitcoin is not bought or sold in real time. Instead, the Bitcoin that represents the shares is purchased at least a day earlier.

The ETF issuer creates shares with cash, which is then used to buy Bitcoin. This indirect mechanism means that direct transfers of Bitcoin between ETFs do not occur. Therefore, the impact on Bitcoin’s price is delayed and does not reflect real-time trading activity.

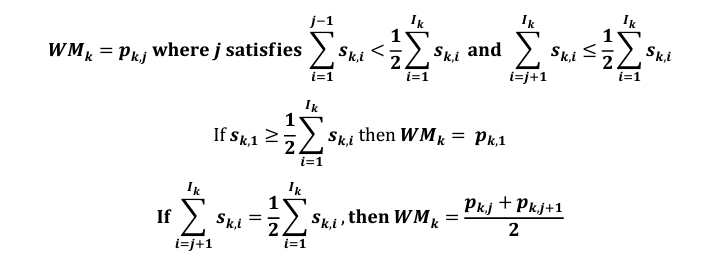

Essentially, with an ETF like BlackRock’s, the share price on any given day is meant to represent the average price for Bitcoin across standard trading hours, not the live price of Bitcoin at any given time. Most ETFs use ‘The CF Benchmarks Index’ to calculate the price of Bitcoin for any given day; the CF Benchmarks website describes it as;

“The CME CF Bitcoin Reference Rate (BRR) is a once a day benchmark index price for Bitcoin that aggregates trade data from multiple Bitcoin-USD markets operated by major cryptocurrency exchanges.”

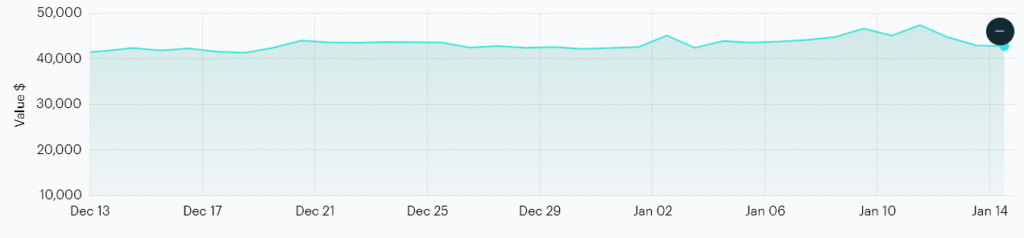

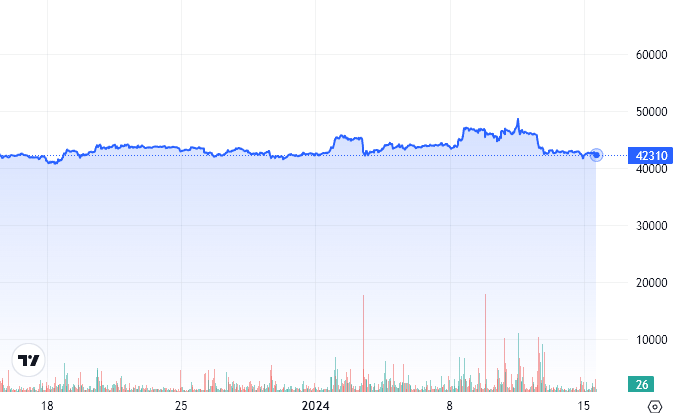

It uses an average price across Bitstamp, Coinbase, Gemini, Itbit, Kraken, and LMAX Digital. According to CF Benchmarks, this is what the price of Bitcoin looks like. Notice its recent high was $47,525 on Jan. 11.

Here is the same period and Y-axis scale using CryptoSlate data on a 1-hour timeframe. As of press time, Bitcoin is worth $42,594.27, according to CF Benchmarks, while CryptoSlate has it at $42,332.35 in real-time. This suggests the spot ETF, which is not available today as it is a public holiday in the U.S., is trading at a discount to spot Bitcoin ETFs.

I’ll be honest: I didn’t think this was what would happen when the ETFs launched. I humbly believed that the ETFs would actually track the price of Bitcoin, and institutions would buy and sell BTC relative to the traded ETF shares. How wrong and naive I was.

I read through the S1 filings in depth but did not consider that the underlying Bitcoin would be bought potentially days later via closed-door trades for average prices. I took it for granted that the CF Benchmark Index price would be a live aggregate price. Notably, that does exist, and it’s called the BRTI. However, this is only used for ‘reference’ purposes, not to calculate trade prices.

How Bitcoin gets into an ETF.

This is how Bitcoin is generally traded across the different spot Bitcoin ETFs.

Authorized Participants such as Goldman Sachs, Jane Street, and JPMorgan Securities place their creation orders for baskets of shares with a ‘Transfer Agent, Cash Custodian, or Prime Execution Agent’ by a set time on any standard business day. This is 2 pm for Grayscale, whereas BlackRock has a 6 pm cut-off time.

Following this, the Sponsor (ETF) is responsible for determining the total basket Net Asset Value (NAV) and calculating any fees. This process is typically completed as soon as practicable; for example, with Grayscale, it’s 4 pm; for BlackRock, it’s 8 pm, New York time. Precise timing here is essential for ensuring the accurate valuation of the baskets based on the day’s closing market data.

You may have seen terms such as T+1 and T+2 floating around concerning ETFs. The term “T+1” or “T+2” refers to the settlement dates for these transactions. “T” stands for the transaction date, the day the order is placed. “T+1” means the transaction will be settled the next business day after the order is placed, while “T+2” indicates settlement occurring two days later.

With the spot Bitcoin ETFs, a liquidity provider transfers the total basket amount in Bitcoin to the Trust’s vault balance on either the T+1 or T+2 date, depending on the specific prospectus. This reportedly ensures the transaction aligns with standard financial market practices for settling trades.

The execution and settlement of the Bitcoin purchase and its transfer into the Trust’s trading wallet typically happen on T+1, not when the ETF shares are purchased.

OTC Trading and its implications

A crucial aspect of this mechanism is the Over-The-Counter (OTC) trading involved. Trades are conducted between institutional players in a private setting, away from public exchanges. While not directly influencing market prices, these transactions set a precedent for exchange prices.

Suppose institutions, such as BlackRock, agree on a lower price for Bitcoin during these OTC trades. In that case, it can indirectly influence the market price if that information becomes available to the public or market makers. It does not, however, affect the live price of Bitcoin as these trades aren’t added to the global combined order book. They are essentially peer-to-peer private trades.

Further, based on the CF Benchmark Index pricing methodology, if Bitcoin were to trade at, say, $42,000 all day but then rally into close to $50,000 in the closing minutes of the day, the CF index price would likely be well under the current spot price depending on volume (and other complicated calculations made by CF Benchmarks.)

This would then mean the NAV would be calculated based on a lower price than the spot price, and any creations or redemptions for the following day would occur OTC, aiming to be as close to NAV as possible.

Any market makers who have access to these OTC desk trades are then unlikely to want to trade Bitcoin at the current spot price of $50,000, potentially removing liquidity at these higher prices and thus bringing the spot price back in line with the NAV of the ETFs. In the short term, the ETF NAVs could play a much more significant role in defining the spot Bitcoin price and, therefore, reduce volatility toward a smoother average price.

However, these trades must still occur on the blockchain, necessitating the transfer of Bitcoin between wallets. This movement, especially among institutional wallets, will become increasingly significant for market analysis.

For example, Coinbase Prime’s hot wallet facilitates trades, while institutions’ cold storage wallets are used for longer-term holding and can be analyzed on platforms like Arkham Intelligence.

I believe the more transparent these OTC trades can become, the better for all market participants. However, the visibility of these activities is currently somewhat opaque, something the SEC seemingly believes is ‘best’ for investors.

A supply crunch is coming for Bitcoin ETFs.

Yet, these desks don’t have an infinite supply of Bitcoin; it isn’t gold or cash. This limitation becomes even more relevant when considering the total liquid Bitcoin available, estimated to be between 6.2 and 11.6 million coins, or around $400 billion. As ETFs grow and the available Bitcoin supply tightens, OTC desks may be forced to acquire Bitcoin from the open market, potentially impacting prices.

A significant portion of Bitcoin remains unmovable, locked in long-term holdings or lost wallets. Over time, this scarcity of liquid Bitcoin could influence market dynamics significantly. Samsom Mow believes this may be even more imminent than I think.

By comparing the influx of Bitcoin into ETF against the issuance through mining, he argues that Bitcoin could soar to $1 million within weeks. I think there’s too much liquidity in the markets right now for this to happen, but a guy can dream.

Grayscale’s Bitcoin holdings and fee structure are notable in this ecosystem. With its higher fees (1.5%) compared to competitors (~0.2%), any redemptions from Grayscale could release Bitcoin into the OTC market, influencing average prices and market dynamics.

There is around $29 billion Bitcoin in Grayscale ready to be sold into other Bitcoin ETFs; that’s a lot of liquidity. This interplay between different ETFs and their pricing mechanisms accentuates the complex nature of Bitcoin’s market.

Final thoughts and consumer ‘protection.’

The current market state, with significant inflows into Bitcoin ETFs yet no proportional increase in Bitcoin’s price, is attributed to the delayed and averaged pricing mechanism of ETF trading. This phenomenon, coupled with institutional players operating under different rules, raises questions about market efficiency and potential’ manipulation.’

Gary Gensler worked ‘tirelessly’ to ensure that investors were protected when investing in any Bitcoin-related product. I’m sure glad that these ETFs are so clear and transparent, with no possibility for price fixing behind closed doors, and that everything is out in the open like it is on the transparent, open ledger that is Bitcoin…

The 11+ 100-page ETF prospectuses succinctly explain all aspects of how investing in Bitcoin works under Gary Gensler. Coupled with the T+1 CF Benchmark Index averaged pricing for share basket creation and redemption, the price of investing in Bitcoin has to be safer and more straightforward than ever… right?

Sarcasm aside, this is how regulated ETFs work; the spot Bitcoin ETFs are no different from similar products, and I assume those who use them understand what they are investing in.

Ultimately, the finite nature of Bitcoin (21 million coins) coupled with the halving events and market liquidity suggests that significant price impact from ETFs might continue to be delayed, but not forever. For retail investors, holding Bitcoin could influence markets by limiting the availability of Bitcoin for institutional purchases.

This scarcity could force ETFs and institutional players to source Bitcoin from the open market, potentially driving up prices.

The comparison to the GameStop’ Mother of all short squeezes’ comes to mind to highlight the potential power of collective retail action. Just as shareholders were encouraged not to sell their shares to short sellers, Bitcoin holders might influence the market by not selling their coins to ETFs. As assets under management (AUM) in these ETFs increase and the liquid Bitcoin supply diminishes, the market could shift significantly.

In summary, while OTC trading and averaged pricing mechanisms currently dominate the scene, the evolving landscape suggests that the finite supply of Bitcoin and the growing demand from ETFs could lead to notable market shifts.

“Hodling” Bitcoin could be a strategic move, now more than ever, influencing the availability and pricing of Bitcoin to institutional buyers who may soon run out of coins to purchase at these ‘average’ prices.

Update: Clarification on CF Benchmarks Index reference rate.

The U.S. spot Bitcoin ETFs use the New York variant of the BRR, the BRRNY. This rate is similar to the BRR but “calculated as of 4:00 p.m. Eastern time (“ET”), whereas the BRR is calculated as of 4:00 p.m. London time.”

Mentioned in this article

Liam 'Akiba' Wright

Editor-in-Chief at CryptoSlateAlso known as "Akiba," Liam Wright is a reporter, podcast producer, and Editor-in-Chief at CryptoSlate. He believes that decentralized technology has the potential to make widespread positive change.

News Desk

Editor at CryptoSlateCryptoSlate is a comprehensive and contextualized source for crypto news, insights, and data. Focusing on Bitcoin, macro, DeFi and AI.

Latest US Stories

Latest Bitcoin Stories

Latest Press Releases

Disclaimer: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to content within this article. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies.

Featured Story

Advertise HereIn this article

Bitcoin, a decentralized currency that defies the sway of central banks or administrators, transacts electronically, circumventing intermediaries via a peer-to-peer network.

BlackRock

Asset Management Company in North AmericaBlackRock, synonymous with global asset management, is an American multinational investment management corporation based in New York City.

Grayscale Investments

Asset Management, Bitcoin ETF Company in North AmericaEstablished in 2013 by Digital Currency Group, Grayscale Investments is a trusted authority on digital currency investing and cryptocurrency asset management.

CoinShares

Asset Management, Venture Capital Company in EuropeThe CoinShares Group is a pioneer in digital asset investing.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass