Undercollaterized loans come to DeFi project Aave (LEND)

Undercollaterized loans come to DeFi project Aave (LEND) Undercollaterized loans come to DeFi project Aave (LEND)

Photo by The New York Public Library

Just when you thought DeFi couldn’t get crazier, there’s now a method to burrow loans on zero capital.

Borrow crypto with no capital

Aave’s new Credit Delegation (CD) tool allows depositors to delegate their credit lines to others, project founder Stani Kulechov said on a tweet Tuesday.

The process allows delegated participants to borrow loans without their own capital, based on a predetermined contract confirmed on the blockchain.

@AaveAave is starting native Credit Delegation (CD). Aave depositors can delegate their credit lines. For example, Karen deposits an asset such as USDT to @AaveAave and delegates her credit line to Chad, who draws funds such as ETH from Aave Protocol. pic.twitter.com/MwU1faThIi

— stani.eth Credit Delegation is so hot right now ? (@StaniKulechov) July 7, 2020

Take A and B for example. They conclude an agreement between each other on the terms of the loan such as repayment, interest rate, and covenants.

As Kulechov revealed, OpenLaw—a ConsenSys-owned blockchain-based protocol for the creation and execution of legal forms—would be used to sign that agreement, securing the enforceability of the loan. This is similar to how DocuSign works electronically to confirm agreements.

After the agreement is in place, A can create a CD Vault smart contract, allowing for the setting of a credit line and payable currency as predetermined on the terms. B can then draw the credit via a borrow() function and repay, via repay().

The process allows A to earn higher undercollateralized lending rates while delegating credit on their deposits. B, a trusted party, can source this liquidity from Aave without collateral.

Credit Delegation allows @AaveAave to scale DeFi TVL into financial debt markets world wide, making DeFi the liquidity backbone for finance. The overall DeFi narrative expands from deposit capital to DeFi to source capital from DeFi.

— stani.eth Credit Delegation is so hot right now ? (@StaniKulechov) July 7, 2020

The implications for such a project are unfounded. There’s never been a tech-based capital delegation system prior to Aave’s CD launch—at least when millions or billions could be handled in this manner.

Crypto funds, NGOs to benefit

On the enterprise level, Kulechov noted a DeFi-focussed crypto fund could play the part of a credit delegator. Borrowers could be firms like cryptocurrency exchanges, market makers, NGOs, and governments, who are constantly sourcing liquidity for their operations.

Speaking on how the concept could be a “success,” Kulechov said:

“When we reach the point where the Aave liquidity is sourced all the way to the traditional consumers or businesses via money lenders providing diverse globally available liquidity source.”

More documentation on credit delegation will be released. But for now, the project remains limited to trusted enterprises.

For the uninitiated, Aave is an open-source and non-custodial protocol enabling the creation of money markets. Users can earn interest on deposits and borrow assets.

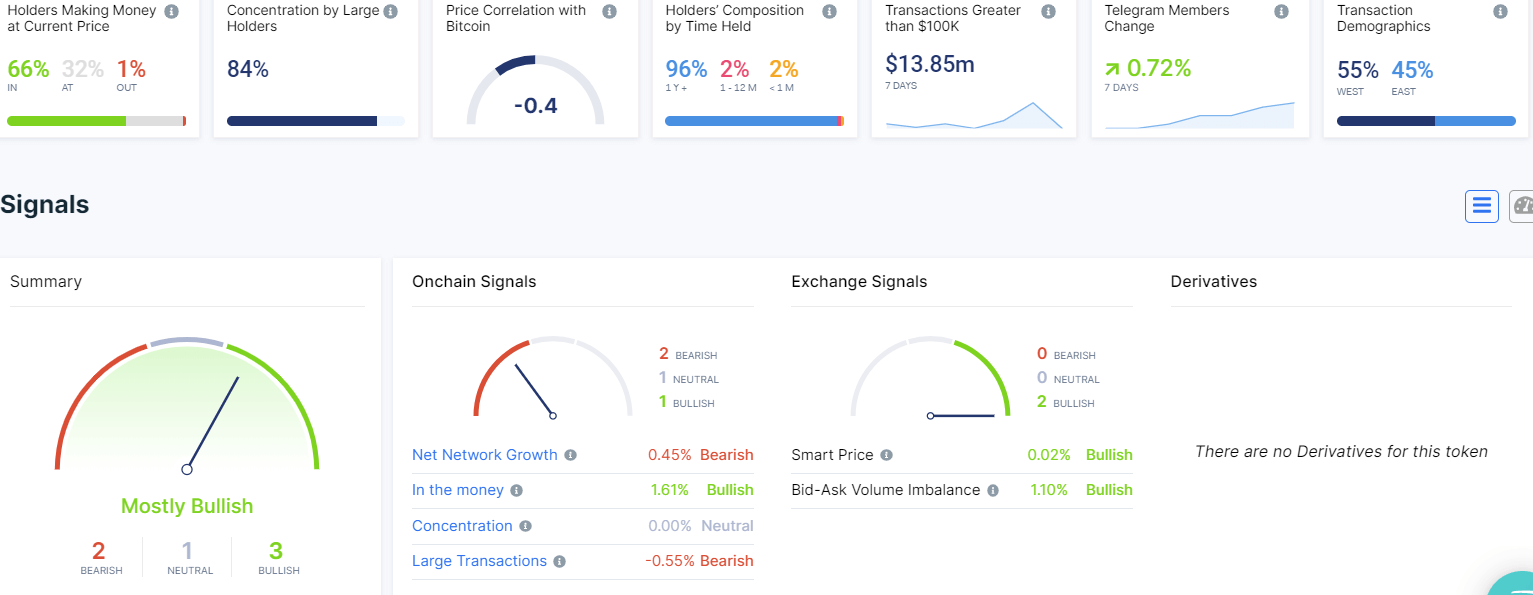

Meanwhile, IntoTheBlock data shows LEND tokens are flashing a “bullish” signal for traders. Over 66 percent of all token holders are in profit, while 84 percent of LEND is held by “large” holders.

As per CryptoSlate’s DeFi token tracker, LEND has a market cap of approximately $250 million and trades at $0.20 at press time. It has returned 47 percent to investors in the past week, and is the top gain in the sub-sector.

Farside Investors

Farside Investors

CoinGlass

CoinGlass