These 3 key factors are behind the impressive 15% upsurge of Tezos

These 3 key factors are behind the impressive 15% upsurge of Tezos These 3 key factors are behind the impressive 15% upsurge of Tezos

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Tezos (XTZ) is up 28 percent in the past three days, well-outperforming Bitcoin which has increased by 11 percent in the same period. Three major factors are behind the strong momentum of the cryptocurrency.

Three factors that are pushing the price of Tezos are thriving ecosystem supported by large grants for projects, stable asset portfolio of the Tezos Foundation, and an optimistic medium-term technical structure of XTZ.

The Tezos ecosystem is thriving with grants

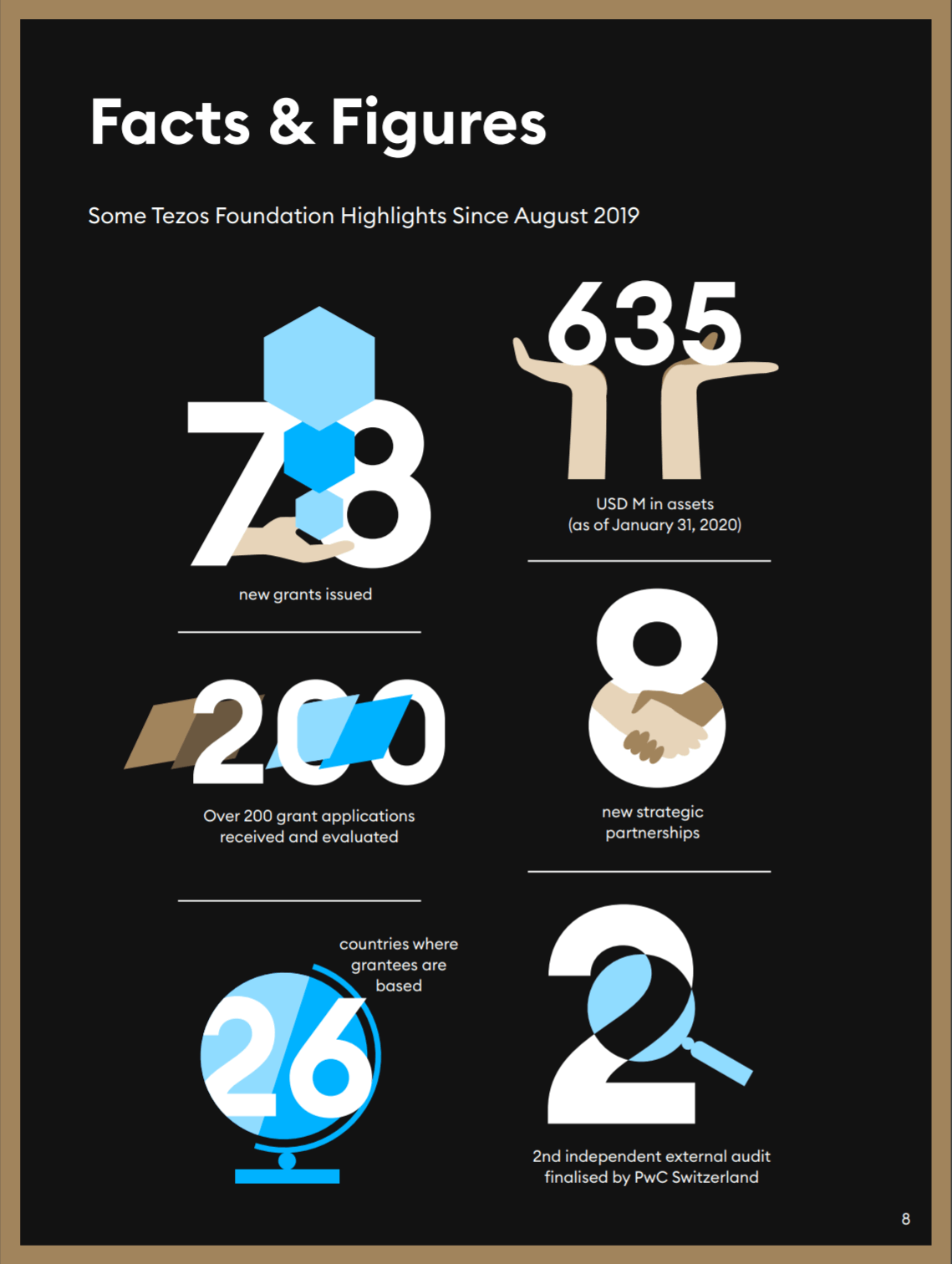

Since August 2019, within merely seven months, the foundation has given out 78 grants in total to new projects.

In its Q2 2020 report, Tezos Foundation president Ryan Jesperson said that the ecosystem is rapidly growing and the interest of projects to build on top of the blockchain network is widely increasing.

Jesperson said:

“The rapid growth of the ecosystem is clearly evident with rising interest to build on Tezos from those both inside and outside of the Tezos community. In September 2019, the Tezos Foundation announced its second cohort of Tezos ecosystem grants with 14 projects approved out of 38 applications. More recently, we were thrilled to announce the third cohort of ecosystem grants, with 21 new projects receiving grants out of 90 applications.”

As a governance protocol that operates as a foundation of blockchain applications and platforms, it is one of the few protocols that would largely benefit from having a large number of developers working on the infrastructure of its blockchain network.

Projects that received grants from the Tezos Foundation in the likes of BUIDL Labs and Blockmatics will teach new developers to code smart contracts on top of the blockchain.

Over the long-term, the grants will lead to a consistent expansion of the blockchain’s developer community, increasing productivity on the network.

Strong financials of the foundation

The official Q2 report states that as of January 31, 2020, the Tezos Foundation had $635 million in assets.

In 2017, the blockchain project raised around $232 million in Bitcoin and Ethereum in a token sale. The current portfolio of assets that the foundation has is 173 percent higher than the capital it raised during its token sale around three years ago.

A financially healthy foundation is critical in maintaining a fast growth rate of a blockchain ecosystem and encouraging more projects and developers to expand the network.

XTZ Cryptocurrency is still in a price discovery mode

The term “price discovery” is used in trading when an asset sees a new record high. When an asset breaks past its all-time high, it seeks for the next ceiling and it typically overextends to the upside.

Tezos reached its record high at $3.9 on February 19, rising by 200 percent in a single month from $1.28.

The cryptocurrency achieving a record high merely two months ago and its price rapidly recovering in a v-shape rebound since March 12 — when the Bitcoin price fell to $3,600 as the global stock market crashed — indicates a highly positive medium-term technical trend for XTZ.

Tezos Market Data

At the time of press 2:58 am UTC on Apr. 25, 2020, Tezos is ranked #10 by market cap and the price is up 4.8% over the past 24 hours. Tezos has a market capitalization of $1.91 billion with a 24-hour trading volume of $347.68 million. Learn more about Tezos ›

Crypto Market Summary

At the time of press 2:58 am UTC on Apr. 25, 2020, the total crypto market is valued at at $216.48 billion with a 24-hour volume of $124.17 billion. Bitcoin dominance is currently at 63.94%. Learn more about the crypto market ›