Seven things the DeFi suite can do for you in 2021

Seven things the DeFi suite can do for you in 2021 Seven things the DeFi suite can do for you in 2021

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

DeFi was the hottest topic of the year in the 2020 crypto realm. It has ruffled feathers and disrupted the financial world as blockchain technology transcends simple value transfer to include other financial services.

DeFi is a game-changer, innovation at the forefront, a promise, the next step to a global financial ecosystem where anyone, anywhere, at any time can access a variety of financial services. This goes beyond being able to transfer bitcoin or other cryptocurrencies across the world instantly and seamlessly. DeFi makes savings, loans, trading, insurance, and more accessible to anyone around the world with a smartphone (or supported wallet) and internet connection.

Short for decentralized finance, DeFi revolves around an ecosystem of decentralized applications (dApps) built on top of a blockchain network. Almost all DeFi applications are built on the Ethereum blockchain, which is primarily designed to create and execute smart contracts. These smart contracts are programs running on the blockchain that deploy automatically when specific conditions written into the contract are met.

As a simple example, a smart contract can be programmed to release funds to another user for Christmas each year. But smart contracts can also enable developers to build sophisticated dApps that provide functions beyond sending and receiving cryptocurrency. DeFi dApps can create stablecoins, lend out money and earn interest, take out a loan, exchange one asset for another, or even implement advanced automated investment strategies.

Here is a list of seven of the most popular types of applications in the DeFi suite and what they can do for you:

1. Decentralized exchanges (DEXes) where you own your keys

A DEX allows users to buy and sell their crypto with one another directly through a smart contract on the Ethereum blockchain, without a central authority. It effectively cuts out any middlemen (especially centralized crypto exchanges) so users can regain control of their finances and no longer need to entrust their money with governments, financial institutions or central banks.

Decentralized exchange platforms (DEXes) such as AirSwap Team, Bancor, IDEX, paraswap, and SushiSwap all have slightly different architectures.

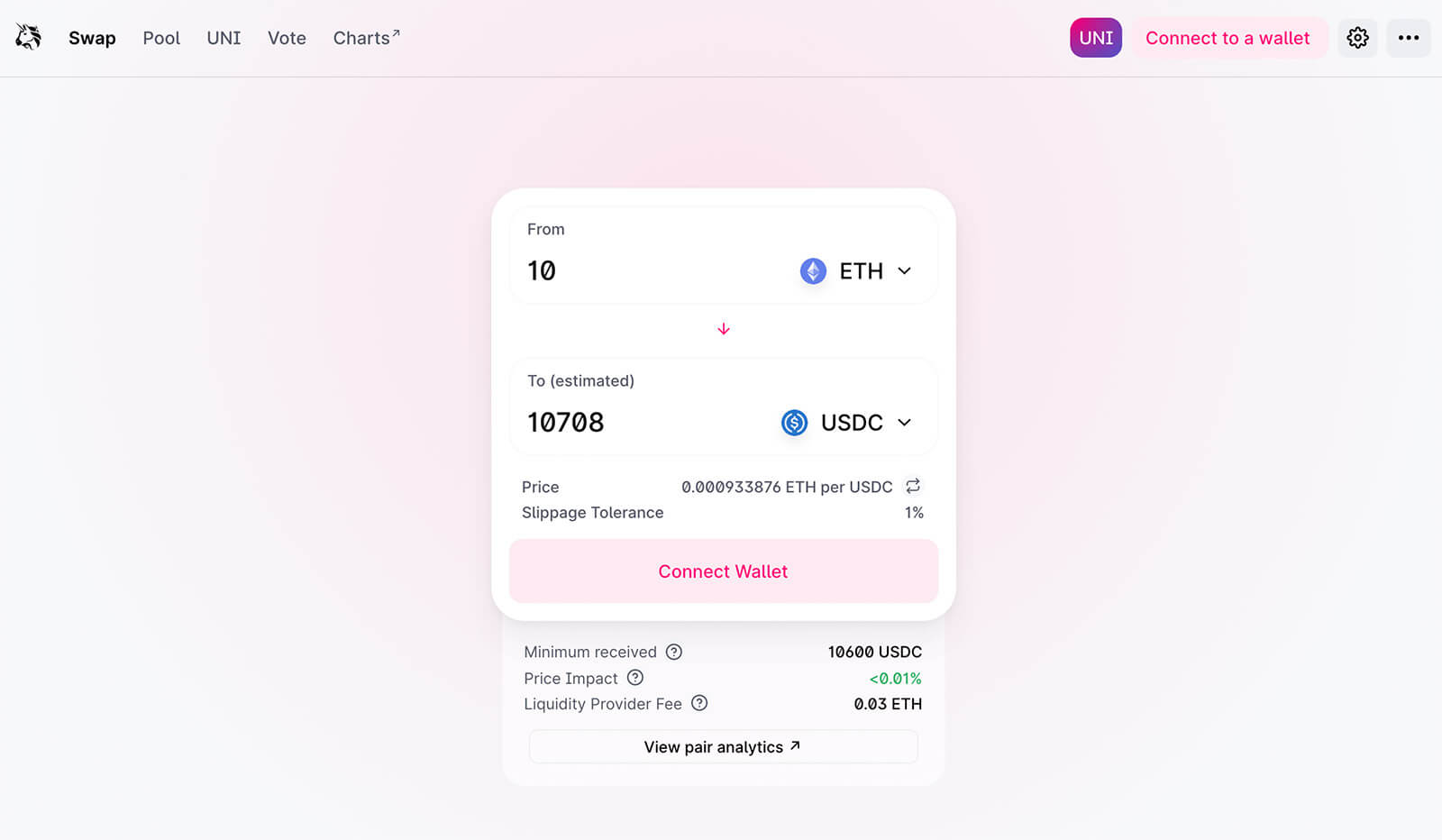

One of the most popular DEXes at the moment is the decentralized trading protocol UniSwap. Uniswap is a fully decentralized cryptocurrency exchange that uses Automated Market Making to automatically settle trades and lets users trade popular tokens directly from their wallets.

In an unprecedented move to show gratitude to their early community members, Uniswap conducted an airdrop in October, giving away 400 UNI to each address created before September 1, 2020, that conducted at least one transaction on Uniswap v1 or v2. At the time, 400 UNI was worth between 1,600 and 3,200USD, and currently hovers under 1,000USD.

Users with multiple addresses have really benefited from this unexpected gift. Furthermore, in the latest version of Uniswap (launch yet to be announced), UNI token holders will receive a percentage of each transaction that goes through the platform.

2. Borrowing and lending — Higher yields, lower cost

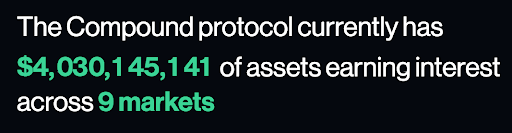

Arguably the fastest-growing sector of DeFi, borrowing and lending platforms connect parties through smart contracts rather than leaving the management up to banks. Lenders can provide loans to businesses or deposit money and earn interest as others borrow their assets. Since middlemen are cut out of the exchange, lenders are able to earn higher returns.

Compound is an example of a popular blockchain-based borrowing and lending dApp. Users can lend out their crypto and earn interest on them, or deposit cryptocurrencies to the Compound smart contract as collateral in order to borrow funds. Due to its decentralized nature, users don’t have to specify their personal details (name, financial history, etc.) and their collateral is enough to get a loan. The borrowing/lending rates are algorithmically adjusted based on supply and demand.

3. Stablecoins — Instant processing, lower volatility

Stablecoins are less volatile cryptocurrencies as their price is pegged to a reserve asset such as the US Dollar or commodities like gold. Combining this elimination of doubt over value volatility with instant processing, and the security and privacy of crypto payments, they offer a strong value proposition.

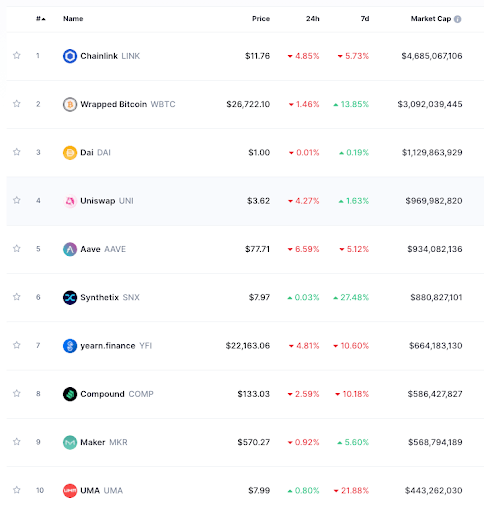

Wrapped Bitcoin (WBTC) is one of the top DeFi tokens by market capitalization, in second rank with a market cap of approximately 1.6 billion USD at the time of writing. WBTCs are a method of sending bitcoin to the Ethereum network so they can be used directly in Ethereum’s DeFi system. It allows users to earn interest on the bitcoin they lend out via decentralized lending platforms. Other popular DeFi stablecoin projects include MakerDAO (DAI) and USD Coin (USDC).

4. Prediction markets — Bet with lower fees and better odds

Decentralized prediction market protocols allow users to bet on the outcome of future events, such as elections, without intermediaries. Traditional betting platforms tend to maximize the amount of value they extract from customers with high fees, low odds and all sorts of limitations.

Blockchain-based prediction markets like Augur and Guesser are changing this by providing a decentralized, peer-to-peer exchange that enables global and transparent access to its markets.

Users keep more of their winnings due to low fees and better odds (thanks to the wisdom of the crowd). An observation from CoinDesk points out that:

“DeFi has the potential to boost interest in prediction markets, since they are traditionally frowned upon by governments and often shut down when run in a centralized manner.”

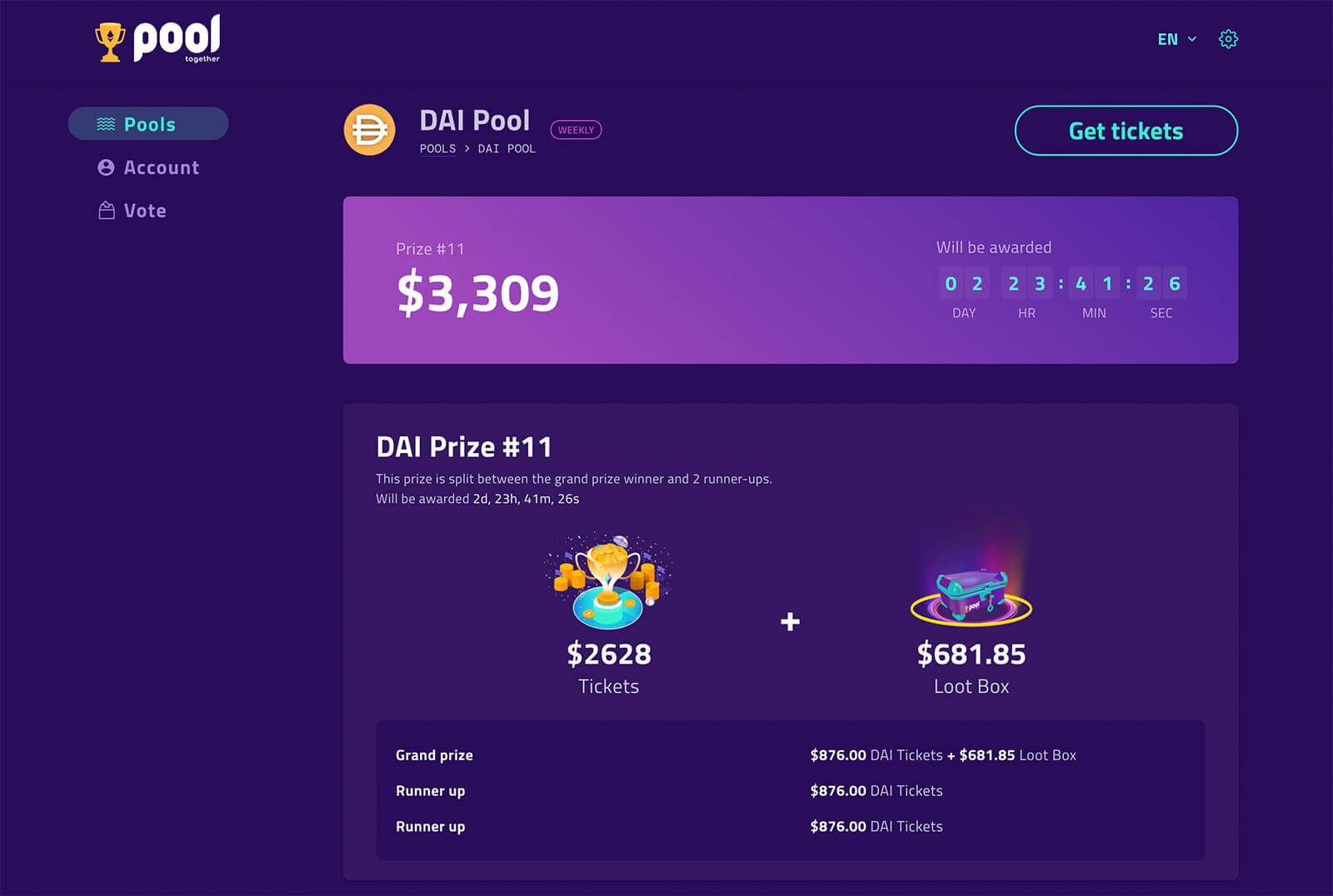

5. No-loss lotteries — Play the lottery without losing your money

Another DeFi service includes participating in a no-loss lottery. PoolTogether is a no-loss game where participants deposit DAI stablecoins into a common pot. At the end of each month, a lucky participant wins all the interest earned and everyone else gets their initial deposits back.

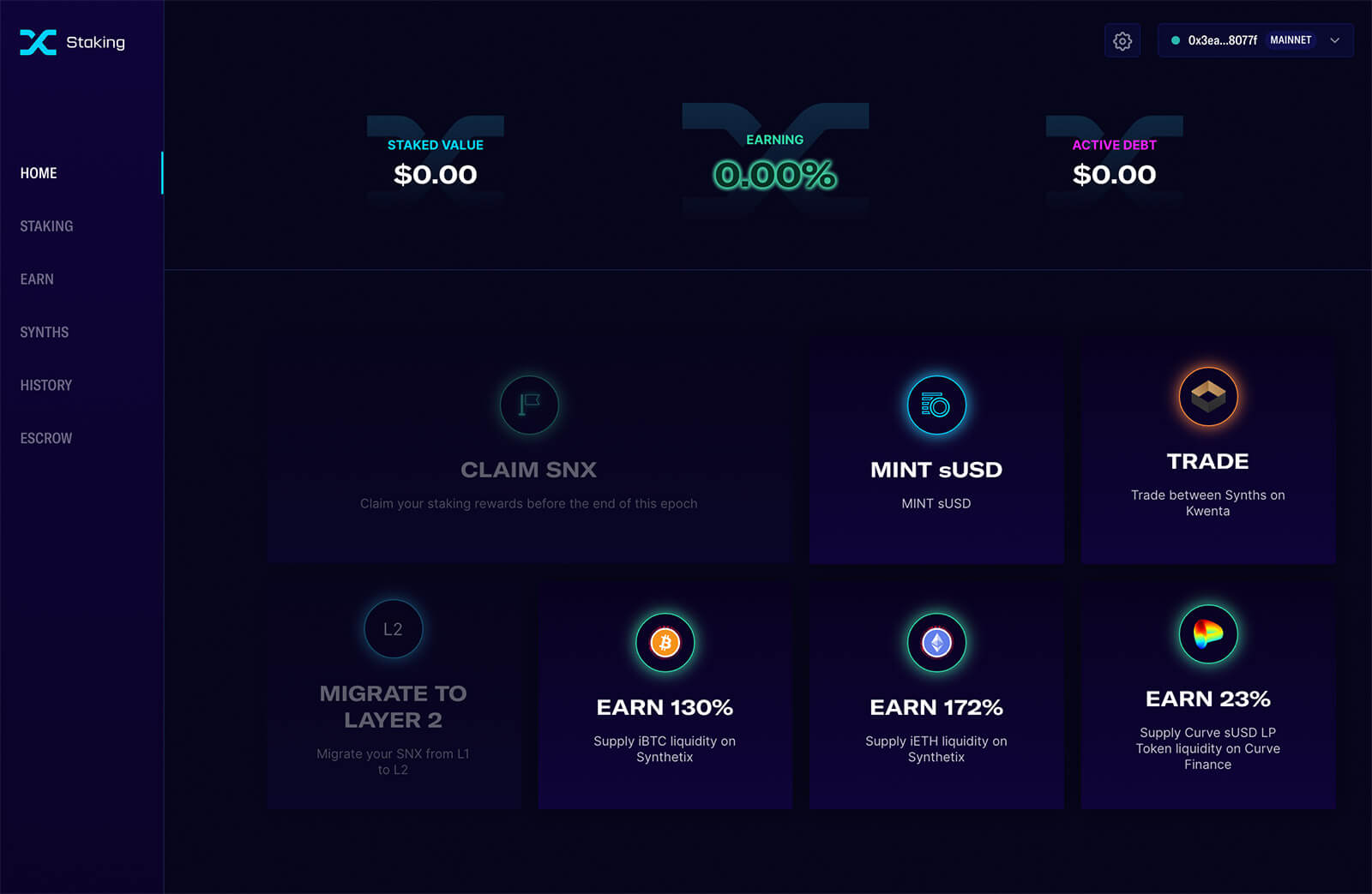

6. Synthetic assets — Bet on real-world assets without holding them

Synthetix is a token trading platform built on Ethereum that allows users to create and exchange synthetic versions of real-world assets. It allows users to bet on crypto assets, stocks, currencies, precious metals and other assets in the form of ERC-20 tokens, without holding the actual asset. The synthetic assets are backed by excess collateral locked into the Synthetix contracts.

Synthetix rose to the top of the DeFi dApp charts in 2019 and has focused on transitioning to a decentralized governance structure in 2020. The big Synthetix feature that many are anticipating is when it attains the “ability to trade stocks like Tesla and Apple on top of Ethereum”.

Trade stocks like Tesla and Apple on top of Ethereum, without ever holding the actual shares.

7. Robo-advisors — Automated smart contract-based investment portfolios

Although relatively nascent to the DeFi scene, investors in DeFi can generate the highest possible yields with the help of robo-advisors. Investors would normally need to keep a constant eye on contracts and quickly reallocate in order to get the best yields. But now a robo-advisor (designed and set through a smart contract) can conduct the monitoring and allocating for investors. For example, an investment pool with five million worth of ETH in it will automatically be moved to a platform that offers the highest percent for collateral on ETH-based derivatives.

Staked’s Robo-Advisor for Yield (RAY) and Rari Capital are two popular robo-advisors that automate the process of finding high-yielding opportunities. RAY targets investors holding ETH, USDC or DAI, who can put their assets into a pool and let the smart contract automatically invest the pool (or part of it) into contracts with the best yield. Rari Capital operates on the same principles, but takes things a step further by offering three separate pools for users with different risk appetites.

Conclusion

With today’s DeFi suite, users can exchange cryptocurrencies through a decentralized platform, obtain a loan through a borrowing and lending platform, earn interest on their cryptocurrencies, bet in decentralized prediction markets with lower fees and better odds, enter no-loss lotteries, bet on synthetic real-world assets without holding them, invest strategically with the help of robo-advisors, and more. This is what DeFi can do now, and this article only highlights seven of the most popular use cases.

As an evolving and developing field, DeFi has yet to unleash its full potential. Its talents, its strengths, its risks, its possibilities, we’re still in the process of discovering them all. DeFi will continue to push boundaries, break down walls, and create havoc (regulators, I’m looking at you) in the financial industry. It’s the next step in a movement that aims to create an open-source, permissionless, and transparent financial service ecosystem available to anyone, anywhere, without the involvement of a central authority.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors