New Grayscale trust filings spin rumour mill into overdrive for Cardano, Polkadot, Cosmos and more

New Grayscale trust filings spin rumour mill into overdrive for Cardano, Polkadot, Cosmos and more New Grayscale trust filings spin rumour mill into overdrive for Cardano, Polkadot, Cosmos and more

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

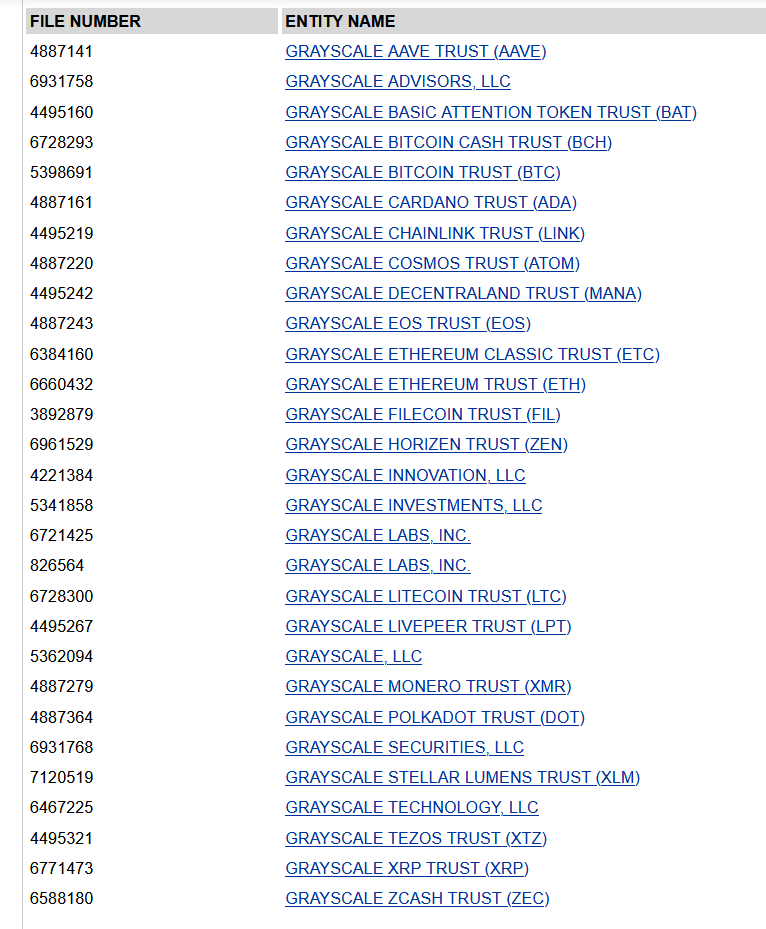

Crypto asset manager Grayscale Investments filed new trusts for Aave, Cardano, Cosmos, Monero, and Polkadot in the Delaware corporate registry.

As expected, each respective community is bullish over the news. However, filings do not necessarily mean Grayscale will follow through with them. The firm commented on the matter by saying filings relate to preparation for possible trust launches. But that in itself is no guarantee of any future launch.

A Chainlink filing was made at the Delaware corporate registry office a week ago, fanning speculation over the imminent introduction of a Grayscale Chainlink trust.

This was followed by a +20% breakout performance from LINK and a subsequent new all-time high, at $25.36.

In conjunction with the news, Grayscale CEO Michael Sonnenshein had also posted a Justin Sun-style teaser tweet saying:

“Stay tuned CT, @Grayscale and I have something good for you in the AM! (yes, that was the announcement of the announcement)”

But much to the Link Marines’ disappointment, this tweet later turned out to relate to a $1 million donation and pledge match to Coin Center.

Coin Center is a non-profit organization based in Washinton, DC, that advocates public policy concerning cryptocurrencies. Its mission is to promote regulatory change that’s conducive to blockchain innovation.

#JoinTheMatch: We’re donating $1 million to @coincenter and pledging to match up to an additional $1 million in donations through the month of February.

You can match our donation here. ⬇️https://t.co/pNf6wNoCPi pic.twitter.com/Ptsiz6RIs2

— Grayscale (@Grayscale) January 25, 2021

At the time, Grayscale, or more accurately, its trustees, the Delaware Trust Company, also filed trusts for Basic Attention Token, Decentraland, Filecoin, Livepeer, Tezos, alongside Chainlink.

Analysis of the new filings shows a strong DeFi flavor amongst the selection. However, with FATF pressure and the ensuing clampdown on privacy coins, Monero makes a surprising entry for trust consideration.

The Grayscale Q4 report

Grayscale is the largest cryptocurrency asset manager with $20.2 billion under management at the end of 2020. They currently offer 8 single asset trusts and a diversified large-cap trust.

The biggest of which is the Bitcoin trust with holdings of $17.5 billion. In comparison, the next largest is the Ethereum trust at $2.2 billion.

Grayscale’s latest quarterly report shows a record-breaking quarter with $3.3 billion of inflows. More significantly, heightened investor demand has led to a bumper year in which total 2020 inflows were four times greater than the cumulative inflows for the six years from 2013.

“$3 Billion Dollar Quarter: Grayscale experienced unprecedented investor demand, with approximately $3.3 billion of inflows. Investment into the Grayscale family of products surpassed $5.7 billion during 2020, more than four times the $1.2 billion cumulative inflow into the products from 2013-2019.”

The firm said this is largely due to institutions piling in, especially during Q4, in which more than half of total yearly inflows came in the last quarter.

CoinGlass

CoinGlass

Farside Investors

Farside Investors