Investors flock to Bitcoin after Ethereum’s Shapella upgrade

Investors flock to Bitcoin after Ethereum’s Shapella upgrade Investors flock to Bitcoin after Ethereum’s Shapella upgrade

The total value of assets under management for blockchain equities reached $1.9 billion — its highest since October 2022.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

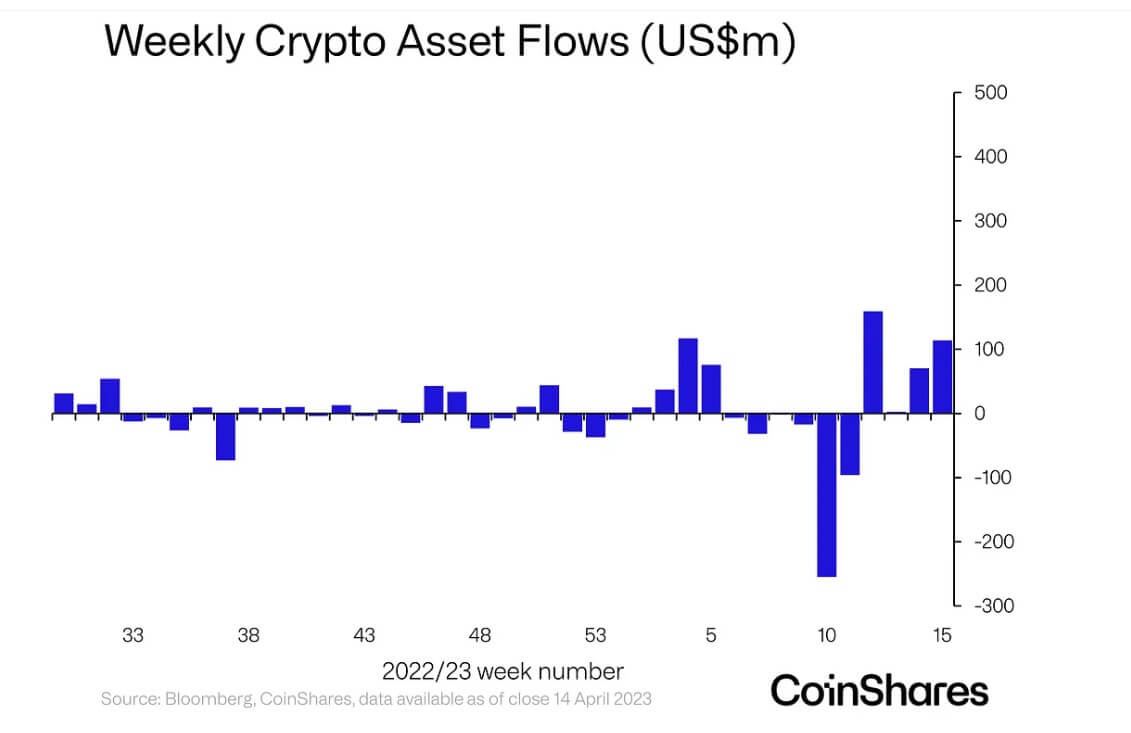

Digital assets investment products saw $114 million in inflows during the week of April 11 as investors pumped money into Bitcoin (BTC), according to CoinShares’ report.

The past week’s inflow marks the fourth consecutive week for crypto products. According to CoinShares, inflows during this period now total $345 million.

Bitcoin inflow tops $100 million

BTC dominated inflows to crypto investment products, seeing 91% — $104 million — of all the investments for the week.

The flagship digital asset traded above $30,000 for the first time in almost a year. Its adoption also rose to a new all-time high as more addresses were holding at least 0.1 BTC than ever before.

Meanwhile, CoinShares investment strategist James Butterfill wrote that the BTC inflows indicate a “flight to safety by investors fearful of the ongoing traditional finance challenges.”

Butterfill added:

“This improving sentiment comes at a time of very low volumes in the Bitcoin market, averaging just $5.6 billion per day compared to $12 billion for the full year.”

However, he noted that “opinion remains divided” because Short Bitcoin products also saw inflows of $14.6 million.

BTC’s total inflow on the year-to-date metric is around $78 million.

Ethereum, others see minimal inflow

Ethereum (ETH) saw an inflow of $300,000 during the past week despite the completion of its Shapella upgrade. The Shappella upgrade is the first major ETH network update since the Merge and would enable validators to withdraw their staked ETH.

The upgrade positively reflected on ETH’s value, pushing it above $2100 for the first time since May 2022. As of press time, over 1 million ETH have been withdrawn.

According to Coinshares, there was little activity in altcoins except for Polygon (MATIC) and Solana, (SOL) which saw $2.1 million in outflows, respectively.

Meanwhile, blockchain equities returned to their pre-FTX levels as they saw inflows of $5.8 million during the week under review. The total value of assets under management for this product reached $1.9 billion — its highest since October 2022.

Farside Investors

Farside Investors