GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows

GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows Quick Take

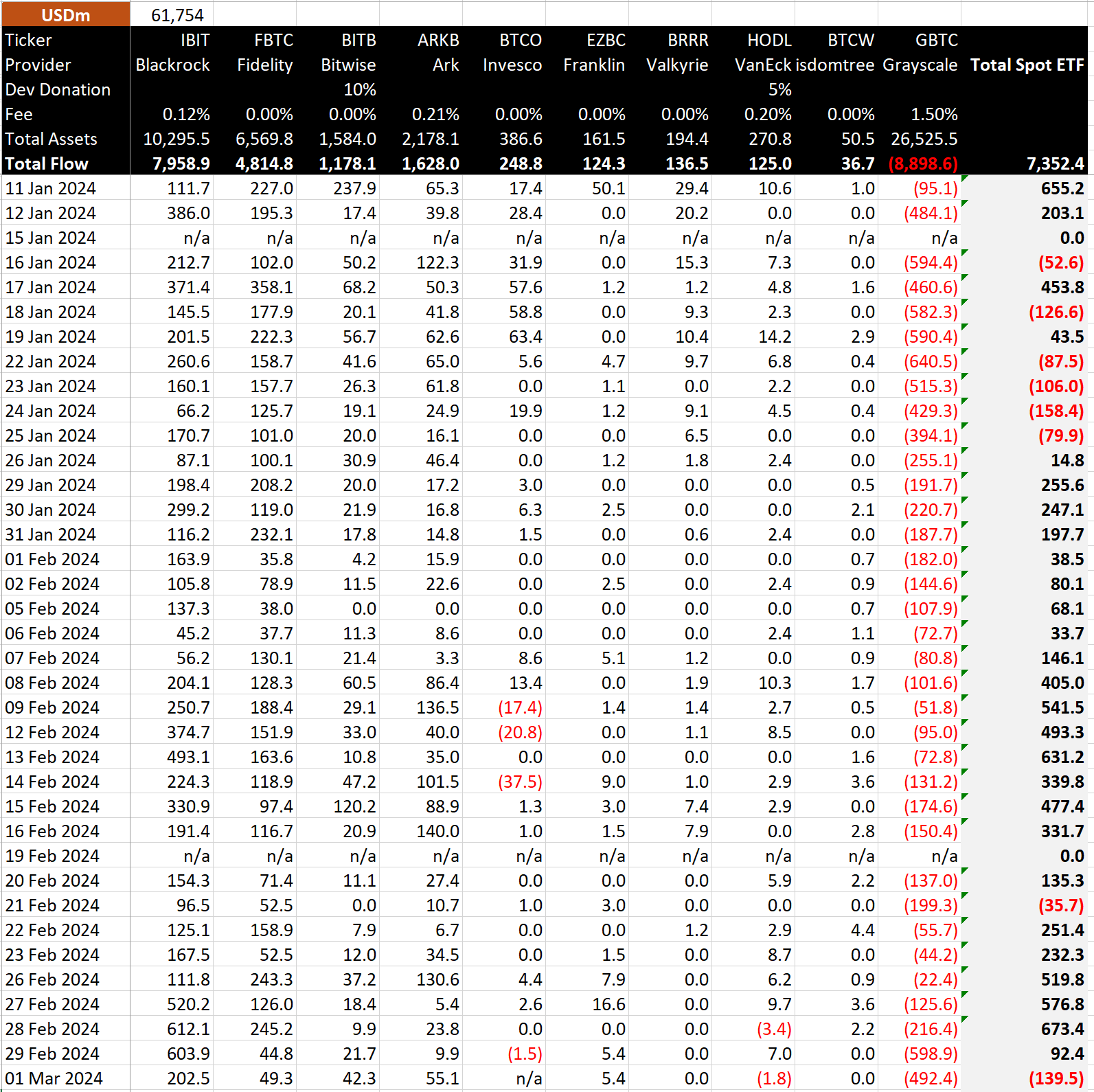

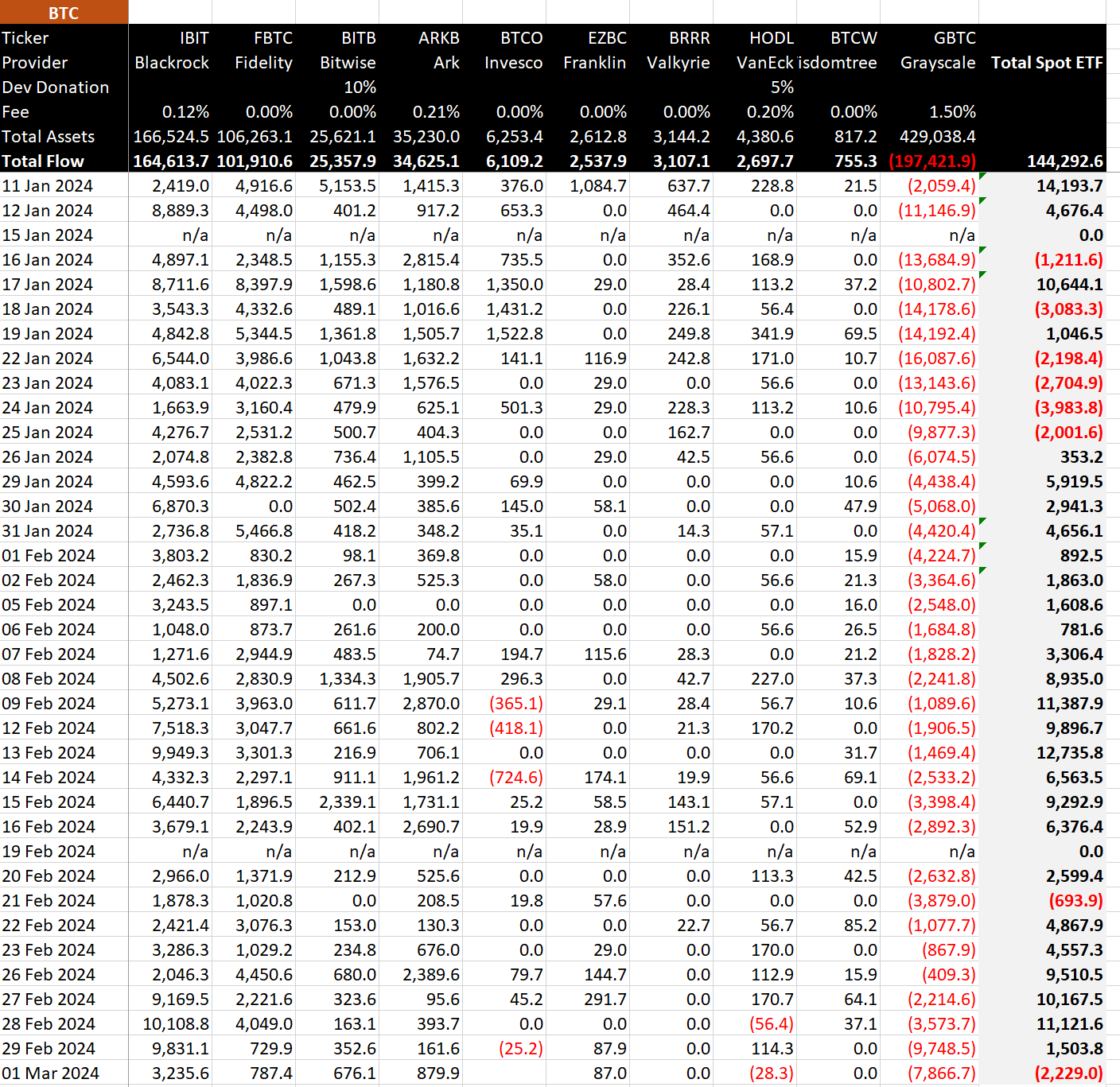

Data from BitMEX shows March began with the first total outflow since Feb. 21. The day saw an outflow of $140 million, significantly impacted by a massive $492 million outflow from the Grayscale Bitcoin Trust (GBTC), marking one of the largest single-day outflows.

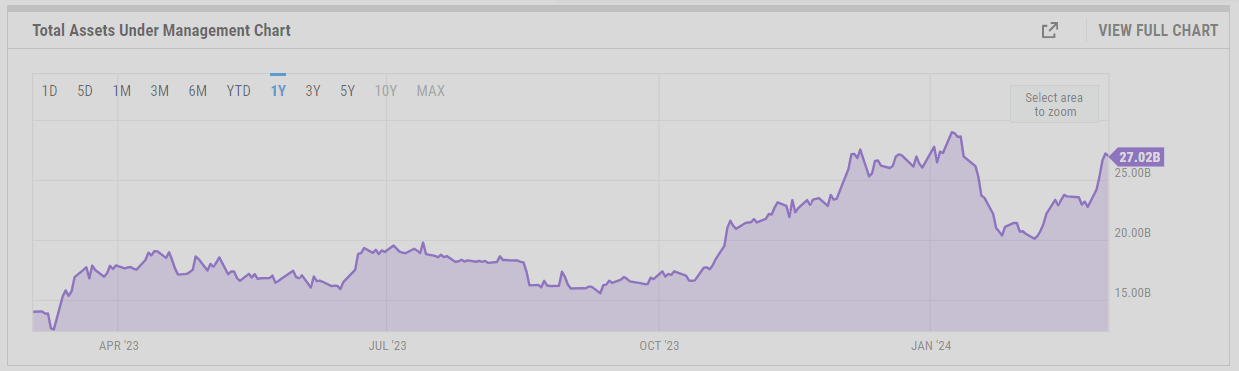

According to BitMEX data, the Grayscale Bitcoin Trust (GBTC) has experienced outflows totaling $8.9 billion. Despite this significant outflow, the assets under management (AUM) of GBTC only decreased by $1.6 billion, moving from $28.6 billion to $27 billion, as reported by ycharts.

This relatively small decrease in AUM, in the face of large outflows, can be attributed to the increase in Bitcoin’s price, which rose from $49,000 to $65,000 since the ETF was launched on Jan. 11.

Despite these outflows, GBTC maintains a strong market presence with a 55% share, though down from 100% two months ago, as noted by ETF Store President Nate Geraci.

Furthermore, GBTC’s annual fee revenue stands at a significant $398 million, dwarfing the $53 million from the nine new ETFs, not including fee waivers, according to Geraci.

Meanwhile, BlackRock’s IBIT saw much quieter inflows of $203 million on Mar. 1, following consecutive record-breaking days. These inflows have taken their total net inflow to $8 billion, roughly equivalent to holding 165,000 Bitcoin, according to BitMEX.

BitMEX has noted that Invesco Galaxy Bitcoin ETF (BTCO) has not disclosed its data for Mar. 1.