Bitcoin options volume skyrockets as June expirations loom

Bitcoin options volume skyrockets as June expirations loom Quick Take

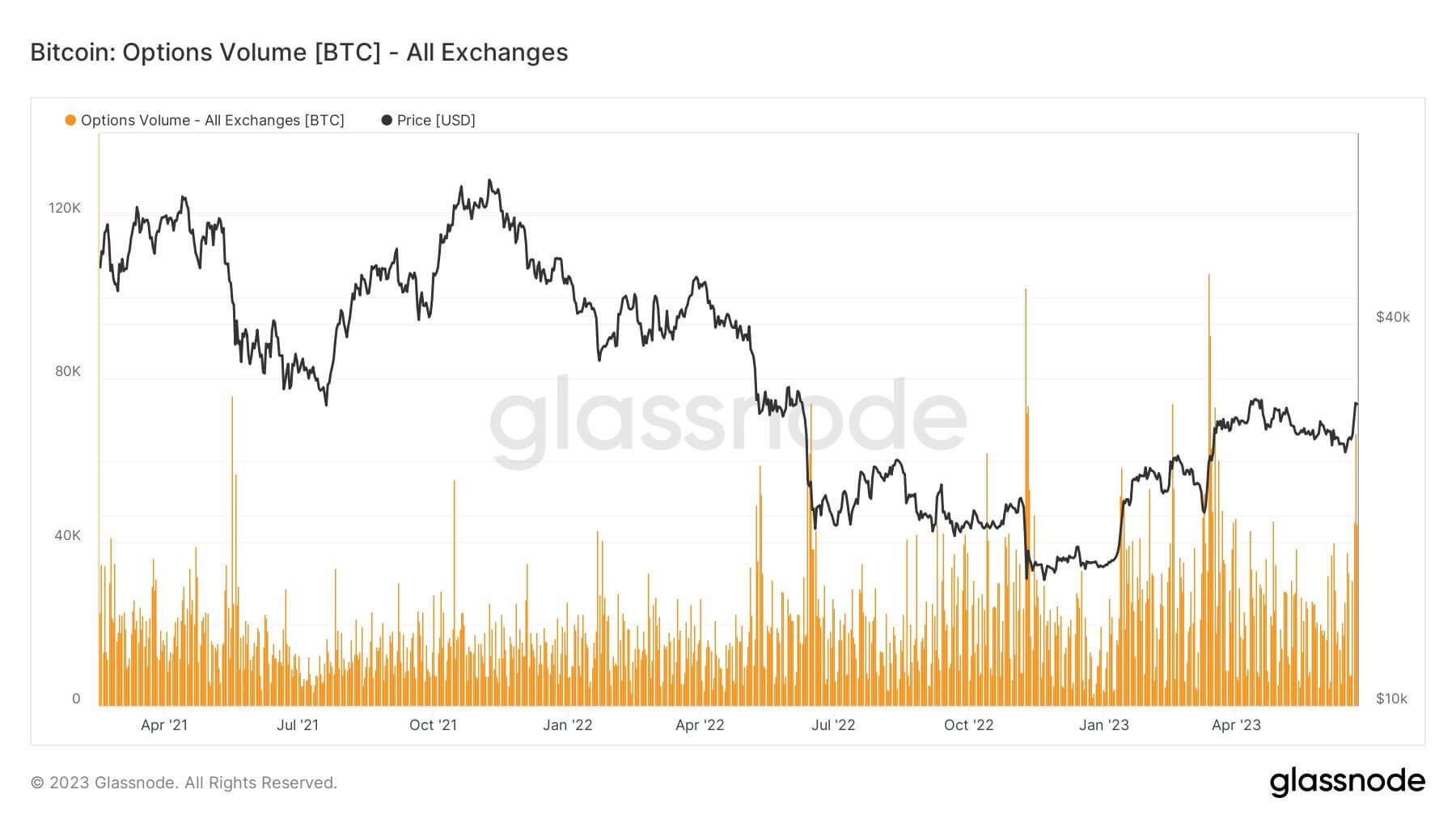

On June 21, the volume of Bitcoin (BTC) options soared to a level not seen in the last three months. Around 67,000 Bitcoin were involved in options contracts, indicating substantial participation in this type of digital asset trading.

Market analyst Alessio Urban believes the recent surge of Bitcoin to $30,000 is mainly due to a notable increase at the $30,000 strike price. This significant rise has undoubtedly played a pivotal role in reshaping the existing cryptocurrency market.

A deeper look into the market shows that the total worth of open-interest contracts was an impressive $10.8 billion. This statistic enhances our understanding of Bitcoin’s current market performance.

An additional key point to note is the massive options expiration set for the end of June, worth over $4.3 billion. Given the current put-to-call ratio standing at 0.5 and the max pain price set at $25,000, this upcoming event is likely to have a substantial effect on the market activity of Bitcoin as we approach the end of the month.