Bitcoin ETFs exploded with $10 billion traded in first days, overshadowing combined 2023 ETF launches

Bitcoin ETFs exploded with $10 billion traded in first days, overshadowing combined 2023 ETF launches Bitcoin ETFs exploded with $10 billion traded in first days, overshadowing combined 2023 ETF launches

Bitcoin ETFs outperform entire 2023 'Freshman Class' of ETFs with massive trading volume, according to Balchunas.

Quick Take

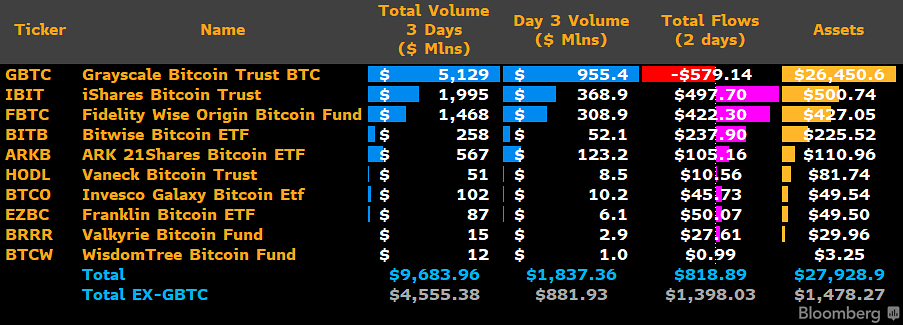

According to Bloomberg ETF analyst Eric Blachunas, during the first three trading days of the newly launched Bitcoin ETFs, almost $10 billion was traded, dwarfing the activity of other ETFs launched in 2023. The total trading volume for all 500 ETFs launched in 2023 combined was a mere $450 million, according to Balchunas.

Balchunas goes on to say that even the most successful of these ETFs had a daily trading volume of just $45 million, a figure that pales compared to the Bitcoin ETFs. $IBIT, one of the Bitcoin ETFs, witnessed more trading activity than the entire ‘Freshman Class’ 2023 ETFs.

Blachunas further observed that half of these new ETFs struggled to cross a million in daily volume, underscoring the difficulties in generating volume, mainly because it cannot be artificially created and must form naturally in the marketplace.

Grayscale has recorded a substantial amount of the trading volume exceeding $5 billion. In comparison, BlackRock’s iShares has registered a volume just shy of $2 billion, and Fidelity’s ETF has observed a trading volume of $1.5 billion.

Farside Investors

Farside Investors