Bitcoin consolidation tests investors’ patience amidst volatile market sentiment

Bitcoin consolidation tests investors’ patience amidst volatile market sentiment Quick Take

Bitcoin continues to hover in the mid-$50,000s, entering a consolidation period characterized by downward volatility. This period has tested investors’ patience as other asset classes, like US stocks and gold, approach or have reached all-time highs. Meanwhile, Bitcoin remains over 20% below its record peak.

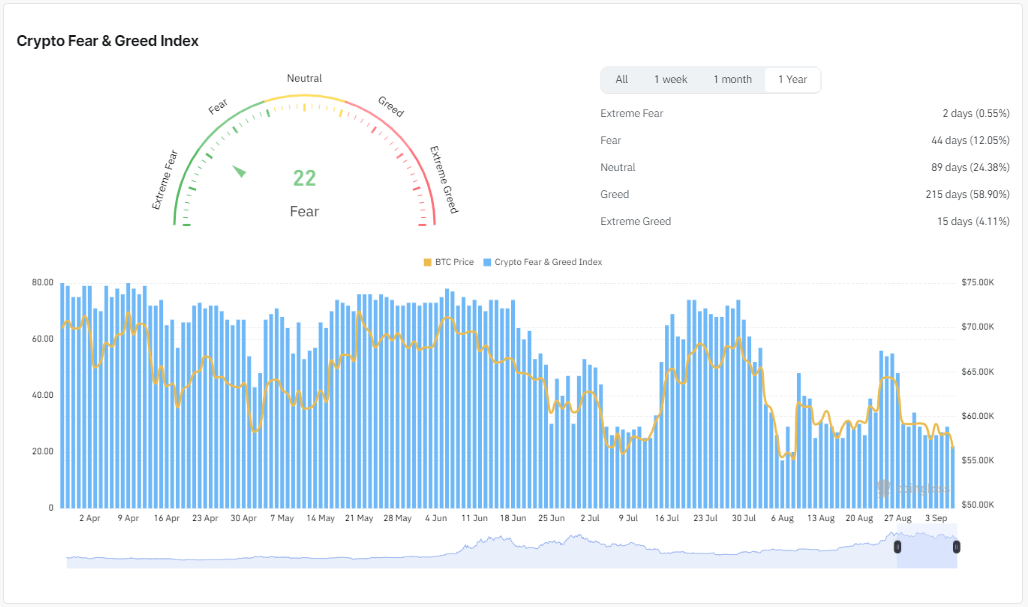

The Coinglass Crypto Fear and Greed Index currently sits at 22, indicating a state of fear. Since August, the market sentiment has remained mainly in this fearful zone. Over the past year, Bitcoin has experienced two days of extreme fear, notably during the Aug. 5 sell-off triggered by the yen carry trade unwind. In total, over the past year, Bitcoin has experienced 44 days of fear, 89 days of neutrality, 215 days of greed, and 15 days of extreme greed.

Zooming out further, the past seven years reveal that Bitcoin spends roughly 45% of the time in a state of fear or extreme fear, compared to about 30% in greed or extreme greed. Despite its long-term growth potential, this trend highlights the frequent uncertainty surrounding Bitcoin.