Bitcoin accumulation addresses decline sharply in 2024

Bitcoin accumulation addresses decline sharply in 2024 Onchain Highlights

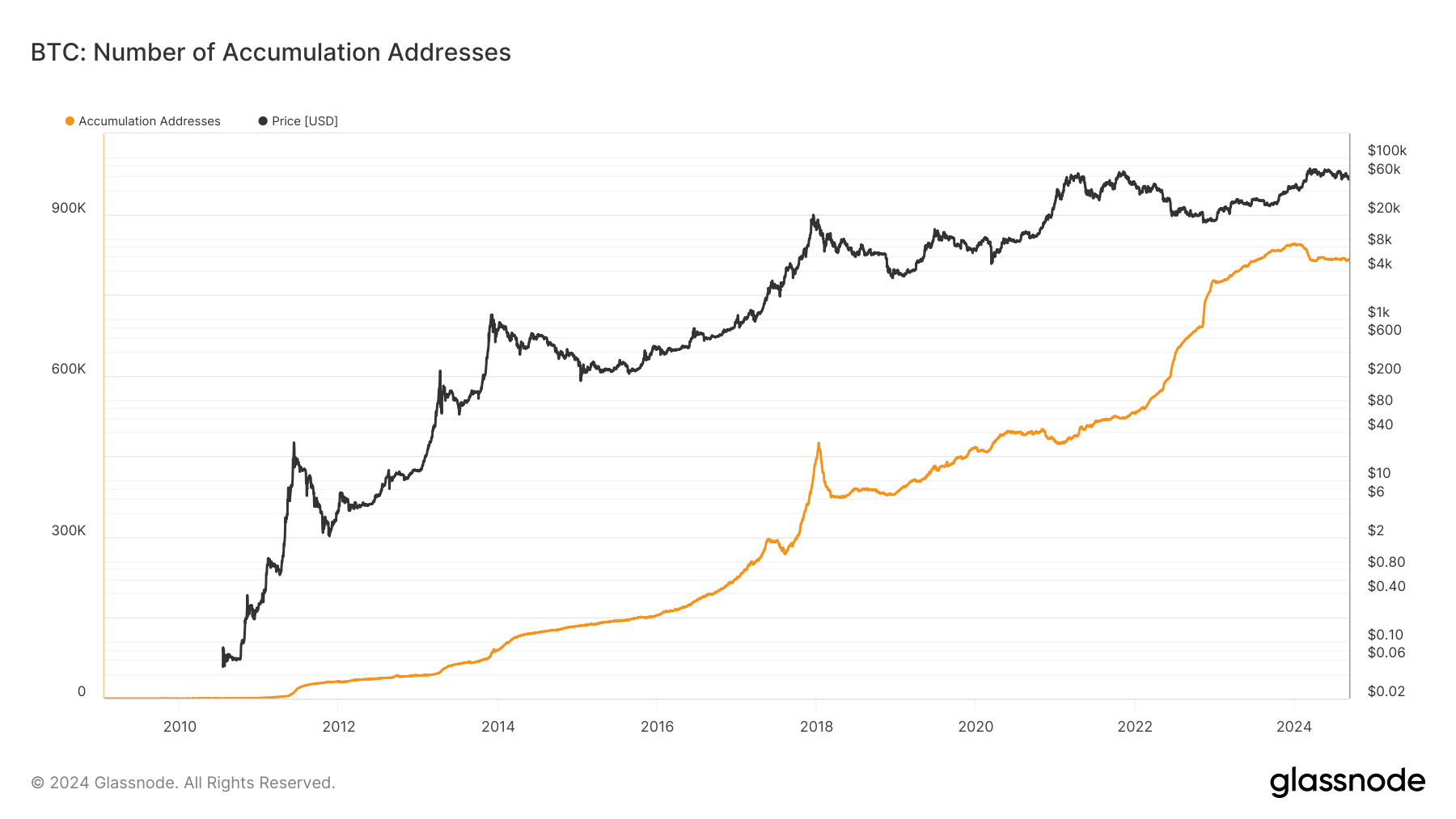

DEFINITION: The number of unique accumulation addresses. Accumulation addresses are defined as addresses that have at least 2 incoming non-dust transfers and have never spent funds. Exchange addresses and addresses receiving assets from Coinbase transactions (miner addresses) are discarded. To account for lost coins, addresses that were last active more than 7 years ago are omitted as well.

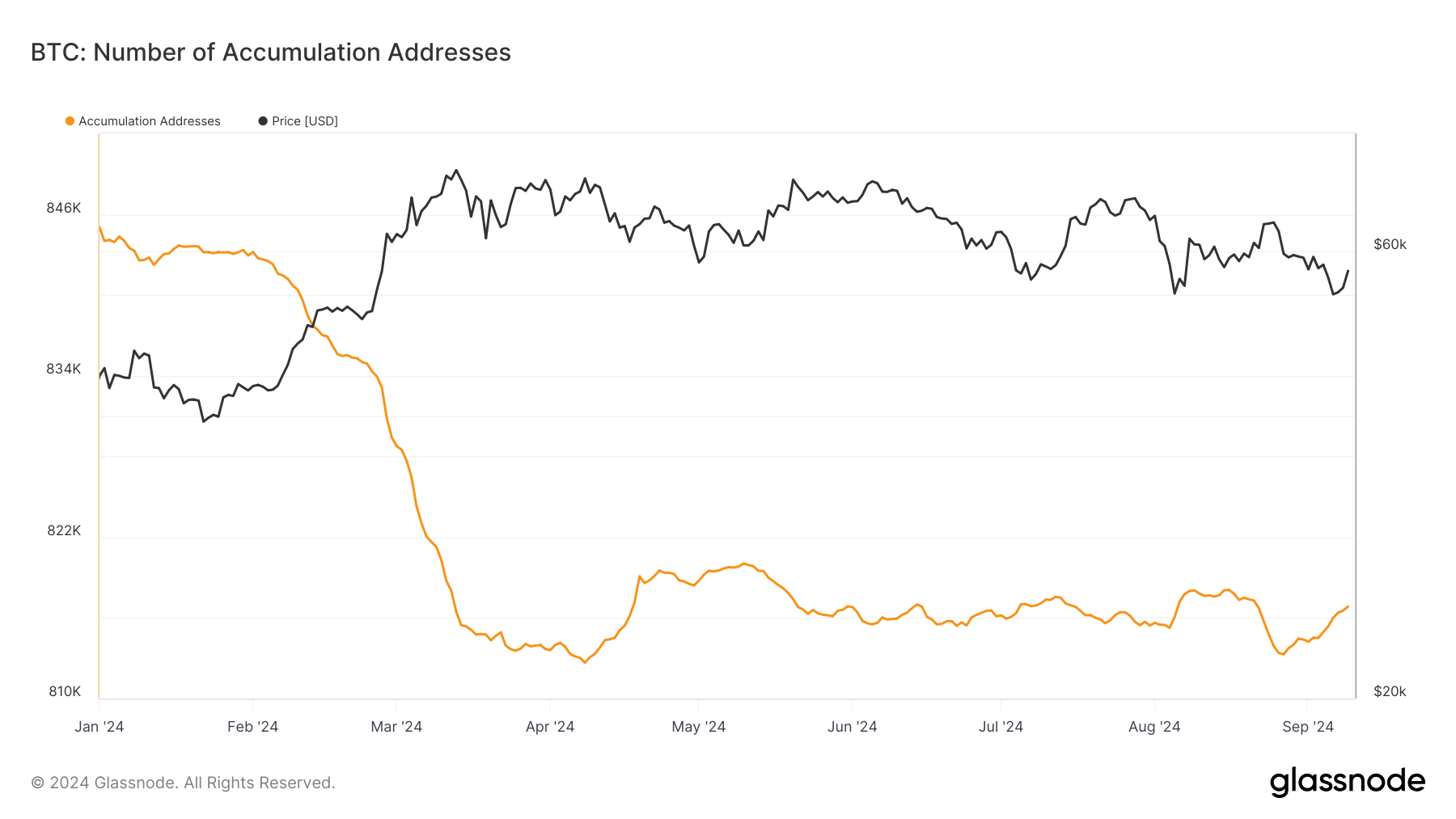

Bitcoin accumulation addresses have experienced a notable decline throughout 2024, diverging from previous years’ steady growth trends, based on Glassnode data,

The number of these addresses began the year at over 840,000 but dropped to around 815,000 by mid-April. This downward movement coincided with Bitcoin’s price volatility, particularly around the April halving event.

Historically, accumulation addresses have steadily increased, surpassing 800,000 during Bitcoin’s price surges in 2021 and early 2022. However, in 2024, a sharp reduction is evident in the months following the halving.

The halving likely prompted a shift in market sentiment, with holders liquidating positions rather than continuing to accumulate. Since mid-year, there has been only a slight recovery in accumulation addresses despite Bitcoin’s price fluctuations.

The relationship between accumulation trends and market cycles remains crucial in understanding long-term holder behavior. This year’s contraction may signal changes in investor strategies as Bitcoin approaches new market phases.

Farside Investors

Farside Investors