Assessing Bitcoin’s value relative to inflation

Assessing Bitcoin’s value relative to inflation Quick Take

When evaluating the performance of assets or prices over time, it is crucial to differentiate between real and nominal values. Nominal prices show the face value without accounting for inflation, while real prices factor in inflation to depict the true purchasing power. This distinction has significant implications in inflationary environments.

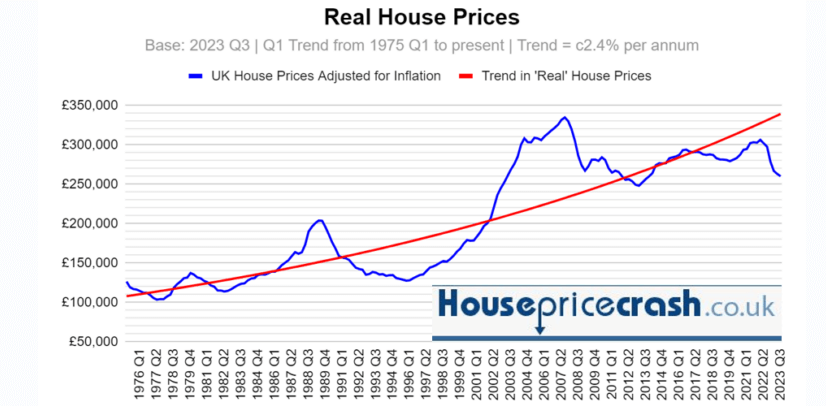

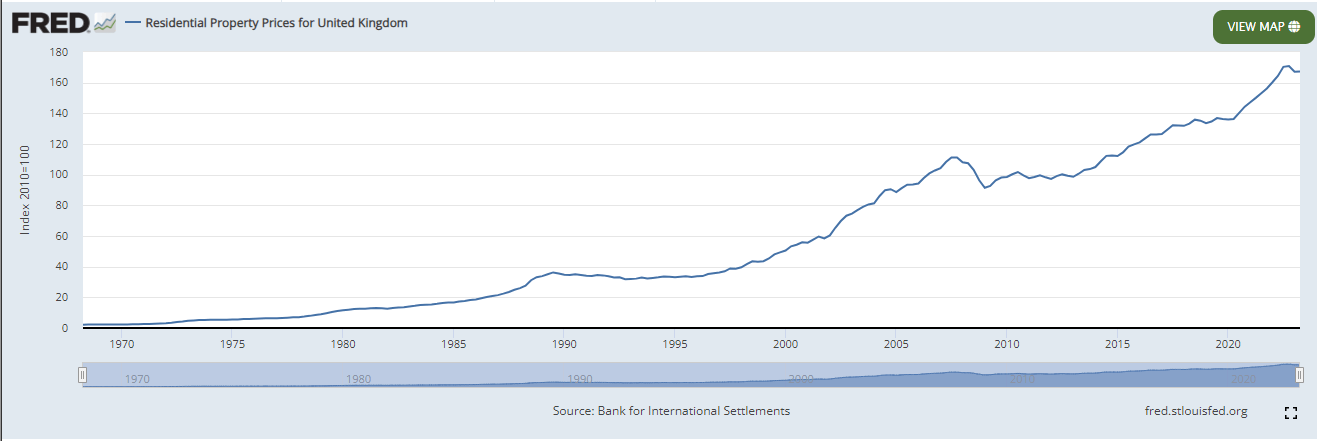

For example, when analyzing historical UK residential property prices, it is important to differentiate between real and nominal values, which have followed diverging trends since 2008.

In real terms, accounting for inflation, UK house prices increased steadily from the 1970s until peaking in 2007. However, real prices have declined overall since 2008 in the aftermath of the global financial crisis, reflecting reduced purchasing power.

In contrast, nominal UK house prices based on simple market values have continued rising despite brief dips during recessions. The nominal nationwide index shows steady gains, recently reaching new highs in 2022.

This divergence highlights how nominal prices can mask declines in real values during periods of high inflation. While nominal UK house prices paint a picture of consistent appreciation, real prices reveal stagnation since 2008.

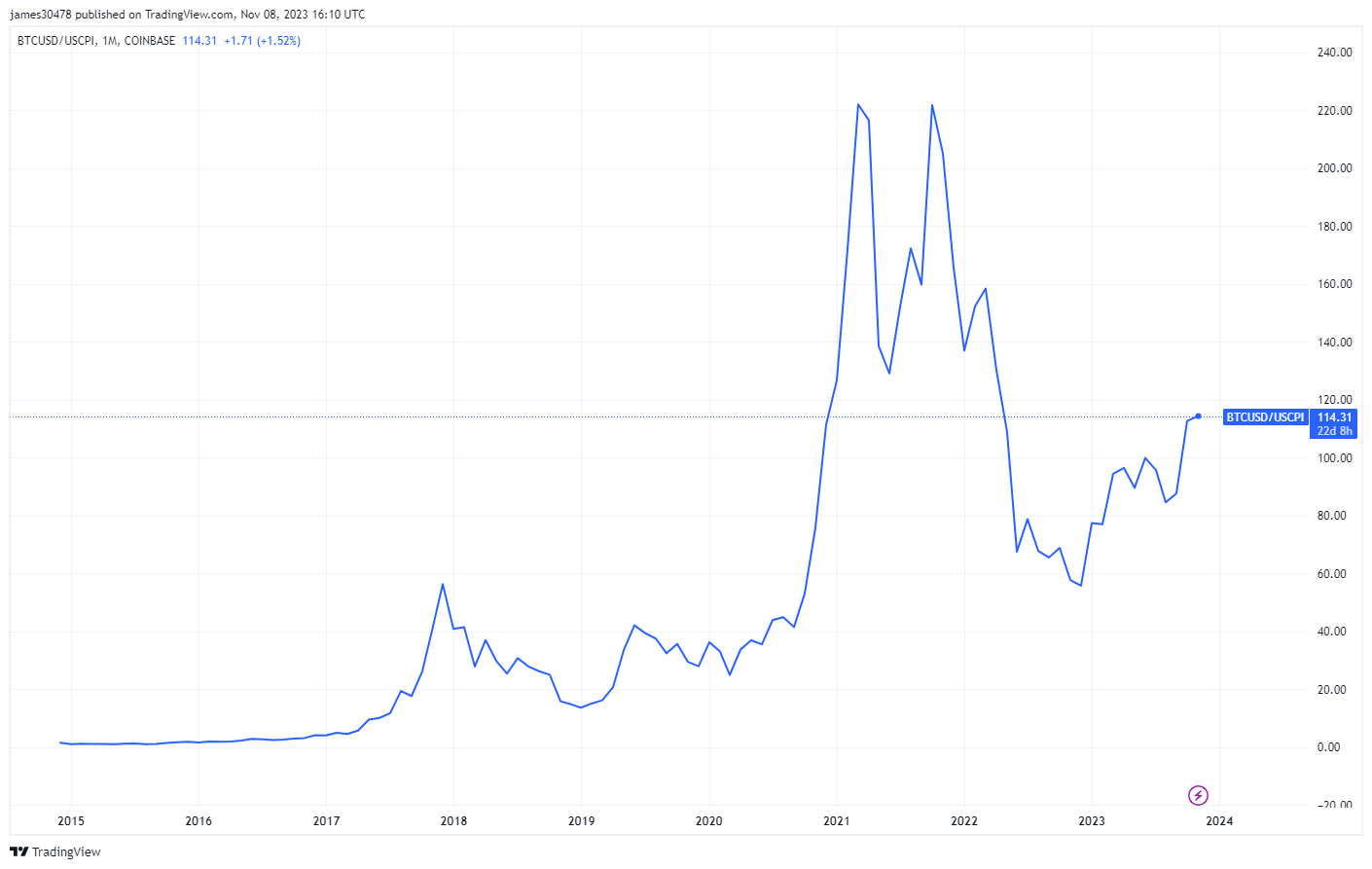

When analyzing Bitcoin’s performance relative to inflation, dividing its price by the U.S. Consumer Price Index (CPI) provides useful insight. This adjustment accounts for the declining purchasing power of the US dollar.

Viewed through this lens, Bitcoin has reached higher peaks versus inflation with each market cycle. Despite volatility, Bitcoin’s purchasing power, as measured in real terms, continues appreciating over multi-year periods. This suggests Bitcoin is maintaining its value compared to the dollar’s inflationary erosion.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors