Analysis of inflation-adjusted trends shows gold unable to break 1980 high

Analysis of inflation-adjusted trends shows gold unable to break 1980 high Quick Take

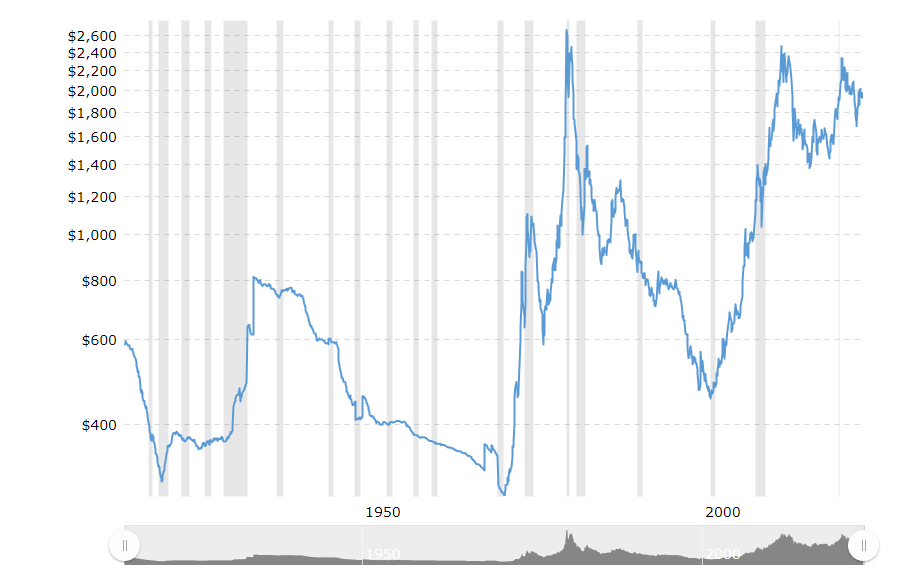

An examination of the real, inflation-adjusted gold prices since 1915, using the headline Consumer Price Index (CPI), reveals a striking pattern of peaks and troughs. Particularly noteworthy is the peak in January 1980, when an ounce of gold reached $2,675, its highest ever in inflation-adjusted terms.

Since then, despite two subsequent peaks in August 2011 and August 2020, at $2,472 and $2,327 respectively, gold has not yet reclaimed its inflation-adjusted high from 1980. This data suggests a significant resistance level for real gold prices, indicative of underlying economic factors and market sentiment that prevent a return to the 1980 high.

As gold is often seen as a hedge against inflation, this trend might also shed light on different periods of economic stability and inflationary pressures.