How this new VC brings on-chain fund management to the YFLink ecosystem

How this new VC brings on-chain fund management to the YFLink ecosystem How this new VC brings on-chain fund management to the YFLink ecosystem

Decentralized Autonomous Organizations (DAOs) can present a new paradigm for various old-world ideologies (except for ones that involve iced teas).

Popular examples include the managing and rejigging of supply chain models, borderless identity processing, management of credit and lending, and even collateralizing principal amounts and debts for additional usage.

But a new project is going one step further with what the DAO model can achieve.

Enter LINKPAD: A protocol that touts itself as the first-ever decentralized venture capital fund that allows its investors to access pre-sale crypto projects and other tier-1 opportunities.

LINKPAD TL;DR pic.twitter.com/MothTRTOxI

— LINKPAD (@linkpadio) November 18, 2020

The latter may strike a chord or two with those who’ve been in the crypto game long enough — excellent pre-sales are either limited to the wealthy and well-heeled or require “connections” to be made possible. This is arguably opposite to the ethos of cryptocurrencies—such as financial inclusivity and fairness—and LINKPAD hopes to change just that.

“We understand that there currently exists a climate where large venture capital players get access to presales, private sales, and seed rounds that the typical retail investors simply cannot get involved with.”

A ‘Linkie’ backstory

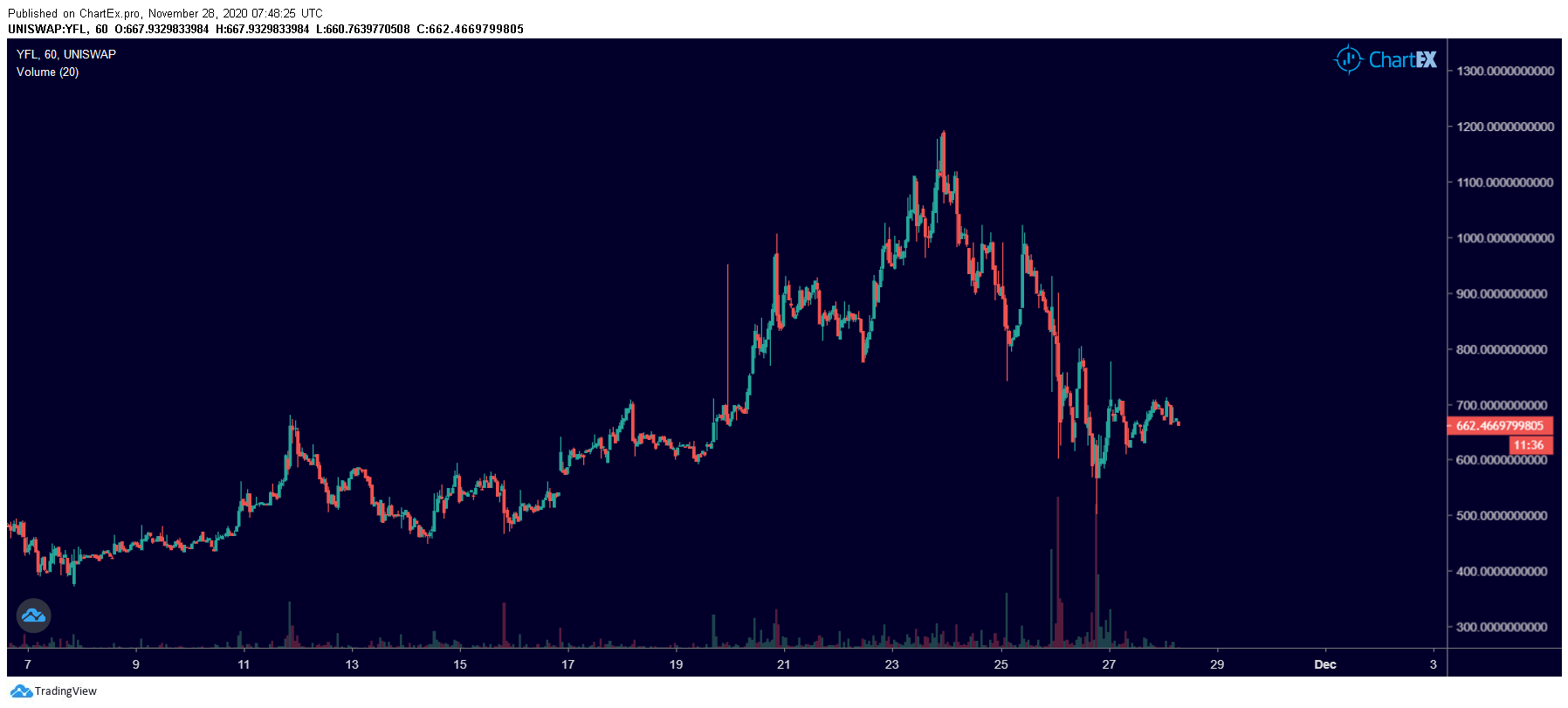

LINKPAD is part of the YFLink ecosystem, itself a fork of the Yearn Finance protocol, that uses its own governance token, YFL, and bases itself around Chainlink’s LINK token (to both tap into the Link Marines’ meme energy and also to move away from Yearn’s yCRV peg).

YFLink’s since grown to a current $30 million market cap with an engaged, 6,500-strong community on Twitter. Its major upcoming use case is LinkSwap, a community-governed Automated Market Maker that cuts down on the challenge of impermanent loss (ask a SushiSwap user), cuts down on the inevitable rug pull (hello Harvest Finance), and grows the use case of YFL beyond a mere governance token to a more value-accrual mechanism.

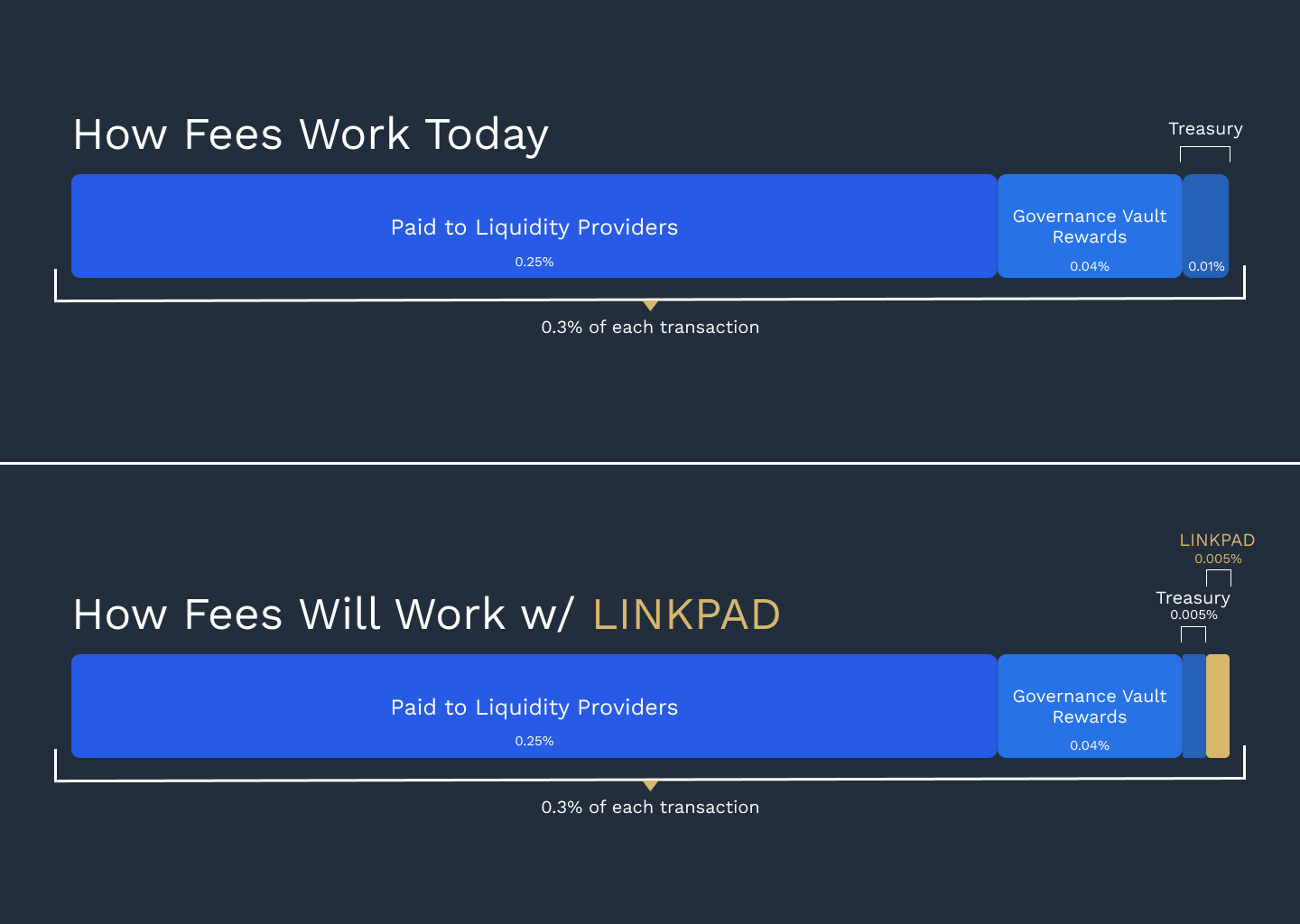

As such, the YFLink treasury is expected to see a portion of each trade executed on LinkSwap for use in further project development. However, a portion of those funds, as per LINKPAD founder Cole Petersen (who also writes for this publication), can be driven towards making strategic investments in early-stage projects, in turn creating better value for both YFL and its holders.

“Essentially, we’re looking to build a venture fund with a fraction of the fees generated by the LINKSWAP platform, and use these funds to make seed investments in early-stage projects. To mitigate issues with transparency and liquidity, we will be only making investments in tokens, not equity,” explained Petersen in a blog.

How would it work?

While LINKPAD is still a proposal (the fund itself has been seeded and is operational), its mechanism calls for redirecting half (50%) of the treasury fees to be sent to the LINKPAD fund.

All such movements will be duly audited and wholly owned by the YFL ecosystem, with all profits from token allocations reinvested back into the governance staking vault. Such a design is expected to help YFL token holders enjoy even more revenue, as the below image shows:

The funds themselves would find their way into various investment paths: such as seed investments in early-stage projects, liquidity provision on LinkSwap, yield farming across the aggregated DeFi space (only low-risk, fully audited ones), and investing in other community-led projects.

To ensure no Yam scam, a public Ethereum address will be released to the community and used to monitor all fund movements. In addition, the team page can be accessed here and the wallet keys will be held by multisig holders belonging to four different teams.

DAO funds have been tried before but none with a mechanism like LINKPAD. Can this one be radically different and pave the path for similar community-owned funds across other crypto projects?

Only time will tell.

(The announcement and project scope can be accessed here.)