Data shows high levels of correlation between Bitcoin and Ethereum

Data shows high levels of correlation between Bitcoin and Ethereum Data shows high levels of correlation between Bitcoin and Ethereum

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

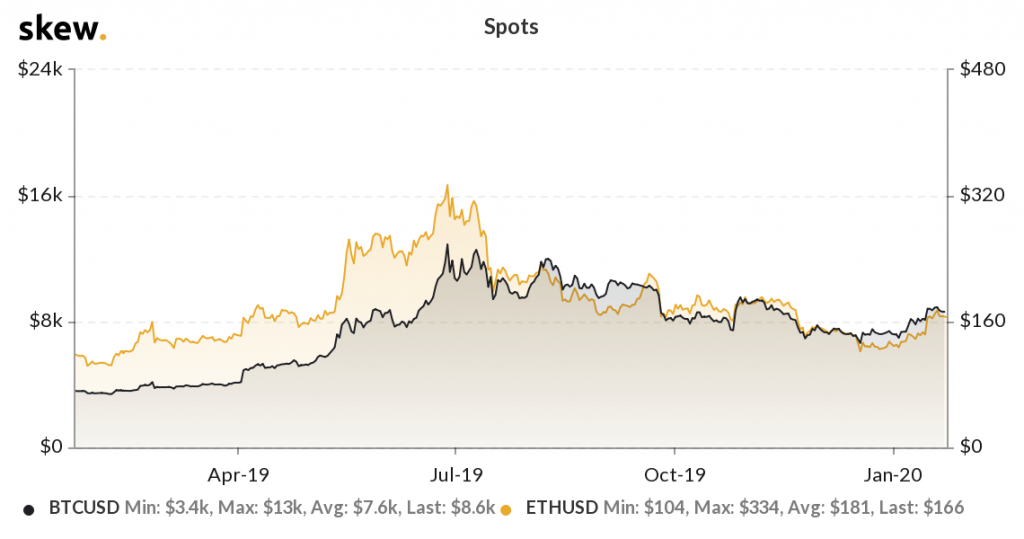

Bitcoin and Ethereum have been highly correlated over the past couple of years. The association between the top two cryptocurrencies by market capitalization shows the lack of diversification opportunities that investors have in this industry.

The highest correlated asset

Investopedia defines the term correlation as a statistic that measures the degree to which two assets move in relation to each other. This gauge can be implemented in portfolio management and is computed as a value that must fall between -1.0 and +1.0.

Assets with a correlation above 0.5 have a strong positive linear relationship. Conversely, assets with a correlation below -0.5 are considered to have a strong negative association. If the correlation coefficient is 0, this implies that there is no observable linear relationship between the two assets.

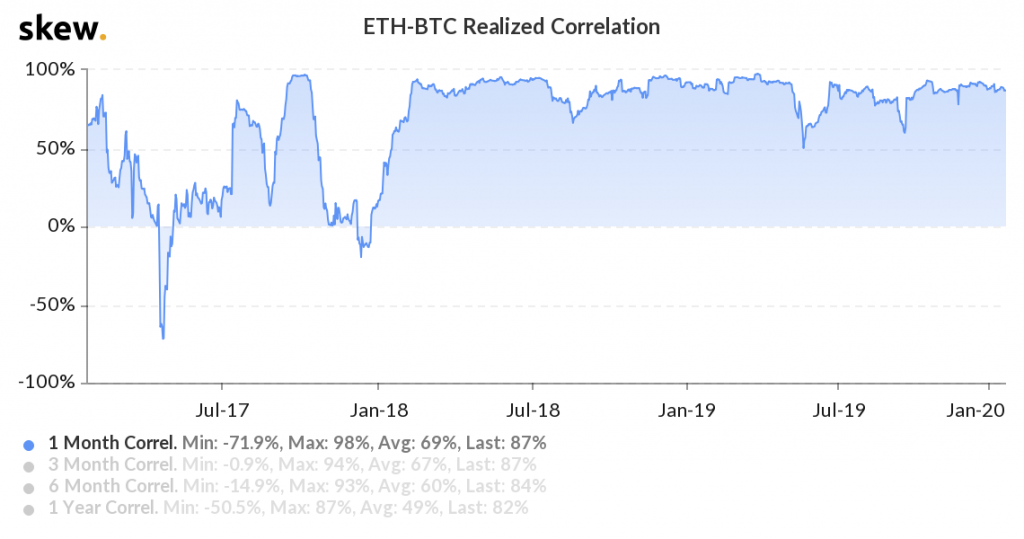

Skew, one of the leading data analytics provider in the industry, revealed that Bitcoin and Ethereum entered a high “correlation regime” since 2018. Since then, Ether has remained the highest correlated assets to the flagship cryptocurrency.

Throughout 2019, Ether maintained an average correlation coefficient of 0.69, according to a Binance report. During the first quarter of that year, the coefficient was 0.69 and dropped to 0.65 points in Q2. However, Q3 saw the correlation coefficient between ETH and BTC rise to 0.74. And, over the fourth quarter, these assets displayed a correlation coefficient of 0.86.

Binance’s report reads:

“Ethereum became the most relevant benchmark of the crypto-market in 2019, displaying the highest median correlation with all other cryptoassets.”

Maximum returns for a given level of risk

Harry Markowitz is an American economist who pioneered the modern portfolio theory (MPT). This theory argues that investors can build a portfolio with multiple assets that are meant to maximize returns given a certain level of risk. Based on different statistical measures such as variance and correlation, an asset’s price action is less important when considered in the context of an entire portfolio.

Under this premise, the high level of correlation between Ether and Bitcoin does not make them ideal to have in the same portfolio. If one of them takes a nosedive, it is very likely that the other will follow. Therefore, assets with lower association could provide better diversification opportunities.

According to Binance, the lowest correlated asset is Cosmos (ATOM) with a median annual correlation coefficient of 0.31, followed by Chainlink (LINK) and Tezos (XTZ) with coefficients of 0.32 and 0.4, respectively.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)