CryptoSlate Wrapped Daily: More Bitcoin leaves Coinbase; Kraken CEO deems Binance’s proof of reserves ‘pointless’

CryptoSlate Wrapped Daily: More Bitcoin leaves Coinbase; Kraken CEO deems Binance’s proof of reserves ‘pointless’ CryptoSlate Wrapped Daily: More Bitcoin leaves Coinbase; Kraken CEO deems Binance’s proof of reserves ‘pointless’

Coinbase reserve declined by 50,000 BTC daily between Nov. 23 and Nov. 27-equating to roughly $3 billion, JP Morgan said that the coming regulation may lead to convergence of crypto and TradFi, and much more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptoverse for Nov. 28 includes Kraken CEO saying Binance Proof-of-Reserve is pointless without proof of liabilities, Coinbase losing Bitcoin worth $2 billion over the weekend, and BlockFi filing for Chapter 11 bankruptcy.

CryptoSlate Top Stories

Another $2B worth of Bitcoin withdrawn from Coinbase over weekend

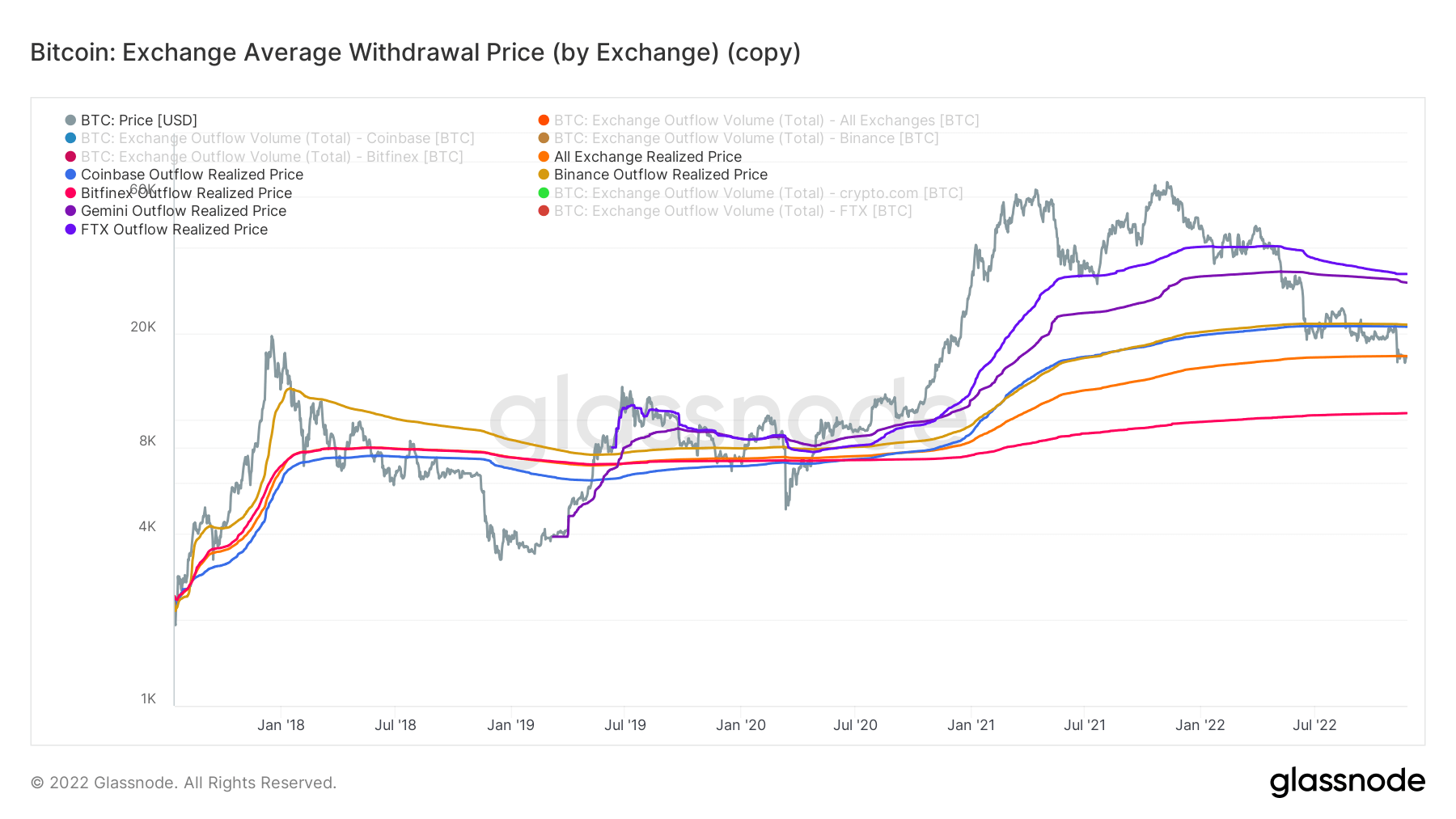

According to Glassnode, crypto exchanges have lost over $15 billion worth of Bitcoin (BTC) in the past five days, with Coinbase losing the most.

Between Nov. 24 and Nov. 25, about 100,000 BTC (totaling $1.5 billion) was reportedly withdrawn from Coinbass. The trend continued over the weekend of Nov. 26 and Nov. 27, which saw some $2 billion worth of Bitcoin leave the exchange’s reserve

Consequently, Coinbase has lost $3.5 billion over the past five days, while Binance has topped its reserve with roughly $1.2 billion worth of Bitcoin.

Kraken’s Powell says Binance Proof-of-Reserve is pointless without liabilities

Kraken CEO Jesse Powell argued that Binance’s proof of reserve (PoR) was insufficient as it failed to highlight its liabilities. He added that implementing a Merkle Tree without an external auditor is not enough to prove that the exchange did not boost its reserve with accounts having negative balances.

In response, Binance CEO Changpeng Zhao said that his exchange was working to involve external auditors soon while maintaining that the PoR did not include negative balances.

Jokes about wrapped ETH depeg cause brief panic on Twitter

With insolvency rumors taking over the crypto community, prominent Ethereum advocates including Vitalik Buterin made a joke that wrapped Ethereum (WETH) was about to become insolvent.

To avoid further panic in the community, Ethereum developer Hudson Jameson called out the joke and clarified that WETH will technically not face insolvency as it is a smart contract that is as decentralized as Ethereum and cannot face a bank run.

However, the WETH joke caused ETH’s price to decline by roughly 4%, with some community members cautioning that such jokes may get “the silliest of users” rekt.

BitBoy alleges O’Leary was key player in Celsius collapse along with FTX

Crypto YouTuber “Bitboy” while speaking on Altcoin Daily called out Kevin O’Leary for strongly supporting Sam Bankman-Fried (SBF). Bitboy alleged that SBF targeted competing platforms such as Celsius and contributed to its collapse to amass more liquidity for FTX.

Bitboy added that SBF-supporter O’Leary had publicly called for Celsius to go down to zero, prior to the crypto lender’s fallout.

Texas wants to be the centerpiece of Bitcoin innovation, says Governor Abbott

Texas Governor Greg Abbott has called on Bitcoin companies to set up their offices in Texas, as it was advancing pro-Bitcoin/blockchain agenda that will make the state “more inviting” for Bitcoin innovation.

Abbott added that Texas was improving its legislation to be “kind of anti-regulation”, while providing the needed infrastructure for Bitcoin to succeed.

Germany has the second highest concentration of ETH nodes in the world

According to CV VC Labs’s 2022 Blockchain report, about 22.8% of all Ethereum validators operate from Germany. This makes the European nation have the second-highest concentration of ETH nodes, only behind the United States which leads with 45.3%.

Additionally, the report highlighted that German blockchain projects raised approximately $8 billion across 220 funding, with about 34 startups becoming unicorns.

JP Morgan believes regulation will lead to convergence of crypto, TradFi

In the wake of the FTX collapse, JP Morgan & Chase highlighted possible changes it believes will help crypto and traditional finance coverage. The banking giant said it anticipates the approval of regulatory frameworks like the European Union’s Markets in Crypto Assets (MiCA) bill in 2023, which will focus largely on customer protection and self-custody regulation.

It added that crypto exchanges may be required to improve transparency by publishing a regular reserve, assets, and liabilities audit. Also, it predicts a shift away from centralized exchanges (CEX) to decentralized exchanges (DEX).

Blockfi becomes another victim of the FTX collpase with bankruptcy filing

Barely two weeks after pausing customers’ withdrawals, crypto lender BlockFi has filed for a Chapter 11 bankruptcy due to its massive exposure to FTX. It reportedly owes about 100,000 creditors including the Securities and the Exchange Commission (SEC) which it owes some $30 million.

BlockFi added that it has roughly $256 million in cash to go through the restructuring process, with the aim of “maximizing values for all clients and stakeholders.”

LINE-founded cryptocurrency exchange BITFRONT announces closure

Asia-based crypto exchange BITFRONT announced plans to cease operation effective March 31, 2023. After the date, it will halt withdrawals and go on to delete all personal files of users from its system.

VP of AAX speaks out against handling of company bankruptcy decision

The bankruptcy trend has hit Hong Kong exchange AAX, which disclosed it cannot pay employees’ salaries beyond November, while its customers will receive about 50% of their funds.

AAX Vice President Ben Caselin moved to quit his role and expressed dissatisfaction over the bankruptcy process.

Research Highlight

Binance led 2017 ‘dumb money’ Bitcoin investment; FTX leads 2022 cycle

Back in 2017 when Binance was established, it served as a haven for dumb money investors who FOMOed into Bitcoin trades based on hype and withdrew their holdings even at loss after the price peaked.

Fast forward to 2022, Binance has grown to become the leading crypto exchange, making it a home for smart money investors, while exchanges like bankrupt FTX housed the dumb money investors.

News from around the Cryptoverse

Gam7 launches $100M grant program

Web3 gaming DAO Gam7 has established a $100 million grant program for game developers to build tools and scaling solutions that will lead to the global adoption of Web3 games.

Kraken to pay $363K to U.S. Treasury

The U.S. Department of Treasury announced that it has levied a $362,158 on crypto exchange Kraken for failing to implement sanctions against Iran.

Kraken reportedly failed to block the IP addresses of Iranian users who transacted on the exchange at a time when the Treasury placed a ban on Iran.

Crypto Market

In the last 24 hours, Bitcoin (BTC) decreased slightly by -1.87% to trade at $16.243, while Ethereum (ETH) decreased by -3.44% to trade at $1,172.

Biggest Gainers (24h)

- RSK Infrastructure Framework (RIF): +109.29%

- BrainTrust (BTRST): +18.59%

- ApeCoin (APE): +8.1%

Biggest Losers (24h)

- LINK (LN): -10.63%

- Huobi Token (HT): -10.47%

- Render Token (RNDR): -9.62%

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass