CryptoSlate Wrapped Daily: FTX’s FTT on verge of potential sell-off after Binance liquidates FTT holdings

CryptoSlate Wrapped Daily: FTX’s FTT on verge of potential sell-off after Binance liquidates FTT holdings CryptoSlate Wrapped Daily: FTX’s FTT on verge of potential sell-off after Binance liquidates FTT holdings

SBF assures that all is well with FTX, 50,676 Bitcoins confiscated in relation to 2012 silk road attack, and more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptoverse for Nov. 7 includes Bitcoin mining difficulty’s decrease by 0.19%, Binance’s decision to liquidate all its FTT holdings, and FTX CEO Sam Bankman-Fried’s assurance that the exchange is not going bankrupt.

CryptoSlate Top Stories

Bitcoin mining difficulty barely adjusts downward by 0.19% as miner pressure continues

Bitcoin’s (BTC) mining difficulty was adjusted on Nov. 7 and recorded a small 0.19% drop.

The most recent adjustment before this was on October 24, when the mining difficulty recorded a new all-time high, reaching 36.84 trillion. The 0.19% drop retreated it back to 36.76 trillion.

Fears of Terra Luna style collapse of FTX native token FTT as Binance liquidates its holdings

Binance’s CEO Changpeng Zhao (CZ) Tweeted on Nov. 6 and said that Binance would liquidate all FTX native tokens (FTT) it held because of “revelations that came to light.” Binance had over $500 million in FTT tokens at the time of CZ’s Tweet.

This kindled the discussions of FTX’s possible collapse and dropped the FTT token down by 9.4% in one day.

SBF says ‘FTX is fine. Assets are fine’ with over $1B in excess cash amid rumors of liquidity crunch

FTX‘s CEO, Sam Bankman-Fried (SBF), noticed Binance’s decision to liquidate its FTT reserves and published a thread to address concerns regarding FTX’s bankruptcy.

1) A competitor is trying to go after us with false rumors.

FTX is fine. Assets are fine.

Details:

— SBF (@SBF_FTX) November 7, 2022

SBF ensured the community by saying that FTX “has enough to cover all client holdings” and called out to Binance’s CZ to work together for the ecosystem.

Over 50K BTC from Silk Road worth officially seized by DOJ after 10 year investigation

The U.S. Department of Justice officially seized 50,676 Bitcoin in connection with the 2012 Silk Road fraud. The amount equates to roughly $1.05 billion today.

The prosecutors said that the Bitcoins were found hidden in devices belonging to Silk Road attacker James Zhong, who has been taken into custody after his trial on Nov. 4.

Could Bitcoin miner sell pressure indicate further upside potential?

Bitcoin miners have been selling their assets since early 2022, and on-chain data shows that the sell-out rate is accelerating.

While this usually means that the market is underperforming, Bitcoin history proves it has also been a precursor to the upwards movement in price levels.

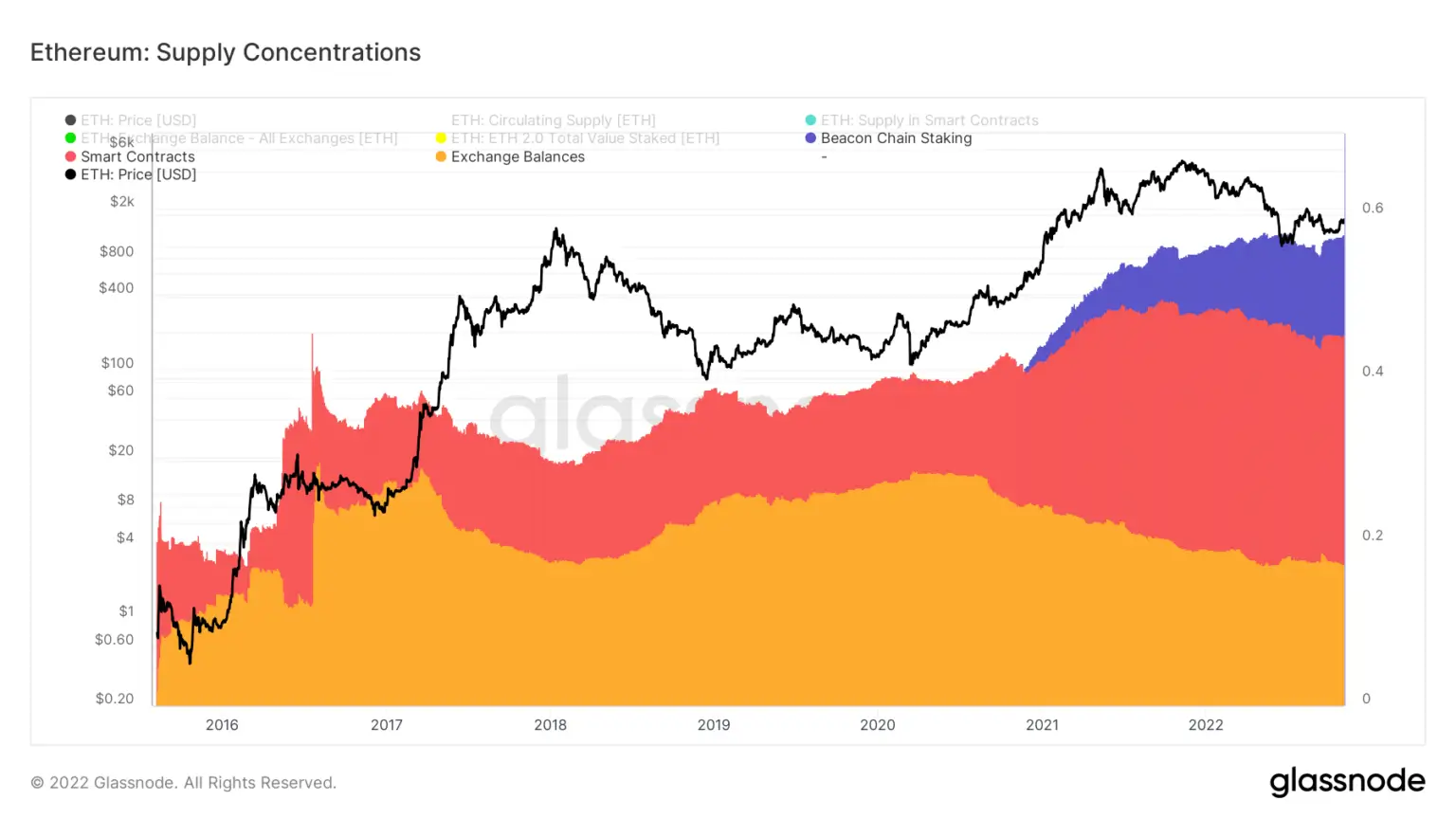

Ethereum supply concentration in smart contracts hits all time high

The amount of Ethereum (ETH) supply concentrated in smart contracts reached an all-time high.

Smart contracts consist of 0.45% of all Ethereum behind staked Ethereum at 0.57% and exchange balances at 0.17%. The supply concentration on exchanges has been declining since mid-2020, while smart contracts and staked ethereum has been increasing since late 2020.

FTX stablecoin reserves plunge as community fears bankrun

Binance’s decision to liquidate its FTT assets also influenced the rest of the community. While crypto influencers urged the community to exit FTX, crypto exchange platforms like Jump Crypto and Nexo also drained most of their assets out of FTX over the last 24 hours.

Hoskinson’s Twitter proposal for Cardano-Dogecoin tie-in snubbed by Reddit mods

Cardano (ADA) founder Charles Hoskinson shared a video on Nov. 6 and offered to build a decentralized Twitter that operates with Dogecoin (DOGE) and Cardano.

Dogecoin Reddit moderators removed Hoskinson’s proposal video from their subreddit on Nov. 7, while the community blamed Hoskinson for “trying to ride on Doge’s wave.”

SBF reveals he donated to Republicans & Democrats as lobbying by crypto firms continues ahead of the midterms

FTX’s CEO SBF Tweeted on Nov. 5 to reveal that he supports bipartisan politicians who support permissionless finance.

1) I was a significant donor in both D and R primaries.

Supporting constructive candidates across the aisle to prevent pandemics and bring a bipartisan climate to DC.

And working with them to support permissionless finance.

— SBF (@SBF_FTX) November 5, 2022

FTX is not the only crypto company that supports politicians with a pro-crypto discourse. However, SBF seems like he’s also supporting politicians personally and the FTX treasury.

Strong Polygon rally outperforms Bitcoin, other large caps

According to CryptoSlate data, Polygon (MATIC) has outperformed Bitcoin since November 4. MATIC’s current price marks at $0.00006085 mark its all-time high of 77 weeks against Bitcoin.

CryptoSlate, Crypto Briefing onboard Access Protocol Ecosystem to leverage Web3 Paywall

CryptoSlate and CryptoBriefing became the latest participants to join Access Protocol Web3 Paywall. The two news outlets have over 1,5 million combined monthly users and can benefit from Access Protocol’s content paywall system.

FTX’s FTT risks drastic fall as tokens flood exchanges

As a result of the exits from the FTX exchange, around 50 million FTT tokens were transferred to other exchanges within 24 hours. Since 90% of FTX’s treasury is in. FTT, this traffic brings the token so close to the verge of a drastic fall.

Winning lottery 9x in a row easier than breaching Bitcoin’s security

According to reports, winning Lotto Powerball nine times in a row is easier than breaching Bitcoin’s security. Therefore, by investing in Bitcoin, investors can enjoy a higher chance of securing their funds to make more wealth.

Research Highlight

Research: Bitcoin options traders expect price to hit $30,000 in Q4

CyrptoSlate analysts revealed that the Implied Volatility and Open Interest metrics indicate options traders are expecting Bitcoin and Ethereum to spike in the fourth quarter.

Implied Volatility (IV) measures the market sentiment toward the probability of changes in an asset price, and the Open Interest (OI) refers to the total number of outstanding derivatives contracts. Both metrics indicate that bullish conditions might be brewing in the fourth quarter.

Research: A fresh take on Bitcoin mining – Why using more energy can lead to abundance

The high energy consumption of Bitcoin mining has been a primary concern for many in the crypto community. Even though Bitcoin’s share in global energy consumption is currently only at 0.45%, the overall sentiment in the subject revolves around the idea of a disastrous future due to the pollution caused by Bitcoin mining.

However, when Bitcoin mining’s energy requirement is compared to Gold’s, it is evident that Gold causes more environmental trouble.

Despite this, no government considers banning gold mining. CryptoSlate analysts looked at Bitcoin mining through the eyes of economic prosperity and GDP and revealed that it is not an environmental disaster, as the current sentiment indicates. Instead, it could evolve into an industry and produce a highly skilled workforce, record significant income increases and improve surrounding infrastructure.

News from around the Cryptoverse

Hong Kong is looking to legalize crypto ETFs

According to Financial Times, Hong Kong’s financial watchdog is looking to launch exchange-traded funds (ETFs) for retail investors. It will only allow ETFs that initially invest in Bitcoin futures and will be expanded to other assets in the following stages.

Society Pass launches crypto payments feature

Society Pass Incorporated announced that it inked a partnership deal with Canada-based crypto payment company CoinSmart Financial to begin offering crypto payment features.

Crypto Market

In the last 24 hours, Bitcoin (BTC) decreased by -1.83% to fall $20,814, while Ethereum (ETH) also fell by -0.64% to trade at $1,600.

Biggest Gainers (24h)

- Chainlink (LINK): +8.05%

- VeChain (VET): +6.53%

- Polygon (MATIC): +5.51%

Biggest Losers (24h)

- Loopring (LRC): -7.3%

- Aptos (APT): -6.27%

- Maker (MKR): -6.04%