Ethereum supply concentration in smart contracts hits all time high

Ethereum supply concentration in smart contracts hits all time high Ethereum supply concentration in smart contracts hits all time high

The supply concentration of Ethereum has seen a divergence since mid 2020 with smart contracts growing considerably

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The amount of Ethereum’s supply concentrated in smart contracts has hit an all-time high post-merge. Smart contracts now create 0.45% of all Ethereum behind staked Ethereum at 0.57% and Exchange balances at 0.17%.

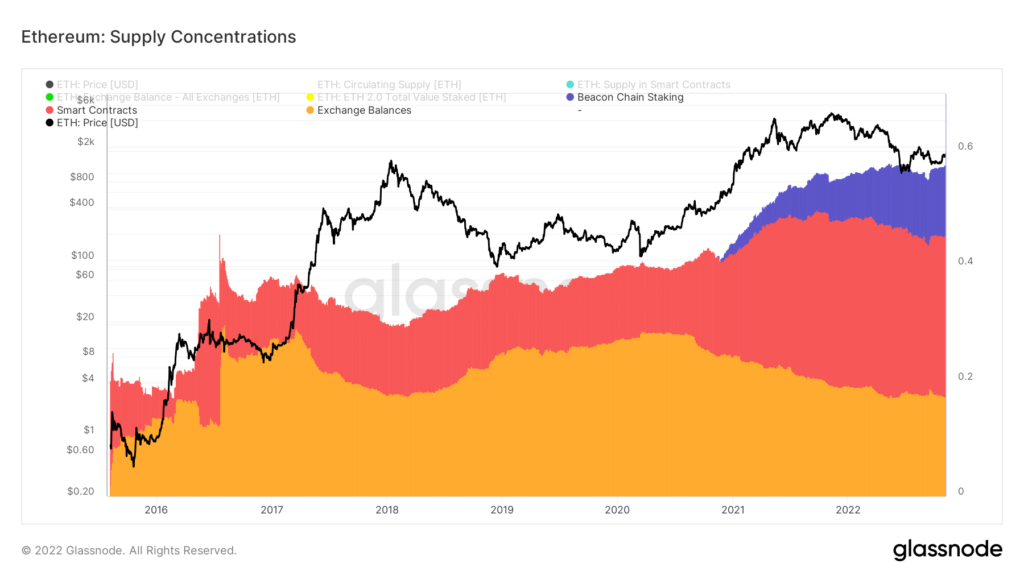

The chart below presents an area view of some of the largest concentrations of the Ethereum supply. Supply regions are shown as a ratio of circulating supply from bottom to top. The supply held on exchanges is shown in yellow, the supply held on Smart Contracts is shown in red, and the supply held on staked on the Beacon Chain is shown in purple.

The data showcases where new Ethereum is being distributed, thus giving insight into network activity for new coins. Supply concentration on exchanges has declined since mid-2020, while smart contracts and staking have increased since late 2020.

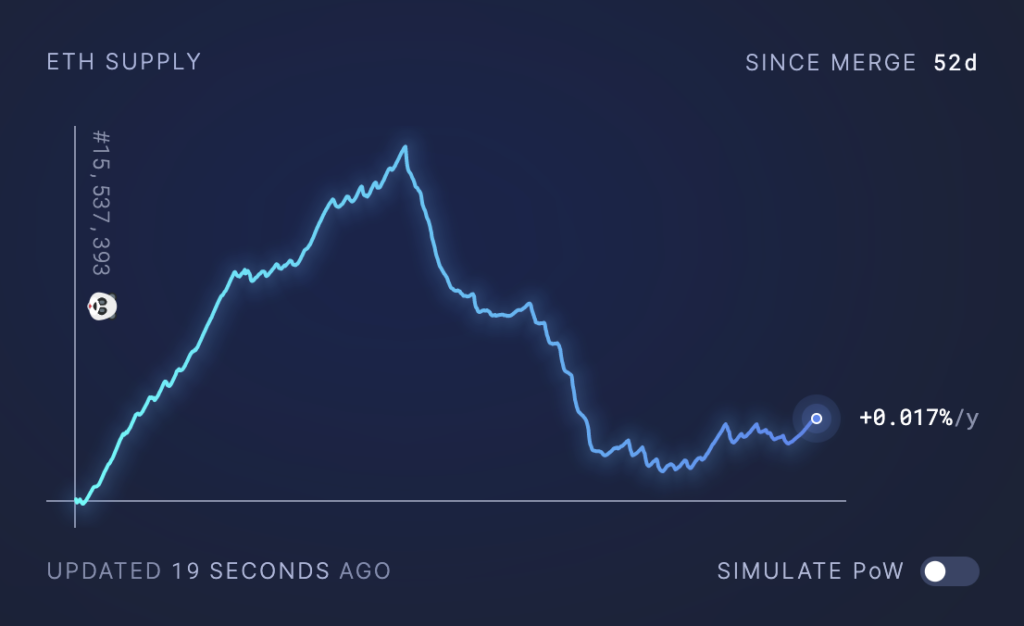

After the ICO launch of Ethereum in 2014, the total circulating supply of Ethereum was 72 million ETH. At the time of The Merge, it had reached 120,534,150 ETH and has since declined by around 10,000 ETH. The circulating supply hit a post-merge low on Oct. 27 before starting to increase into the start of November slowly.

Mining accounted for most of Ethereum’s new supply, resulting in a triple halving following The Merge. Around 13,000 ETH was created daily as a result of mining. Once mining was removed from the network, the new supply was reduced by around 99%. Just 3,000 ETH per day is created from staking, with a daily burn of approximately 1,172 ETH at press time.

The concentration of the total supply can be broken down into Ethereum accounts, smart contracts, and validators, according to data from Ultrasound Money. 72% of the total supply is held in accounts, 15% in smart contracts, and 13% in validators.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass