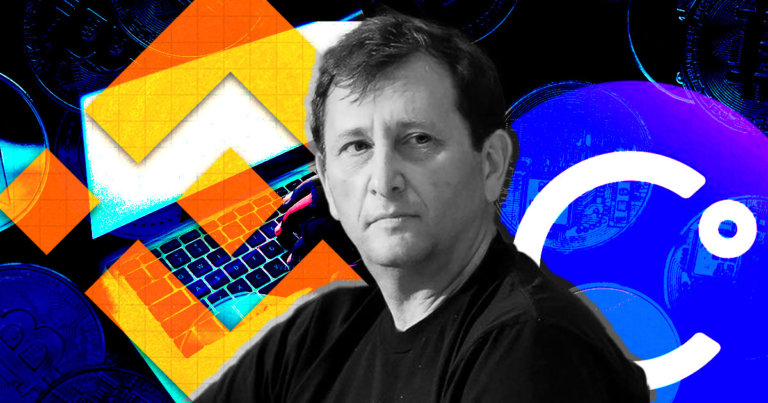

CryptoSlate Wrapped Daily: Binance takes aim at cyber financial crime; CEL tanks after Celsius’ Alex Mashinsky resigns

CryptoSlate Wrapped Daily: Binance takes aim at cyber financial crime; CEL tanks after Celsius’ Alex Mashinsky resigns CryptoSlate Wrapped Daily: Binance takes aim at cyber financial crime; CEL tanks after Celsius’ Alex Mashinsky resigns

CEL drops by 7.5% after Celsius CEO announces resignation, the Ethereum Push Notification Service rebrands as Push Protocol, and much more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptosphere for Sept. 27 includes Binance’s new global program that aims at helping law enforcement fight cybercrime, FTX’s acquisition of the bankrupt Voyager, and Celsius CEO Alex Mashinsky’s resignation.

CryptoSlate Top Stories

Binance launches new program to help law enforcement fight cyber crime

Binance announced the launch of its new Global Law Enforcement Training Program on Sept. 27. The program will aid law enforcement worldwide in detecting cyber financial crime and assist in prosecuting criminals.

The Program will be led by a selective few with hands-on global experience in cyber financial crime from the Binance investigations team, which grew exponentially over the past year.

FTX wins bid to acquire bankrupt Voyager’s assets

Bankrupt crypto lender Voyager had been meeting with numerous investors, including exchange gain FTX, that were interested in purchasing the company. On Sept. 27, Voyager announced that FTX won the bid to acquire the company.

Celsius CEO Alex Mashinsky resigns; CEL tanks

Celsius Network’s CEO Alex Mashinsky announced his resignation from the company on Sept. 27. Celsius’ native token, CEL, responded to the announcement by tanking 7.5% to reach $1.37.

Celsius Network announced the appointment of Chris Ferraro as the Chief Restructuring Officer and the interim CEO immediately after Mashinsky’s resignation announcement.

EPNS rebrands to Push Protocol as it moves to a multi-chain future

The Ethereum Push Notification Service (EPNS) announced that it rebranded to “Push Protocol” on Sept. 27. According to the announcement, push protocol indicates the first step of the service toward becoming a multi-chain communication feature.

ATOM up 3% as Cosmos releases new whitepaper

The whitepaper on the Cosmos (ATOM) update got released on Sept. 27. Even though the document is in a state of proposal, ATOM responded by recording a 3.4% increase to reach $14.57 at the time of reporting.

The proposal suggests adding interchain security to Cosmos hub to turn it into an interchain web. The draft also offers updates to increase ATOM’s utility and value.

Ethereum proof-of-stake client bug caught and patched without incident

Ethereum (ETH) developers detected a bug with the Besu Ethereum client before it could create a consensus error in networks. The find was posted on the Hyperledger GitHub repository, and it was understood that “no production networks had transactions that would trigger this failure.”

Polkadot looks to 10x transaction speed in new updates

Polkadot (DOT) announced upcoming improvements to the network, which include its asynchronous backing update that’ll increase the transaction speed by at least 10x.

The asynchronous backing update will shorten parachain block time to six seconds, thereby increasing each block’s space by five to ten. The new update will be ready for Kusama deployment by the year-end.

California issues cease, refrain order to Nexo over offering clients an Earn Interest Product

California’s Department of Financial Protection and Innovation attempted to refrain order for the crypto lender Nexo. The charge accuses Nexo of allegedly behaving “against interest-bearing cryptocurrency accounts.”

On the other hand, Nexo responded by saying it stopped onboarding new users from the U.S. to its Earn Interest Product in Feb. 2022.

Usage of non-renewable energy in Bitcoin mining increased by 13% in 2021

According to the Cambridge Centre for Alternative Finance (CCAF), sustainable energy usage in Bitcoin (BTC) mining decreased by 13% in 2021 compared to 2020.

The numbers show that over 40% of Bitcoin mining was done using renewable energy sources in 2020. This percentage fell to 28.48% in 2021, which led to a 63% increase in greenhouse gas emissions.

DeFi needs to be regulated ‘carefully and thoughtfully,’ says Fed chair, Jerome Powell

The U.S. Federal Reserve’s Chair Jerome Powell spoke at a roundtable conference on Sept.27 and called on lawmakers to take cautious steps when regulating DeFi protocols. He said that regulators have to be:

“…very careful about how crypto activities are taken within the regulatory perimeter.”

He added that central banks will always be the main trust factor behind money, while stablecoins only “borrow” the trust from their issuer.

Nexo acquires stake in Summit National Bank to expand U.S. offering

Nexo inked a deal with Summit National Bank that’ll enable Nexo to offer various services in the U.S., including bank accounts, asset-backed loans, card programs, and custodial solutions.

Research Highlight

Research: Bitcoin on-chain metrics suggest the bottom is now in

Analyzing various metrics, the CryptoSlate research team concluded that Bitcoin bottom had been reached.

The conclusion was drawn after looking into the percentage of Bitcoin addresses in profit, market value to realized value (MVRV), and supply in profit and loss. These metrics have been under the CryptoSlate radar, and just last month, they indicated that Bitcoin could have fallen further. However, all three showed signs of Bitcoin reaching its bottom this month.

Crypto Market

Bitcoin (BTC) was down 0.57% in the last 24 hours to reach $19,030. Ethereum (ETH), was also down 0.26%, reaching $1,321.

Biggest Gainers (24h)

- Quant (QNT): +12.52%

- Reserve Rights (RSR): +10.22%

- STEPN (GMT): +7.44%

Biggest Losers (24h)

- Terra Classic (LUNC): -9.52%

- Algorand (ALGO): -6.22%

- XRP (XRP): -5.7%