Chainlink’s LINK token hits five-month high in exchange balance amid $75 million inflow

Chainlink’s LINK token hits five-month high in exchange balance amid $75 million inflow Chainlink’s LINK token hits five-month high in exchange balance amid $75 million inflow

Chainlink's price has been on the ascendancy since the beginning of the year, up by arond 25%.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

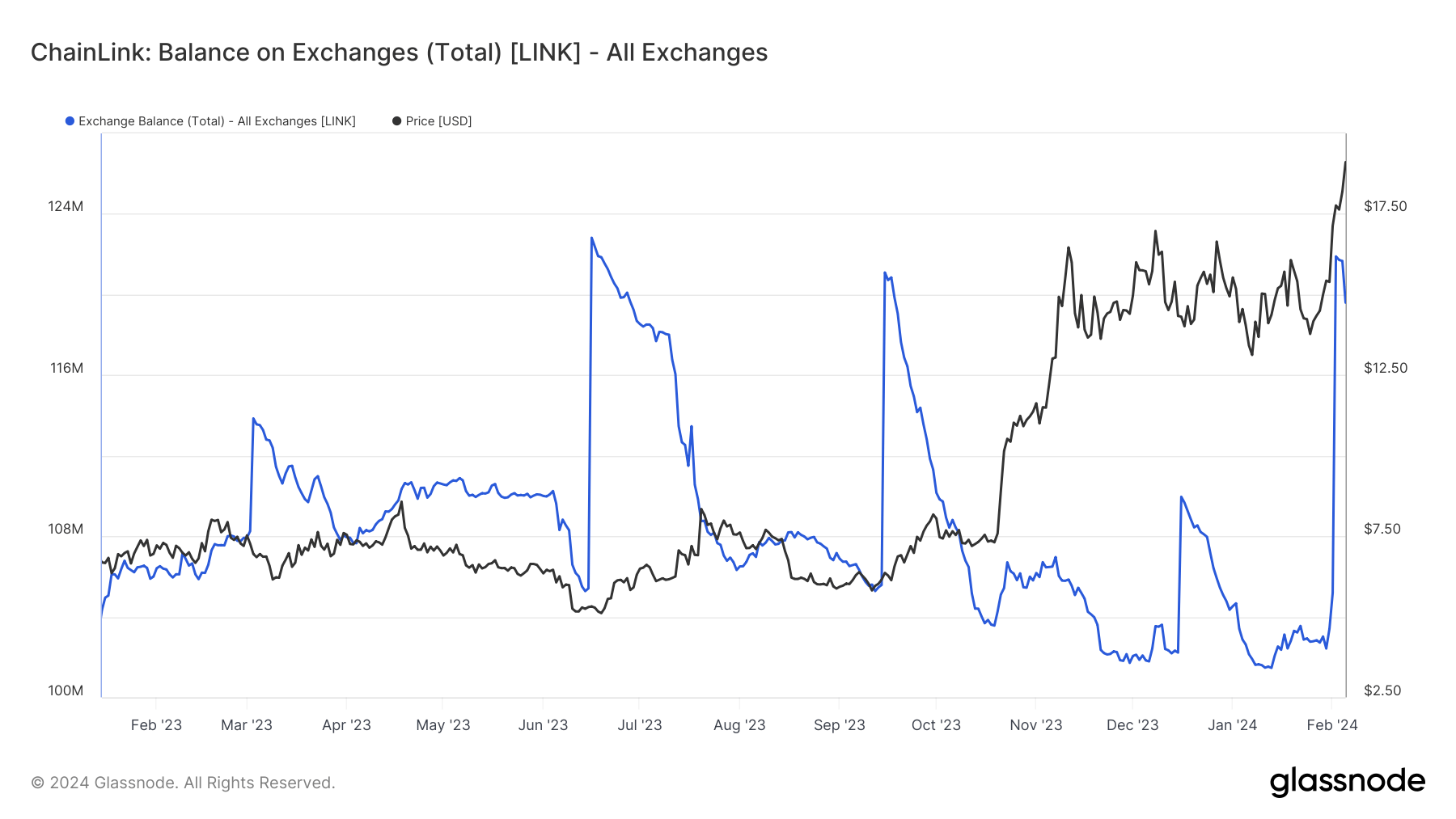

Chainlink’s LINK token has surged to a five-month high in exchange balance, marking a notable uptick in inflows for the first time this year.

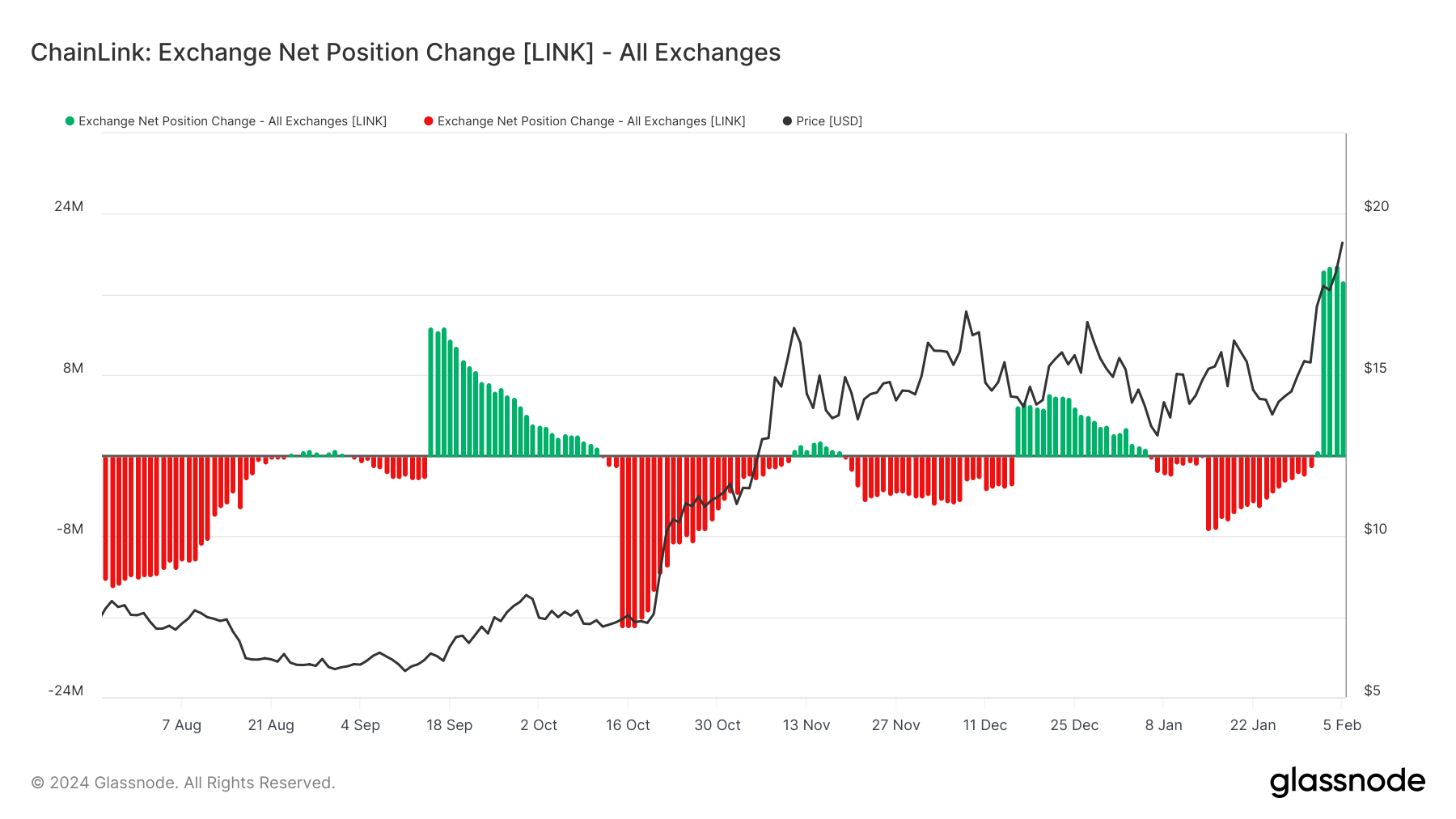

The Glassnode charts below show that approximately $75 million worth of LINK has flooded onto cryptocurrency trading platforms since Feb. 1. Consequently, its exchange balance has surged to around 120 million tokens.

A rising exchange balance traditionally signals investors gearing up to offload their crypto holdings. Such inflows typically indicate selling pressure, a bearish sign of potential price declines.

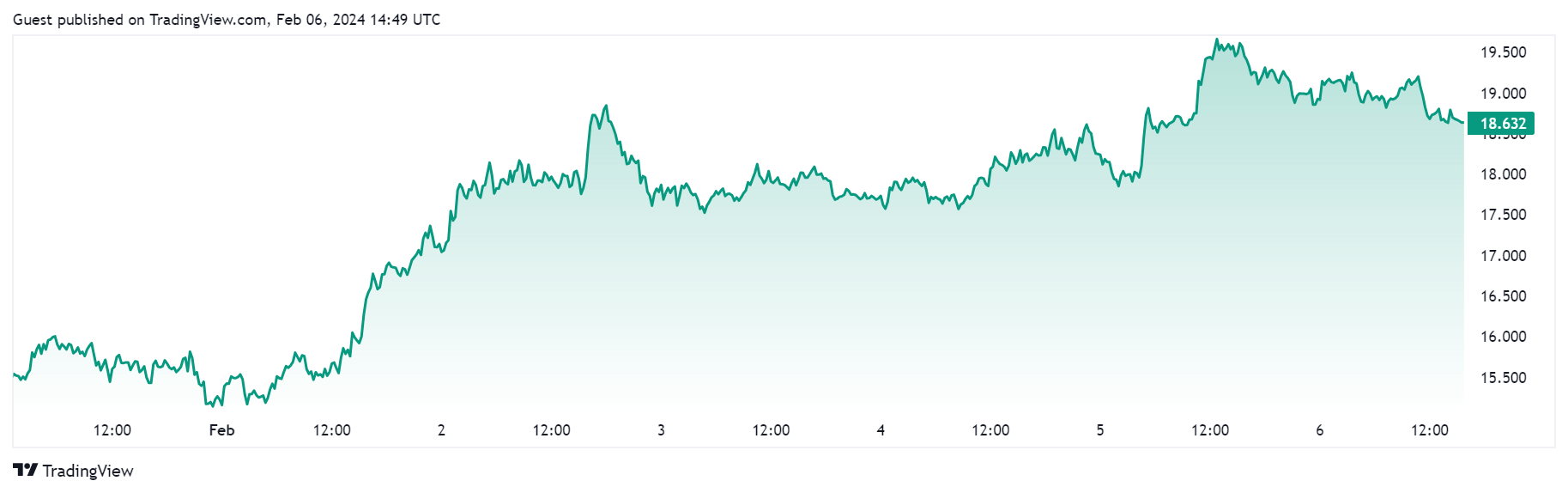

However, this recent surge in balance might be attributed to investors seizing opportunities amidst the recent price surge in the Oracle network. According to CryptoSlate’s data, LINK’s price jumped by more than 23% over the past week, peaking at a two-year high of $19.75.

Nonetheless, amid a broader market downturn, its value has seen a slight dip of around 4% to $18.68 as of press time.

Meanwhile, this slight price correction has proven attractive for a whale address aggressively acquiring the LINK token. Blockchain analyst Lookonchain noted that an unnamed institution, using 47 fresh wallets, withdrew more than 2.2 million LINK units worth approximately $42 million from Binance in the past two days.

Chainlink RWA tokenization venture

Meanwhile, this market dynamic is occurring amid a notable uptick in Chainlink’s Cross-Chain Interoperability Protocol (CCIP) technology adoption for real-world asset (RWA) tokenization.

Last December, the blockchain network revealed that it would look to bridge the gap between traditional finance and blockchain technology through RWA, pointing out that the sector is estimated to be a $16 trillion business opportunity by 2030.

As a result, the network has pushed for partnerships with several traditional firms, including the Society for Worldwide Interbank Transfers (SWIFT), South Korean gaming giant Wemade, and the New Zealand Banking Group. The network has also scored significant integrations with blockchain projects like Base and Circle’s USDC stablecoin.