CFTC considers Bitcoin, Ethereum, Tether to be commodities

CFTC considers Bitcoin, Ethereum, Tether to be commodities CFTC considers Bitcoin, Ethereum, Tether to be commodities

CFTC wrote that these digital assets are commodities because they meet the definition of the term as defined by the U.S. Constitution.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

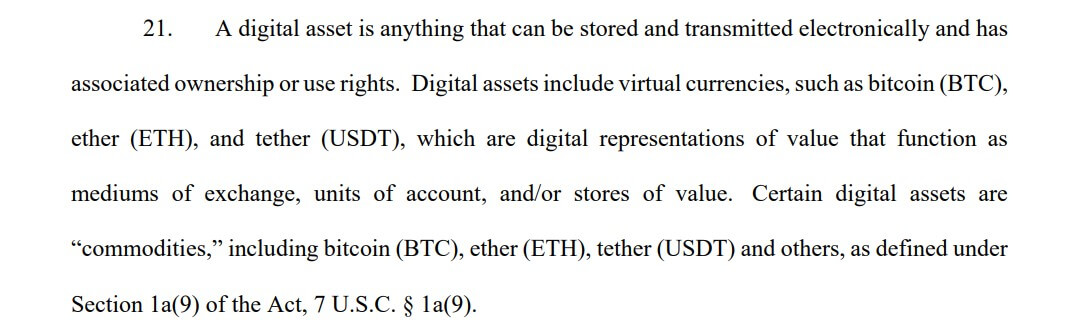

The U.S. Commodity Futures Trading Commission (CFTC) stated in its Dec. 13 court filing against FTX founder Sam Bankman-Fried that digital assets like Bitcoin(BTC), Ethereum (ETH), and Tether (USDT) are commodities.

CFTC wrote that these digital assets are commodities because they meet the definition of the term as defined by the U.S. Constitution.

Does the CFTC Chairman hold a different opinion?

While the CFTC lawsuit said ETH was a commodity, CFTC chairman Rostin Behnam appears to hold a different opinion of the asset.

At a recent private crypto event at Princeton University, Benham said BTC was the only cryptocurrency that should be classified as a commodity.

The statement was in contrast to previous ones made by the regulatory chief. In May, Benham said Bitcoin and Ethereum were fit to be labeled commodities in a CNBC interview.

He also reportedly made a similar statement at a New York event in October, suggesting that the SEC chair Gary Gensler has a different opinion.

After ETH migrated to the proof-of-stake network, Gensler reportedly said cryptocurrencies that allow staking could qualify as securities under the Howey test.

Meanwhile, token classification remains a significant issue in the US as regulators have failed to clarify how assets can be classified. Presently, the SEC and crypto payment firm Ripple is involved in a two-year-long legal battle to determine if the sales of XRP qualify as securities.

Other countries like Belgium declared that assets without issuers, like Bitcoin and Ethereum, are not securities, while Canada’s Securities Administrators (CSA) recently said stablecoins could be securities or derivatives.

CoinGlass

CoinGlass

Farside Investors

Farside Investors