Research: Why a crypto mining company’s IPO is unlikely to be successful

Research: Why a crypto mining company’s IPO is unlikely to be successful Research: Why a crypto mining company’s IPO is unlikely to be successful

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Chinese-based Bitcoin mining giant Ebang is the latest crypto company to list on the public markets. Debuting on the Nasdaq with a $685 million evaluation, the company was able to raise over $100 million.

Its stock price has seen some turbulence since listing, as it appears that investors are conflicted as to what the company’s true value is.

That being said, one prominent research group does not believe that Ebang’s Initial Public Offering (IPO) will be met with long-term success.

They peg this possibility on a few key reasons, including mounting tensions between the US and China, competing mining firm Canaan’s recent profit warnings, and the company’s “weak market positioning.”

Ebang latest crypto company to list on public markets

News of Ebang’s IPO first broke in April of this year when the company filed all the required paperwork to start the listing proceedings.

The listing – which took place this past week – allowed the company to raise a total of $101 million by selling 19.3 million shares at $5.23.

This was below the mid-point of the listing range for the company’s shares, which was set at $5.25.

Shortly after public trading began, Ebang shares (EBON) on the Nasdaq fell to lows of under $4.00. This selloff was met with some heavy buying pressure that sent them back towards $5.00.

In aftermarket trading on Friday, EBON concluded the week trading at $4.56. At the moment, this places the company’s market capitalization at approximately $655 million.

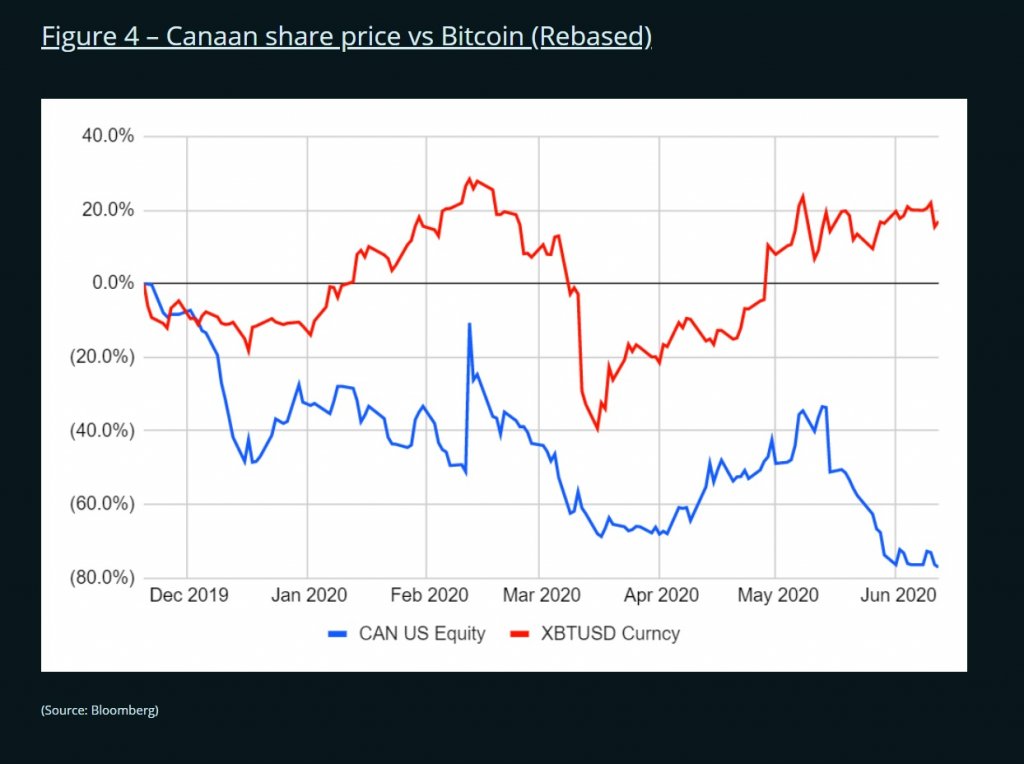

Competing mining firm Canaan has seen incredibly poor performance since its IPO, which has been attributed to write-downs following the initial listing. The company does anticipate their profitability to start climbing towards the end of 2020.

BitMEX Research claims Ebang stock unlikely to see success in coming months

BitMEX Research – the research arm of the popular margin trading platform – recently explained that they believe there are three factors suggesting that the crypto mining firm’s IPO will not ultimately prove to be successful.

They point to rising tensions between the US and China, Canaan’s poor performance, and their weak market positioning as three primary reasons to support their claim.

“In April 2020, Ebang filed for an IPO in the US. However, given the current political tensions between the US and China, the Canaan profit warning & Ebang’s relatively weak market positioning, we think it will be difficult for Ebang to successfully pull off an IPO.”

Because investing in a Bitcoin mining firm is largely a bet on the success of Bitcoin from a price perspective, it may make more sense for investors looking to gain exposure to the crypto markets to buy spot BTC or shares of Grayscales BTC Trust (GBTC).

Farside Investors

Farside Investors

CoinGlass

CoinGlass