Bitcoin Zooms Past $12,700 as Futures Launch Looms Closer

Bitcoin Zooms Past $12,700 as Futures Launch Looms Closer Bitcoin Zooms Past $12,700 as Futures Launch Looms Closer

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

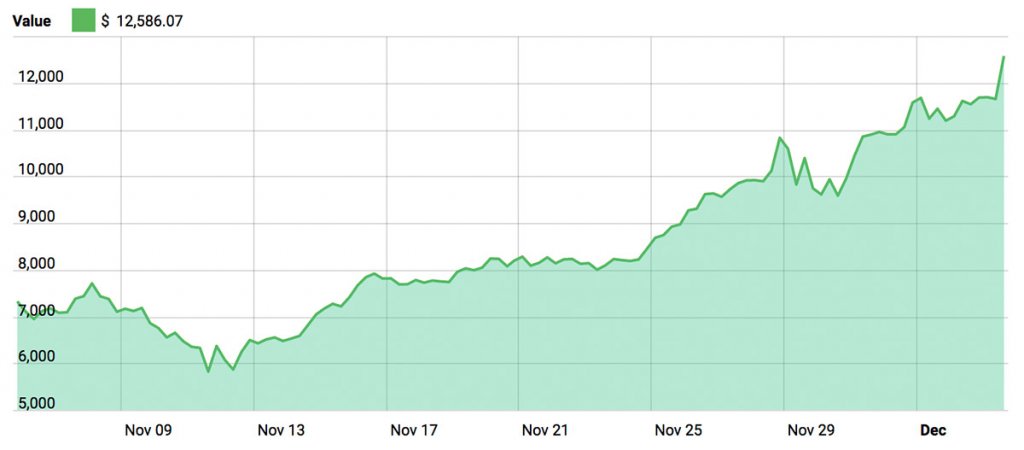

For the first time Bitcoin price has breached the $12,000 mark. Its new all-time high is $12,725 and it’s expected to rise above this figure before the end of the day. Analysts attribute the latest price rally to the anticipated futures trading launches by various platforms, including CME and CBOE.

As always, South Korea leads the market in the recent Bitcoin rally. At press time, the BTC price was $14,134, according to the largest local exchange Bithumb. The US crypto market is not too far behind as the price is currently $12,586. Japanese speculators are also joining the frenzy, and the currency accounts for almost half of the trading volumes on local exchanges.

Compelling Reasons for Market Optimism

Since the CME group announcement in October that they would launch a bitcoin futures product, the Bitcoin price has been on a consistent bull run. The implementation is now reportedly set for December 18, 2017.

JP Morgan is also exploring the idea of rolling out Bitcoin futures. CME seems to have set the pace for other financial institutions, as several others have joined the bandwagon.

JP Morgan’s Chicago rival CBOE announced that they would launch their own bitcoin futures trading on December 10th. They in fact plan to drum up interest by offering investors the opportunity to trade for free through the month. The New York exchange platform NASDAQ is also set to start trading early next year.

These are some of the largest exchange platforms in the global financial market. By launching the product, they will effectively guarantee investors of all levels the requisite liquidity levels and supportive infrastructure for reliable investment. Experts predict that the launch will result in more than $10 billion from the institutional players into the Bitcoin market.

The moves will mark a great step for institutional investors in the crypto scene. This will increase the market’s optimism on Bitcoin and the virtual currency framework as a whole. The derivatives trading within regulatory frameworks is particularly reassuring for retail investors, as it assures them of reduced risk.

The Other Side of the Coin

These announcements have put investment banks in a tight spot as they decide whether to make futures contracts available to their customers. JP Morgan Chase is among those currently assessing customer demand in order to determine whether or not integrating the futures on their platform will be advantageous.

This calls to mind the statements made by the firm’s CEO, Jamie Dimon, a few months back. He compared the growing hype to the Dutch tulip mania and predicted its inevitable collapse. In fact, he threatened to fire any employee who was “stupid” enough to start trading bitcoin. However, personal opinions would have to take a backseat if customer interest is sufficient to warrant the integration.