Bitcoin worth $1.5B withdrawn from Coinbase in 48 hours

Bitcoin worth $1.5B withdrawn from Coinbase in 48 hours Bitcoin worth $1.5B withdrawn from Coinbase in 48 hours

50,000 Bitcoin were withdrawn from Coinbase on Nov. 24 and 25, marking the third-largest withdrawal from the exchange.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A total of 100,000 Bitcoin (BTC) were withdrawn from Coinbase in the past two days, marking the third-largest BTC withdrawal in Coinbase’s history.

Two withdrawals worth 50K

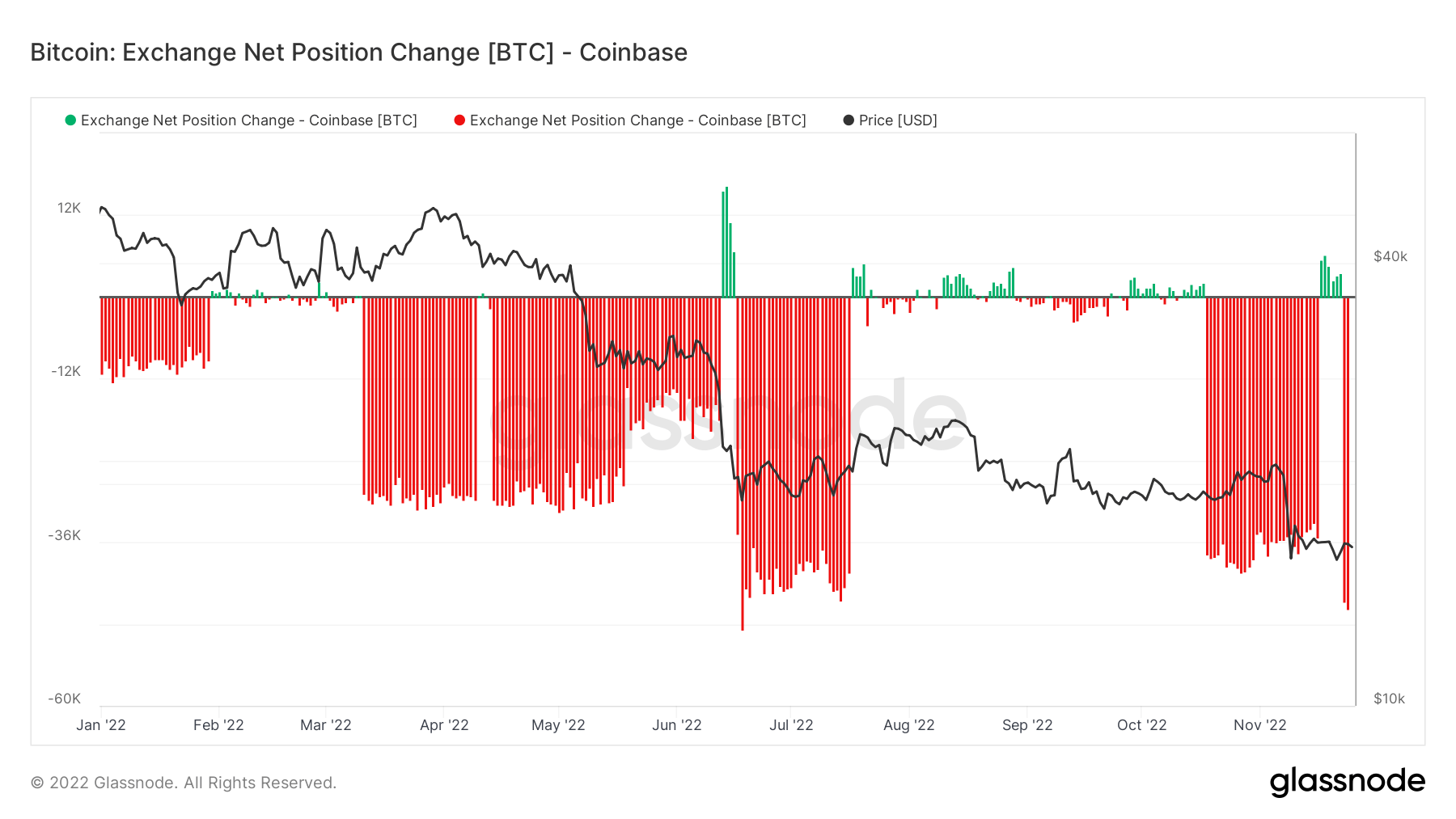

The chart below shows the BTC withdrawals and deposits in Coinbase on a daily basis since the beginning of the year.

On Nov.24, 50,000 BTC were withdrawn from Coinbase. The amount equated to over $800 million at the time, which marked the second-largest BTC withdrawal from Coinbase in 2022. The next day, on Nov. 25, another 50,000 BTC withdrawal took place, which equates to over $825 million at the time of writing.

Considering that Coinbase is preferred mainly by large U.S. institutions, it can be said that they are taking advantage of the affordable prices and accumulating BTC, as the on-chain data indicates that the bottom of the bear market cycle might be near.

Third-largest withdrawal in Coinbase

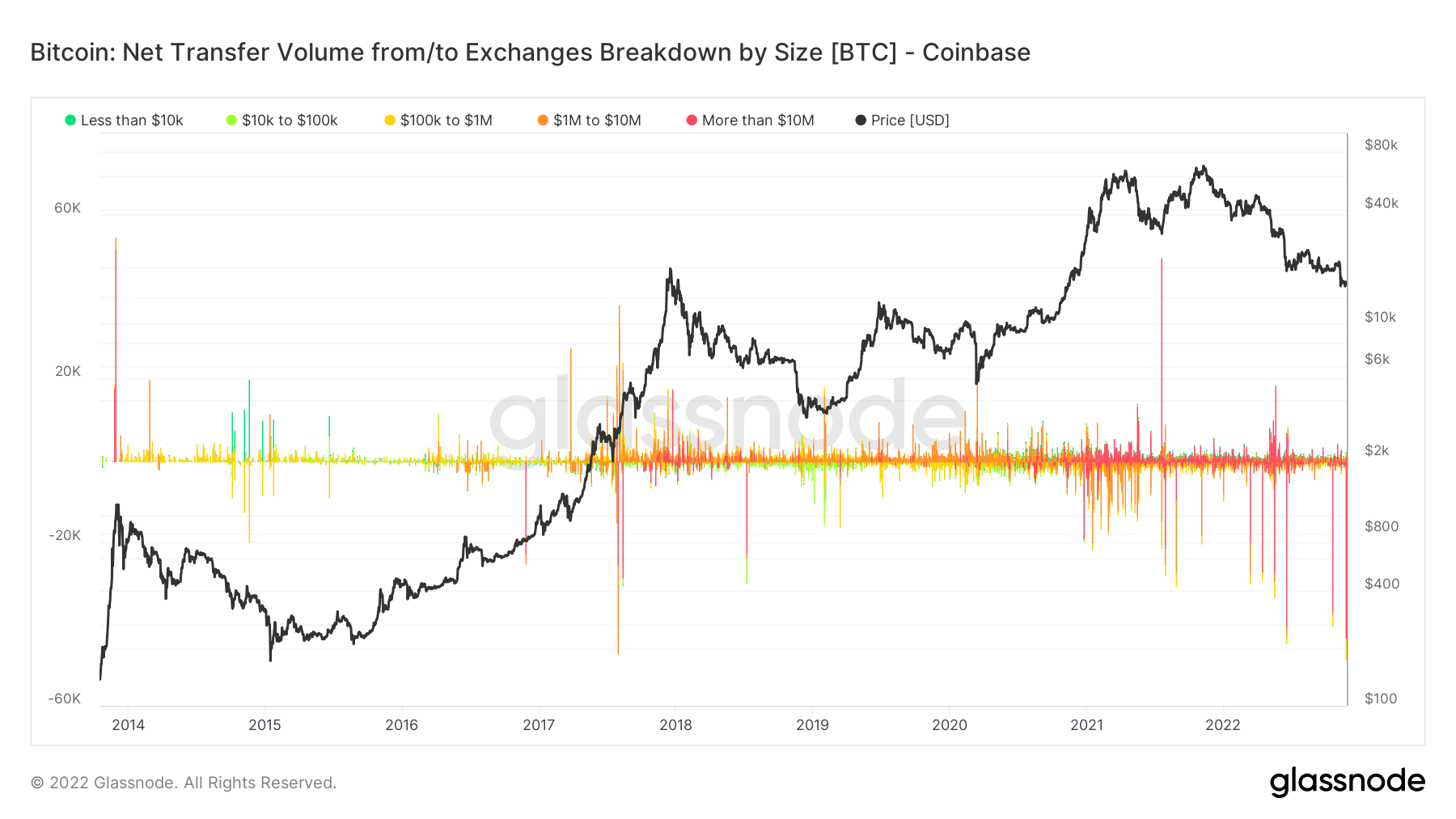

The chart below represents Coinbase’s BTC deposits and withdrawals since the exchange was launched in 2014.

With the second 50,000 BTC withdrawal, Coinbase reserves lost more than $1.5 billion worth of BTC in two days, which currently marks the third-largest BTC withdrawal in Coinbase’s history.

According to the chart, the most significant withdrawal was recorded in late 2017, and the second-largest one took place in mid-2022 after the Terra (Terra) collapse.

It’s not just Coinbase

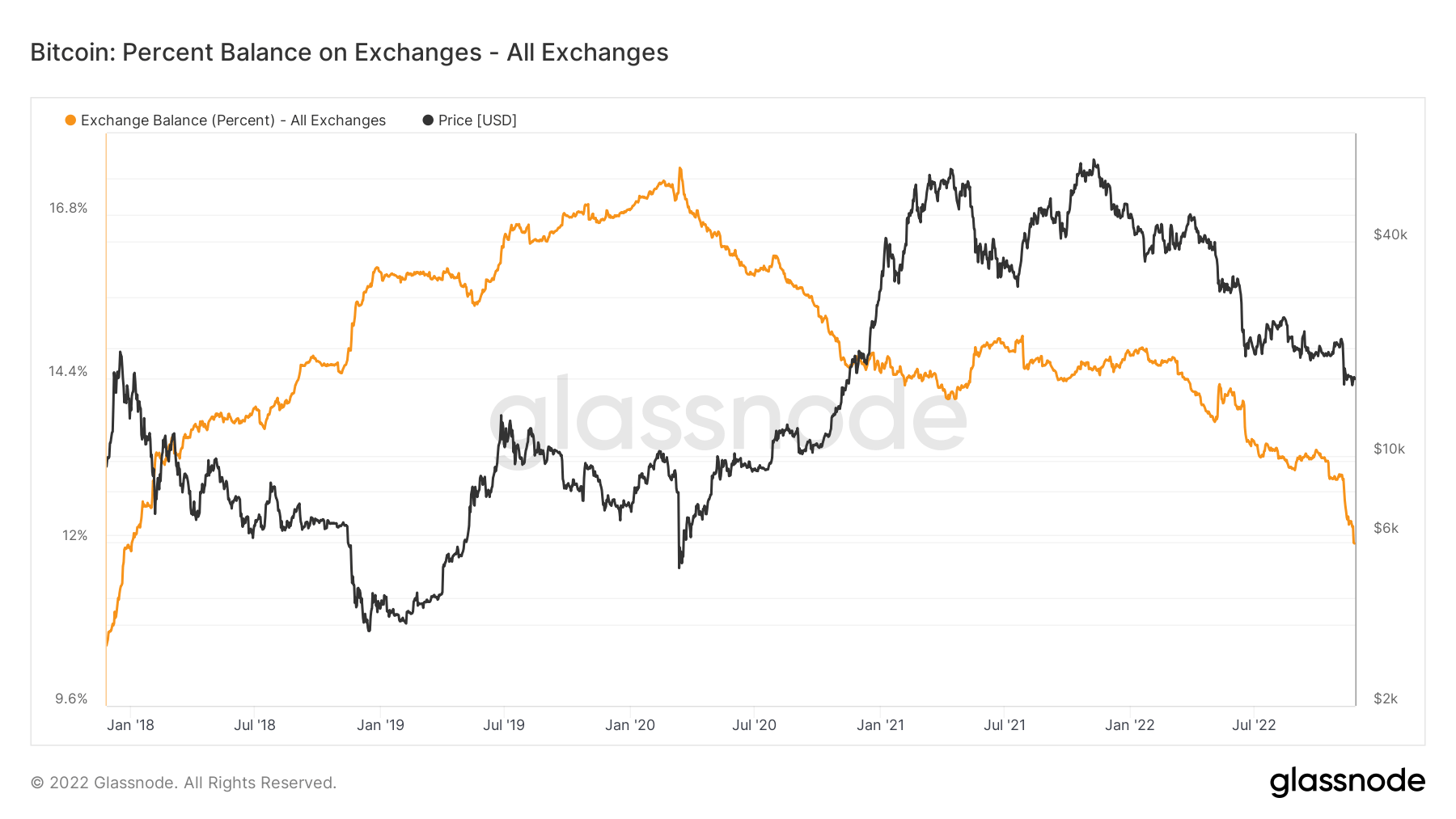

The data shows that Coinbase is not the only exchange experiencing large BTC withdrawals. The chart below demonstrates the BTC balance on all exchanges since January 2018, and a significant downfall can be seen since January 2022.

According to the data, the balance on decentralized exchanges has fallen below 12% for the first time since January 20218.