Bitcoin makes play for $30k, leading to $145M in liquidations

Bitcoin makes play for $30k, leading to $145M in liquidations Bitcoin makes play for $30k, leading to $145M in liquidations

Bitcoin rose by 8.44% in the last 24 hours to trade at $29,614 at the time of writing, according to CryptoSlate's data.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

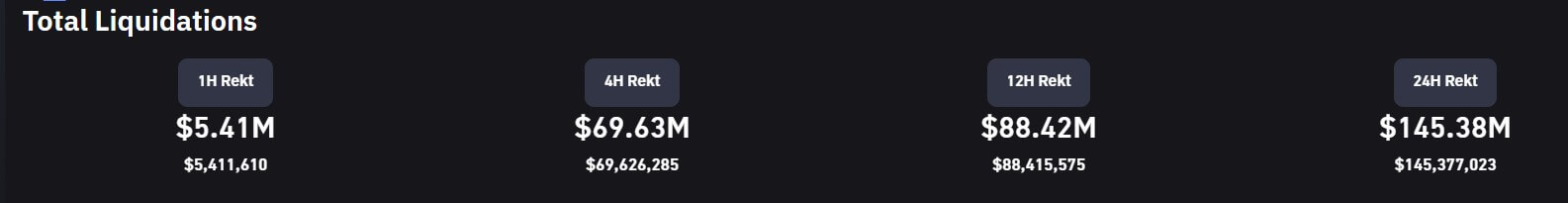

Bitcoin’s (BTC) rally toward $30,000 led to more than $70 million in liquidations for short traders in the last 24 hours, according to Coinglass data.

The overall crypto market saw roughly $145 million in liquidation during the period, mostly from traders who held short positions against BTC and other cryptocurrencies.

According to Coinglass, 37,332 traders were liquidated — with the most significant liquidation being a $2.2 million BTC-USD short position on ByBit.

Other liquidated assets include Ethereum (ETH) and Arbitrum (ARB) — with $29.71 million and $4.11 million, respectively. Others like Polygon (MATIC) saw $2.31 million in liquidation, while Litecoin (LTC) recorded $2.27 million.

Most of the liquidations occurred on Huobi, Binance, and ByBit. The three exchanges accounted for 73% of the overall liquidations — of which 83% were short positions.

Bitcoin eyes $30k

Bitcoin rose by 8.44% in the last 24 hours to trade at $29,614 at the time of writing, according to CryptoSlate’s data.

Fears of another U.S. banking crisis are fueling the new Bitcoin rally. CryptoSlate Insight reported that First Republic Bank shares plunged by more than 29% after news emerged that its deposits fell 40% in 22 days.

Meanwhile, the U.S. government appears unwilling to intervene in the First Republic rescue process as it did with Silicon Valley Bank and Signature Bank in March. The government took over those banks at the time to prevent further contagion to the broader economy.

Since this banking crisis began, BTC has rallied by more than 35%, according to CryptoSlate’s data.

Sentiments in the market have been mainly positive. Matrixport chief researcher Markus Thielen said Bitcoin price might reach around $45,000 by the end of this year. Thielen said:

“As the US 10 year bond yield has started to trade below 3.5%, we can assume that inflation will be a big tailwind for risk assets – notably Bitcoin.”