Bitcoin halving grows ever more pertinent as BTC downtrend continues

Bitcoin halving grows ever more pertinent as BTC downtrend continues Bitcoin halving grows ever more pertinent as BTC downtrend continues

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s upcoming mining rewards halving has long been looked upon as the most immediate impetus for the next BTC bull run, and the hopes that have been pinned on this event have only inflated in recent times as the cryptocurrency remains caught within a firm downtrend.

If history repeats itself, this event will catalyze the next major upswing that brings Bitcoin back up towards, or above, its previously established all-time highs, but there still remains significant debate as to whether this time will be different than the previous ones.

One analyst is noting that he believes BTC is about to enter an accumulation phase that precedes this event, which could help provide fuel for the next big movement.

Bitcoin caught in firm bear trend, will this hamper halving bull run dreams?

Over the past month, Bitcoin has been caught within a firm downtrend that has led its price to dip down to just over $6,800, which marks a significant retrace from its multi-month highs of $10,600 and only a slight climb from its recent lows of $6,500.

This firm and unwavering bear trend are showing no signs of letting up anytime soon and is quite different than the price action that is typically seen going into mining rewards halving events.

Willy Woo, a popular figure within the cryptocurrency industry, explained in a recent tweet that Bitcoin’s bearishness going into this event could signal that its price action in the time directly preceding and following the event will gravely disappoint investors.

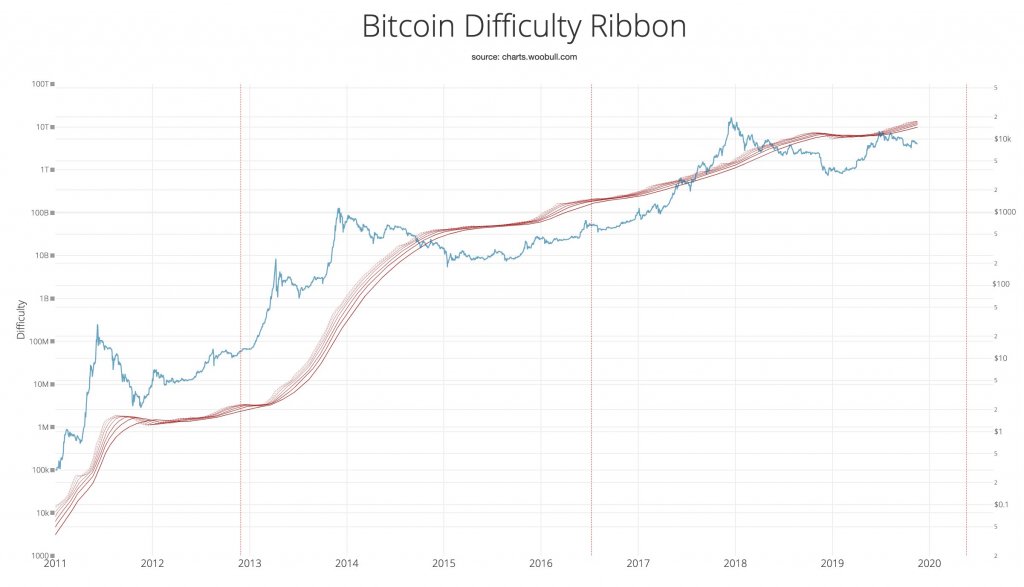

“NEVER gone into a halvening in BEARISH price action, miners already capitulating adding sell volume. Historically we front run with a BULLISH setup, miner capitulating only after halvening when revenues are slashed. This is a unique setup. Quite bearish leading up to the event,” he noted while referencing the chart seen below.

Will pre-halving accumulation bolster BTC’s price action?

This current downtrend may prove to be an ideal opportunity for investors to accumulate the cryptocurrency in anticipation of a halving-induced rally, with this retail buying potentially providing fuel for the next uptrend. Alistair Milne, a prominent Bitcoin investor, explained in a recent tweet:

“Things I expect to happen over the next 4-5 months due to the impending Bitcoin halving: – BTC shorts close out – People re-accumulate BTC if they had sold – Miners start to hoard (e.g. borrow USD against assets) – Under performing altcoins sold for BTC – Bulls lever up.”

It does appear that Bitcoin will end 2019 on a bearish note, but only time will tell as to whether or not the crypto will be able to gain the momentum that is largely anticipated to come about as a result of the halving that is looming on the horizon.

Bitcoin Market Data

At the time of press 9:27 am UTC on Apr. 25, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.7% over the past 24 hours. Bitcoin has a market capitalization of $125.45 billion with a 24-hour trading volume of $20.1 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:27 am UTC on Apr. 25, 2020, the total crypto market is valued at at $187.6 billion with a 24-hour volume of $70.01 billion. Bitcoin dominance is currently at 66.89%. Learn more about the crypto market ›