Bitcoin finally hits a new all-time high: here are what top analysts are saying

Bitcoin finally hits a new all-time high: here are what top analysts are saying Bitcoin finally hits a new all-time high: here are what top analysts are saying

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

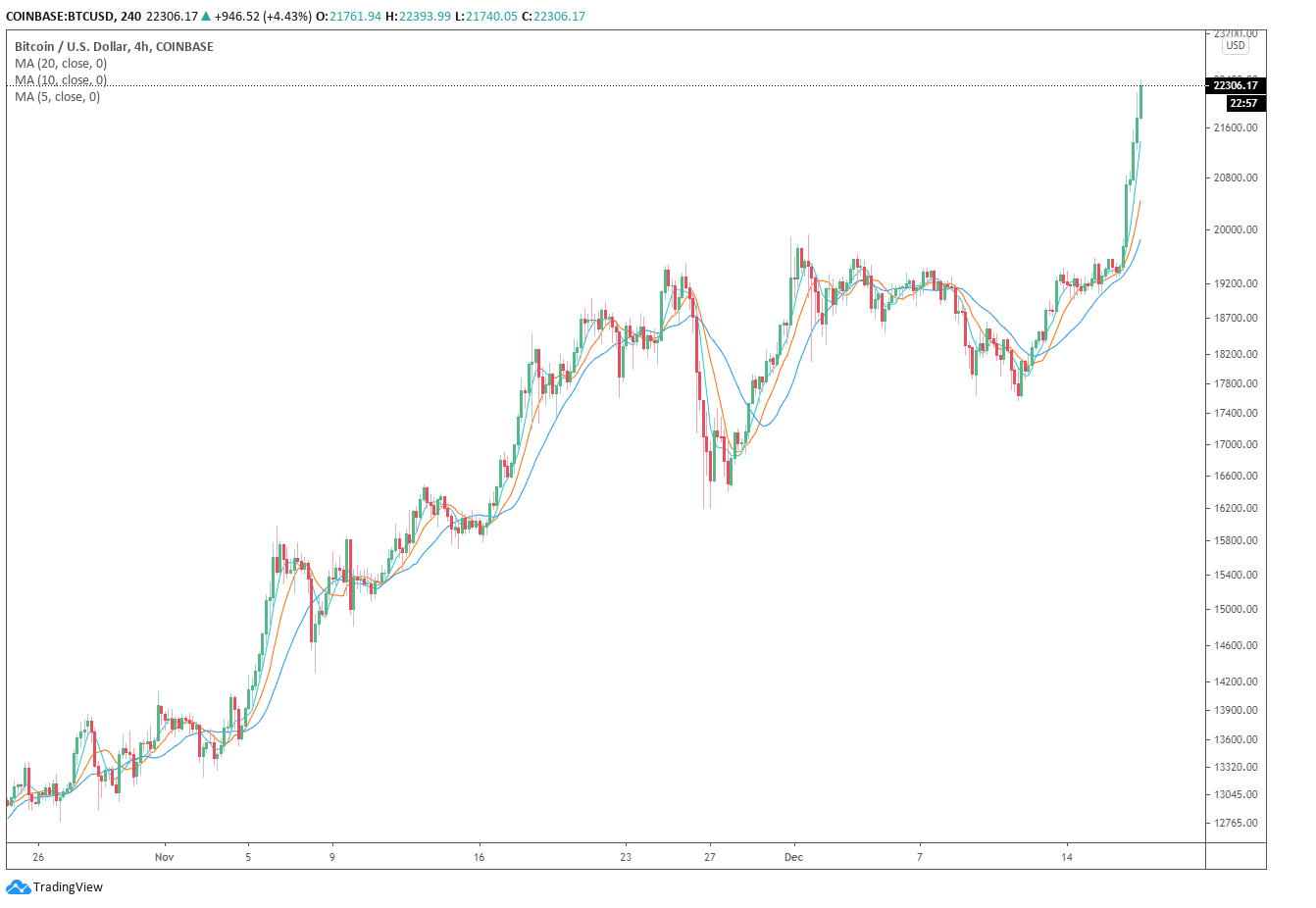

The Bitcoin price (BTC) finally surpassed $22,000 shortly after breaching its all-time high at $20,000. As the dominant cryptocurrency enters price discovery, analysts are forecasting short-term trends.

In the near term, the outlook of Bitcoin remains obviously optimistic. There are no historical resistance and support levels above $20,000, so it remains uncertain how far BTC would rally until the next top.

But, analysts are pinpointing three trends that could emerge as a result of BTC’s strong overnight rally.

Massive volatility is expected to both downside and upside

Bitcoin has rapidly moved upwards in the past 48 hours. This means that order books are thinner and the volume is higher.

A pseudonymous trader known as “Bitcoin Jack” said the BTC price can “cascade up and down viciously.” He said:

“Liquidity is so dry you can clear the sell side on Bitstamp with one buy order of <650 btc lol. Obviously sellers would step in, stops etc, but what I’m trying to say is that books are once again super thin after this recent push, price can cascade up and down viciously.”

Massive price swings are becoming more likely due to higher open interest and rising whale inflows.

The term open interest refers to the total sum of all active futures contracts in the market. The higher the open interest, the more traders are betting on the price of BTC in the derivatives market.

According to data from CryptoQuant, the aggregated open interest on major cryptocurrency exchanges reached an all-time high.

$BTC futures aggregated open interest on major exchanges hit the all-time high. pic.twitter.com/PUXkPdKE9o

— CryptoQuant.com (@cryptoquant_com) December 17, 2020

When the open interest of futures exchanges spikes, the probability of a massive volatility spike increases.

The chances of cascading liquidations also increase, which could fuel intensified upside or downside movements within a short period.

Altcoins would have a hard time

Alternative cryptocurrencies (altcoins) thrive when Bitcoin stagnates or consolidates.

Investors begin looking for higher-risk and more volatile plays to offset the lack of volatility in the Bitcoin market.

But when BTC starts to surge 10% to 20% on a single day, it sucks up the volume and volatility from the cryptocurrency market.

In the foreseeable future, this would mean that altcoins would likely struggle against Bitcoin. A pseudonymous trader known as “Loma” said:

“BTC up ~10% and a sea of red for most ALTBTC pairings… Either be in Bitcoin or try your luck at an outperformer. The play is still heavy Bitcoin imo ALTs will have their time but opportunity cost is a real thing.”

Even most large-cap cryptocurrencies that performed strongly when Bitcoin was rallying in November, such as Ethereum and XRP, have underperformed in recent weeks.

Until Bitcoin stabilizes and establishes clear resistance and support levels, altcoins have a higher chance of stagnating against the Bitcoin pair.