Binance Futures surpasses BitMEX, becomes most liquid Bitcoin perpetual swap

Binance Futures surpasses BitMEX, becomes most liquid Bitcoin perpetual swap Binance Futures surpasses BitMEX, becomes most liquid Bitcoin perpetual swap

Photo by Harrison Kugler on Unsplash

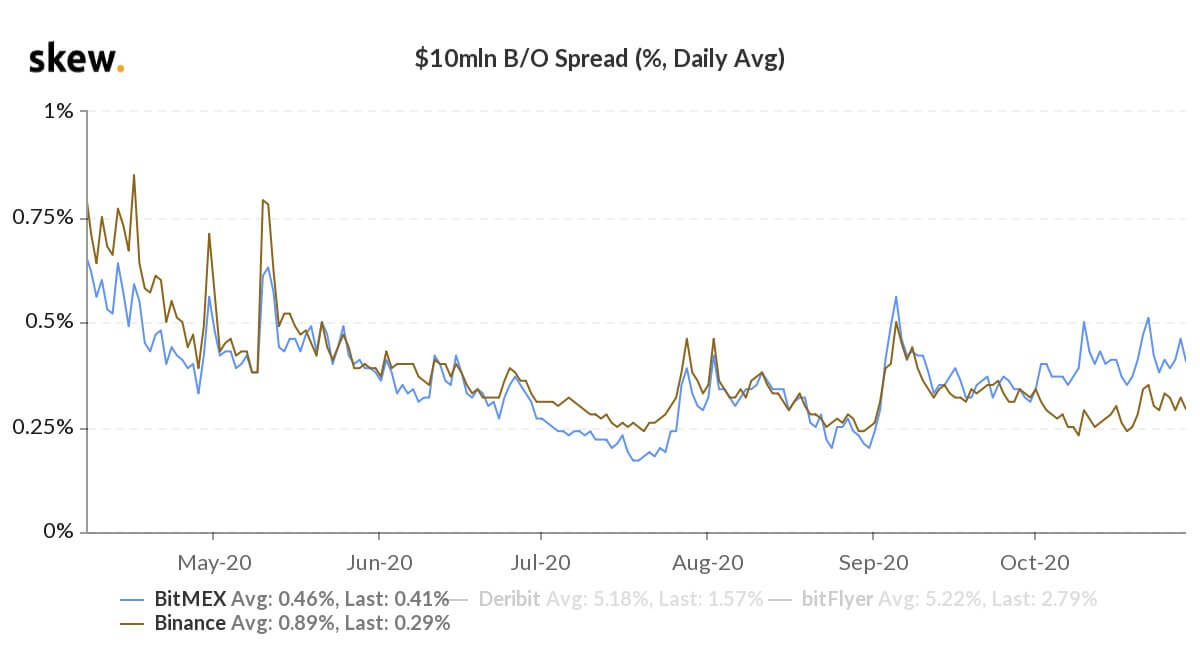

According to the data from Skew, Binance Futures now has the most liquid Bitcoin perpetual swap contract. It surpassed BitMEX, which was probed by U.S. regulators in early October.

Binance Futures, the futures exchange arm of Binance, launched in September 2019. Since then, it has become one of the largest futures exchanges alongside OKEx and CME Bitcoin futures.

Binance Futures already the biggest Bitcoin futures exchange in volume

In cumulative daily volume, Binance Futures is already the largest Bitcoin futures exchange. It processes $6.2 billion daily, which is higher than Huobi and OKEx, based on Skew’s data.

The figure is impressive for two reasons. First, it shows the rapid growth of Binance Futures in a span of 13 months.

Second, the exchange has integrated many alternative cryptocurrencies onto its futures platform apart from Bitcoin. That means the total daily volume of the entire futures exchange is much larger than its Bitcoin futures volume.

The researchers at Skew said:

“Binance overtook BitMEX this month as #bitcoin’s most liquid perpetual swap.”

The abrupt halting of withdrawals at OKEx, the probe against BitMEX, and the uncertainty around major exchanges led to an overall rise in demand for Binance Futures.

The BitMEX probe helped Binance’s dominance

It was not long ago when BitMEX was the most dominant player in the Bitcoin futures market.

On May 12, 2019, BitMEX CEO Arthur Hayes said the exchange reached $10 billion in 24-hour volume. At the time, the demand for BTC was rising and in the next two months that followed, BTC neared $14,000.

New record for BitMEX trading volume. Praise be to volatility and our wonderful traders! pic.twitter.com/iLMGdpz65n

— Arthur Hayes (@CryptoHayes) May 12, 2019

However, the daily volume of BitMEX has pulled back after the Department of Justice’s probe against BitMEX. The DoJ charged the exchange of violating the Bank Secrecy Act, charging the firm’s senior executives. Acting Manhattan U.S. Attorney Audrey Strauss said:

“As alleged, these defendants flouted that obligation and undertook to operate a purportedly ‘off-shore’ crypto exchange while willfully failing to implement and maintain even basic anti-money laundering policies. In so doing, they allegedly allowed BitMEX to operate as a platform in the shadows of the financial markets.”

Atop the events surrounding BitMEX, the recent spike in the volatility of Bitcoin further catalyzed the exchange’s volume.

Bitcoin futures specifically recorded a substantial increase in volume as it continuously outperformed alternative cryptocurrencies.

Ethereum, for instance, has fallen by more than 10% month-to-date against Bitcoin. As BTC takes a larger share of the cryptocurrency market’s volume, it would continuously boost the volume and open interest of the futures market.

At least in the near term, analysts do not see the altcoin market rallying against Bitcoin. Mohit Sorout, a partner at Bitazu Capital, said:

“You know the altcoin rallying when all you see is memes about it you know it’s diving off a cliff when everyone starts talking about the fundamentals again.”

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)