Analyst: Model predicting Bitcoin will hit $288k is no better than “moon cycles”

Analyst: Model predicting Bitcoin will hit $288k is no better than “moon cycles” Analyst: Model predicting Bitcoin will hit $288k is no better than “moon cycles”

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

To most, Bitcoin’s rally from literal irrelevance to becoming one of the most valuable assets in the world is hard to explain. The critics say that the value of the cryptocurrency is entirely based on speculation by foolish retail investors willing to buy into what they think is a Ponzi scheme.

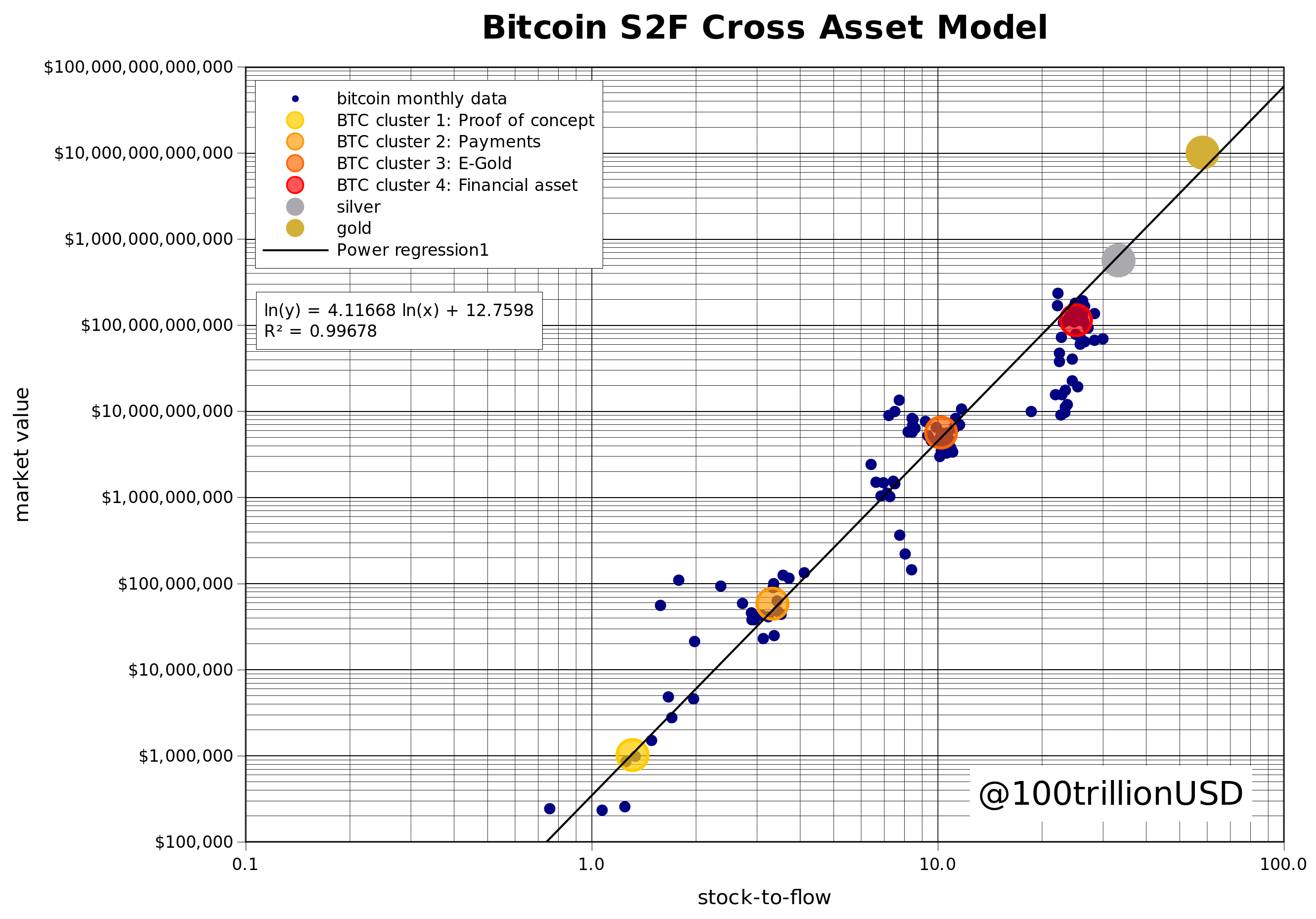

Thus, when a quantitative analyst known as “PlanB” revealed a valuation model for Bitcoin in early 2019, crypto investors felt validated and were rightfully enthused. The model, called the Stock to Flow (S2F) model, suggested that the value of BTC was mostly derived from its scarcity, enforced by the cyclical block reward halvings that take place every four years.

But, as the next halving has neared, the model has come under fire from critics, saying that there is scant evidence to suggest that it is actually applicable to Bitcoin.

Analysts bash Bitcoin price model predicting an imminent exponential rally

Bitcoin’s stock-to-flow ratio and price are “NOT” cointegrated, according to Alex Krüger, an economist closely tracking the cryptocurrency space.

In an extensive Twitter thread published Apr. 29, the analyst stated that the S2F model is flawed because Bitcoin’s scarcity is algorithmic and known in advance, not random, making cointegration between BTC’s scarcity and its price impossible.

Krüger summed up his thoughts with the following conclusion:

“People using S2F to predict BTC may as well be using the moon cycles to predict BTC. […] The S2F analysis is interesting. But the S2F model is useless for predicting price, as the underlying assumptions of the model are not met. Now and always.”

Krüger isn’t the first to have tried to debunk the sentiment that Bitcoin’s halving will be decisively bullish for the cryptocurrency. Per previous reports from CryptoSlate, Seattle-based crypto hedge fund Strix Leviathan debunked a portion of the halving narrative in a report, writing:

“Reality – Not all miner rewards are sold. A meaningful amount of mined BTC is sitting on balance sheets as miners both speculate and utilize BTC-collateralized loans to run and expand operations. The impact of a supply-side cut on price is uncertain at best and minimal at worst.”

Hitting close to home

Alex Krüger’s critical take on the S2F model comes shortly after PlanB released an updated version of the model, as CryptoSlate reported previously.

The analyst found that by taking into account the latest rally in the price of gold and by analyzing Bitcoin slightly differently, a new formula can be created that has a “perfect fit,” an R squared of 99.7 percent. According to PlanB:

“[The new] model estimates a market value of the next BTC phase/cluster of $5.5T. This translates into a BTC price of $288K [between 2020-2024].”

The halving could still have an effect on Bitcoin’s price

That’s not to say that the halving won’t have an effect on the Bitcoin market. It just might have a bearish effect.

CryptoSlate’s Joseph Young recently interviewed Mao Shixing, the co-founder of F2Pool, for an article written for LongHash. Mao said that with the Bitcoin price still relatively low compared to its all-time highs and the halving rapidly approaching, miners could soon feel a profitability crunch that may “doom” them:

“With the halving approaching, Bitcoin miners are doomed to be confronted with the problems of mining profits getting lower and the proportion of electricity bills higher. Meanwhile, miners will need more time to reach the break-even point.”

Low miner profitability threatens the price of Bitcoin because the business of mining is predicated on positive cash flows, as the cost of electricity and cost to maintain ASIC miners is very high.

An analyst explained in a Twitter thread last year that when smaller, non-industrial mining operations “get backed into a corner,” they’re forced to liquidate the coins they earn via mining, often all at once, to keep the lights on, cash out, or to upgrade their systems for the future:

“Undercapitalized miners panic sell, price dumps, longs get squeezed, stop losses cascade — then more miners lose their lunch.”

It’s a trend that has the potential to cause Bitcoin to drop should buying pressure be too slow in the wake of the upcoming halving.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass