Some ICO Blockchain Projects Holding More Ethereum Than Their Actual Market Cap

Photo by Jayson Hinrichsen on Unsplash

The 80 percent correction in the global cryptocurrency exchange market has created a unique setting in the initial coin offering (ICO) market. The development teams of most tokens are now holding more Ethereum in their reserves than their market valuation.

Started With Gnosis

Last week, Ethereum-based decentralized prediction market platform Gnosis founder Martin Köppelmann disclosed that the company will not need to rely on its holdings of 200,000 Ether it garnered from its 2017 token sale for at least six to seven years. Köppelmann stated:

“We heard the Ether price dropped? We don’t care too much. Being active in the space since Bitcoin $9 this is nothing new and we prepared for this event. We have a team of over 50 people now working full time on the Gnosis platform and we can continue to finance this for the next 5–7 years without the need to sell any of our ~200k ETH in reserve.”

Over the past few weeks, the price of Ethereum has dropped substantially against other major cryptocurrencies like Bitcoin, Bitcoin Cash, and EOS, as well as the US dollar. As of Aug. 26, the price of Ethereum remains at around $275.

Currently, the reserve of Ethereum the Gnosis team holds is valued at around $55 million, based on the price of Ether at $275 and the team’s holdings of 200,000 Ether. That is, $22 million larger than its market valuation of $33 million.

Other projects like Tezos, Bancor, and Aragon have demonstrated similar trends, holding significantly more funds in Ethereum than their market valuation. Bancor, for instance, raised over $150 million in its highly anticipated token sale but its current market cap remains below $83 million.

The primary reason why most ICOs and blockchain projects have ended up with more Ethereum than the size of their market cap is the weak momentum of small market cap cryptocurrencies against major digital assets, particularly Bitcoin and Ethereum.

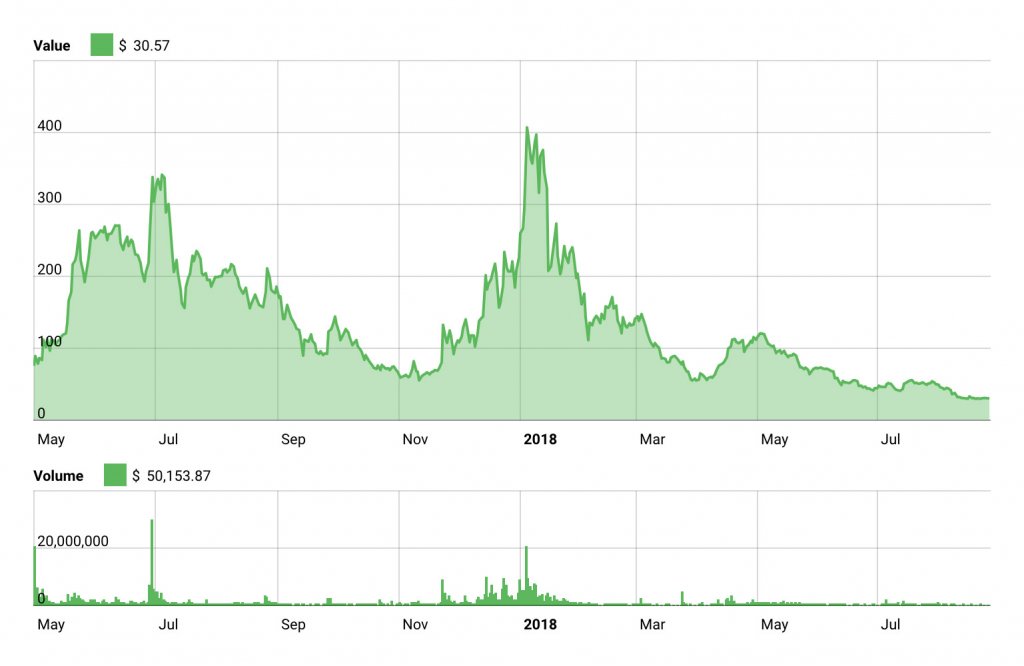

As shown in the chart below, the price of Gnosis token (GNO) dropped by 92.7 percent from its initial price of 1.3 ETH to 0.095 ETH.

In the past eight months, tokens like Gnosis, Bancor, Aragon, Ontology, ICON, and many more have fallen by 60 to 90 percent against Bitcoin which fell by 65 percent on its own, recording 95 to 98 percent losses from its all-time high in December 2017.

How Should Tokens be Valued?

As the price of tokens plunged due to the 2018 correction of the crypto market, a growing number of investors have expressed their dissatisfaction towards the mid-term trend of tokens and the fact that most tokens are in fact holding a larger amount of Ether in their reserves than their market valuation.

Since the price formation of tokens starts with token sales, the frustration of investors regarding the unique situation with tokens and their market valuation is understandable. However, price formation in the cryptocurrency sector is a difficult concept to establish as there are other types of cryptocurrencies such as forks of other cryptocurrencies that also have their own value.

Bitcoin Cash as an example is a fork of Bitcoin created in 2017. Upon its creation, BCH was valued at around $600 but in December 2017, the price of BCH surged to $5,000.

Ultimately, since the cryptocurrency sector is still in its infancy, the digital exchange market mostly relies on speculation. Tokens that are yet to release mainnets and to find a solid use case at a commercial level for their blockchain networks are being traded at a valuation of tens of millions of dollars to hundreds of millions of dollars.

The lack of a realistic maximum cap for token sales has also contributed to the widely recognized trend of the market cap of ICOs falling below their operating capital. In the technology sector, companies raise capital from venture capital firms at valuations ranging from $10 million to $100 million in which 15 to 30 percent of the company will be sold.

Although, in the ICO market, there exists no solid concept of valuation and base price, as most of the capital is driven by pure speculation, which is also one of the reasons why the vast majority of blockchain projects tend to fail and investors tend to lose in the long run.

CoinGlass

CoinGlass

Farside Investors

Farside Investors