IREN shares rise 8% in pre-market trading following strong FY24 results and no debt

IREN shares rise 8% in pre-market trading following strong FY24 results and no debt IREN shares rise 8% in pre-market trading following strong FY24 results and no debt

IREN boosts Bitcoin mining capacity to 15 EH/s, aiming for 30 EH/s by year-end.

Quick Take

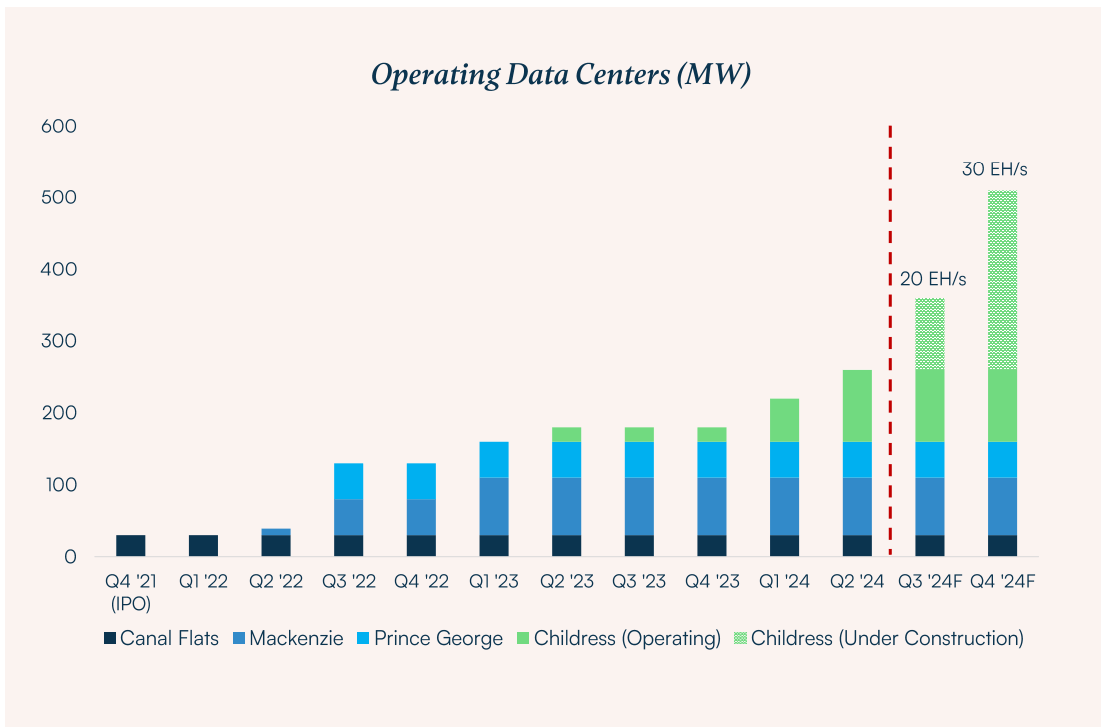

In 2024, IREN achieved a record Bitcoin mining revenue of $184.1 million, reflecting an increase in operating hashrate and Bitcoin prices. The company mined 4,191 BTC, a substantial rise from the 3,259 mined in FY23. As of Aug. 28, 2024, IREN has installed 15 EH/s in Bitcoin mining capacity, with plans to reach 30 EH/s by the end of the year. Daniel Roberts, Co-Founder and Co-CEO of IREN, said:

“Our 2024 guidance remains unchanged. With 15 EH/s installed, we are well on track to achieve our 20 EH/s milestone next month and 30 EH/s this year.”

In the AI sector, IREN’s AI Cloud Services generated $3.1 million in revenue, highlighting the company’s expanding footprint in this rapidly growing market. The launch of the Childress GPU pilot in H2 2024 is expected to bolster this segment further. IREN is focused on scaling its data center operations, with plans to expand to 510MW in 2024. The company confirmed it has secured 10.5 EH/s of the latest Bitmain S21 XP miners, positioning itself for continued growth and efficiency improvements.

IREN states it remains committed to its renewable energy goals, utilizing 100% renewable energy across its operations. The company closed FY24 with $404.6 million in cash and no debt facilities, ensuring a solid foundation for future expansion. As a result, IREN shares have risen 8% in pre-market trading.

CoinGlass

CoinGlass

Farside Investors

Farside Investors