Bitcoin’s hash rate shows resilience, set to propel difficulty to new heights

Bitcoin’s hash rate shows resilience, set to propel difficulty to new heights Quick Take

Data from Coinwarz shows the Bitcoin network is gearing up for another difficulty adjustment, scheduled for April 24 at approximately 1:57 PM UTC. The adjustment is expected to be over 2.2%, pushing the difficulty to a new all-time high of 88.30T.

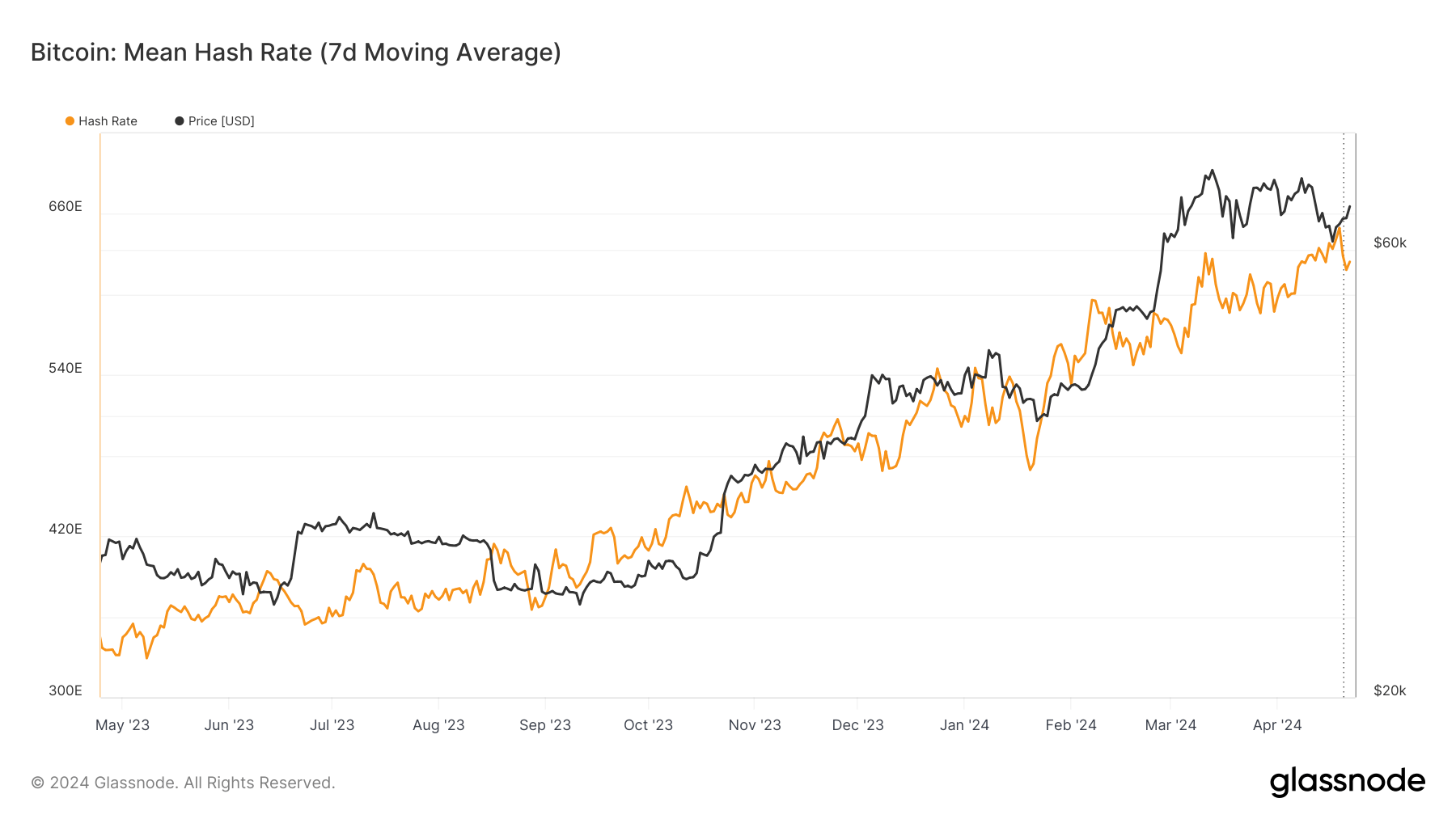

Ahead of the halving on April 20, there was a notable surge in hash rate, peaking at an unprecedented 650 eh/s. Subsequently, post-halving, there has been a modest decline of approximately 4% to 625 eh/s. However, the resilience of the hash rate post-halving has surpassed initial expectations.

The increased hash rate can be attributed to miners plugging into the network to obtain the 6.25 BTC block rewards before the halving on April 20. Additionally, transaction fees, primarily from Runes, have remained high, providing another incentive for miners to stay connected.

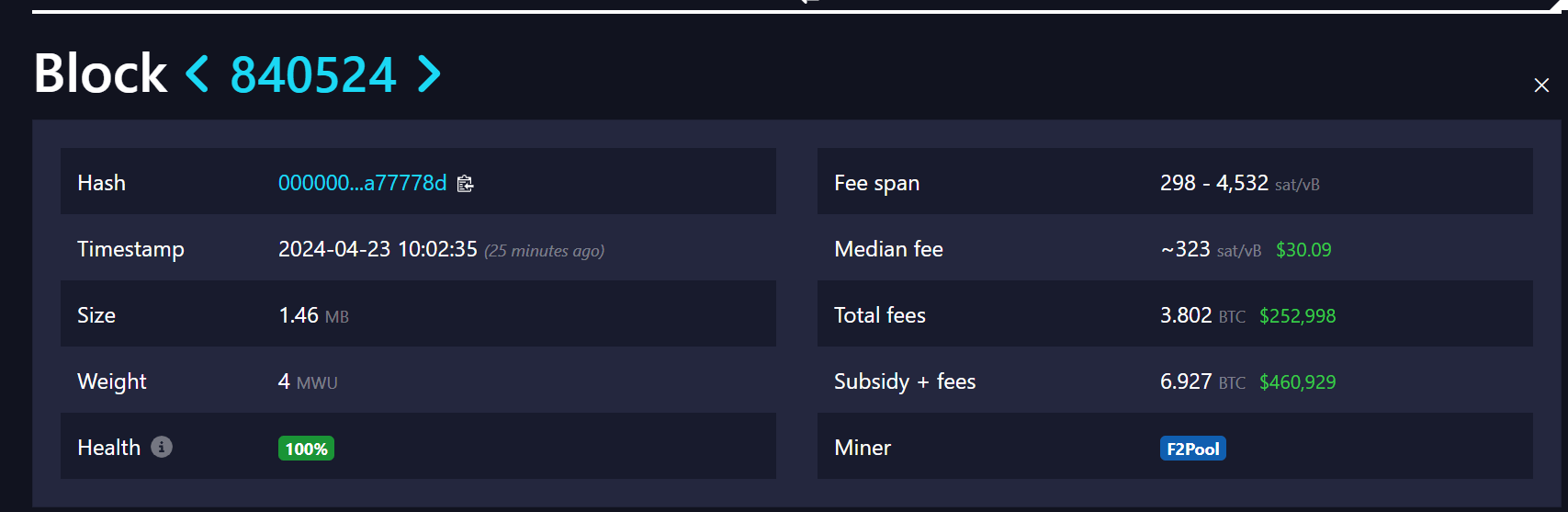

Over 500 blocks since the halving, transaction fees have consistently exceeded 2 BTC, with some recent blocks reaching as high as 4 BTC. For example, block 804524 saw a fee of 3.8 BTC ($252,998), contributing to a total subsidy and fee of 6.927 BTC ($460,929).

As the Bitcoin network continues to evolve post-halving, it will be crucial to monitor transaction fees and hash rate over the next difficulty epoch.

CoinGlass

CoinGlass

Farside Investors

Farside Investors