Tether’s Bitcoin wallet swells to 66,400 BTC, tallying up unrealized gains of over $1B

Tether’s Bitcoin wallet swells to 66,400 BTC, tallying up unrealized gains of over $1B Tether’s Bitcoin wallet swells to 66,400 BTC, tallying up unrealized gains of over $1B

An address potentially belonging to the stablecoin issuer sits on an unrealized profit of more than $1 billion.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Tether has significantly increased its Bitcoin holdings, now comprising more than 66,000 BTC, with an estimated value exceeding $2.8 billion.

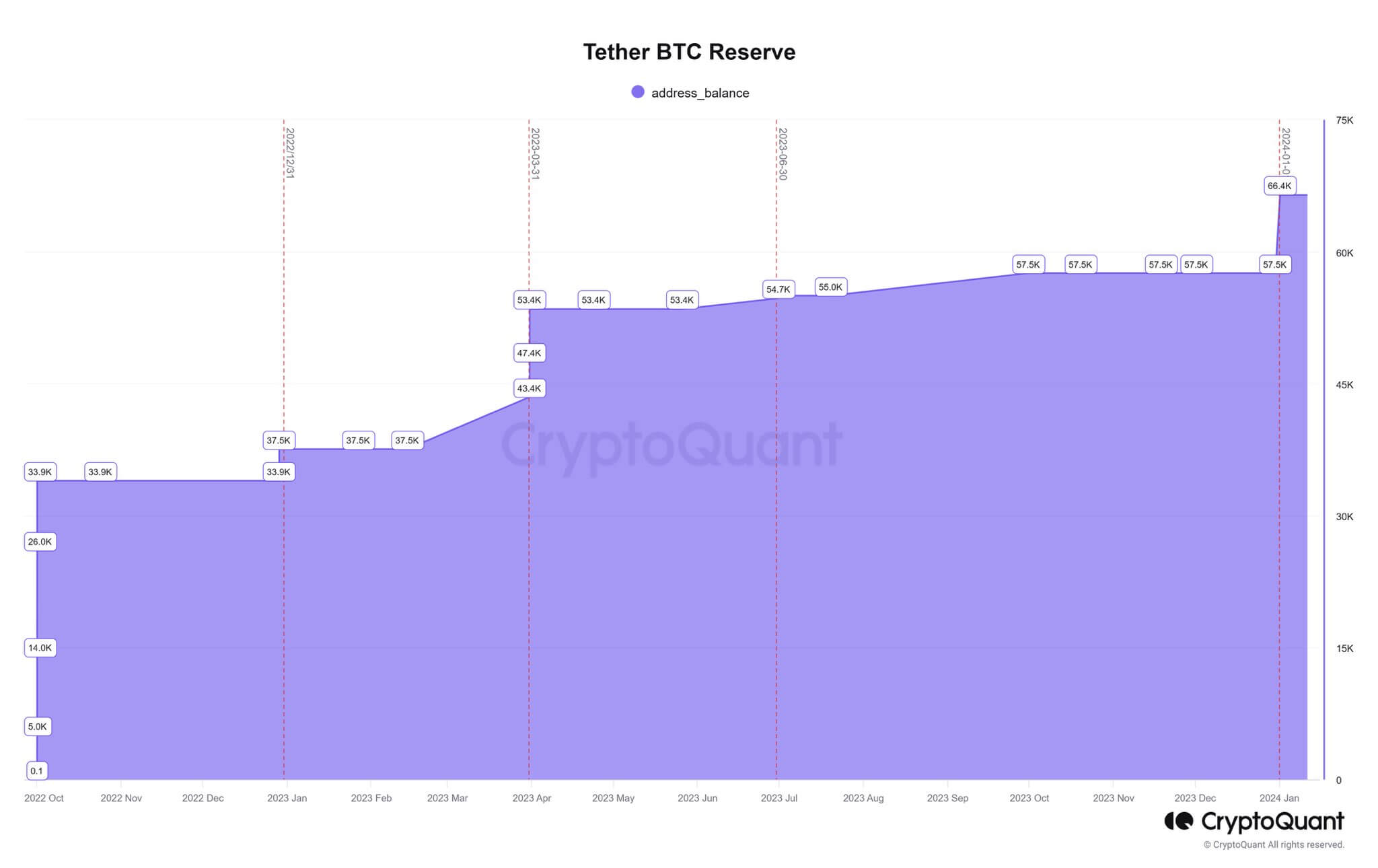

According to data shared by CryptoQuant founder Ki Young Ju, Tether’s BTC holdings surged to 66,400 from the 57,500 recorded at the beginning of the year—indicating an acquisition of approximately 8,900 BTC in the final quarter of 2023.

This strategic move aligns with Tether’s plan to allocate up to 15% of its realized investment profits toward acquiring BTC for its stablecoin reserves.

An address, “bc1qjasf9z3h7w3jspkhtgatgpyvvzgpa2wwd2lr0eh5tx44reyn2k7sfc27a4,” potentially belonging to Tether, is the 11th-largest Bitcoin holder, according to Bitinfocharts data. 21.co Research Analyst Tom Wan discovered the same address last year. The wallet currently boasts an unrealized profit of $1.1 billion.

Despite the notable increase in its Bitcoin holdings, Tether has not officially disclosed its BTC address and has yet to respond to inquiries from CryptoSlate as of press time.

BTC mining investments

In addition, the stablecoin issuer is engaged in strategic investments in BTC mining.

Last November, the company committed to invest approximately $500 million in BTC mining activities over six months. CEO Paolo Ardoino expressed the company’s ambition to elevate its share of the overall computing power on the Bitcoin network to 1%.

The firm is actively pursuing the establishment of mining facilities in Uruguay, Paraguay, and El Salvador, each boasting a substantial capacity ranging from 40 to 70 megawatts.

USDT’s growing supply

Over the past year, Tether’s USDT stablecoin has experienced a significant surge, witnessing a robust 38% increase in its market capitalization from $66 billion to an impressive $91 billion in 2023.

This positive momentum has persisted into the new year, with the stablecoin’s market capitalization reaching $95.08 billion as of press time.

The substantial growth has prompted concerns within the community regarding Tether’s ability to meet redemption demands with adequate reserves.

Addressing these worries, Cantor Fitzgerald CEO Howard Lutnick emphatically reassured the community that Tether diligently upholds the necessary reserve requirements for its stablecoins.

Farside Investors

Farside Investors

CoinGlass

CoinGlass