Old Cobie post surfaces predicting the Bitcoin ETF run up scenario almost on the dot

Old Cobie post surfaces predicting the Bitcoin ETF run up scenario almost on the dot Old Cobie post surfaces predicting the Bitcoin ETF run up scenario almost on the dot

Cobie responded to the old post and said he "can't even remember" writing it and cautioned against taking things out of context in isolation.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

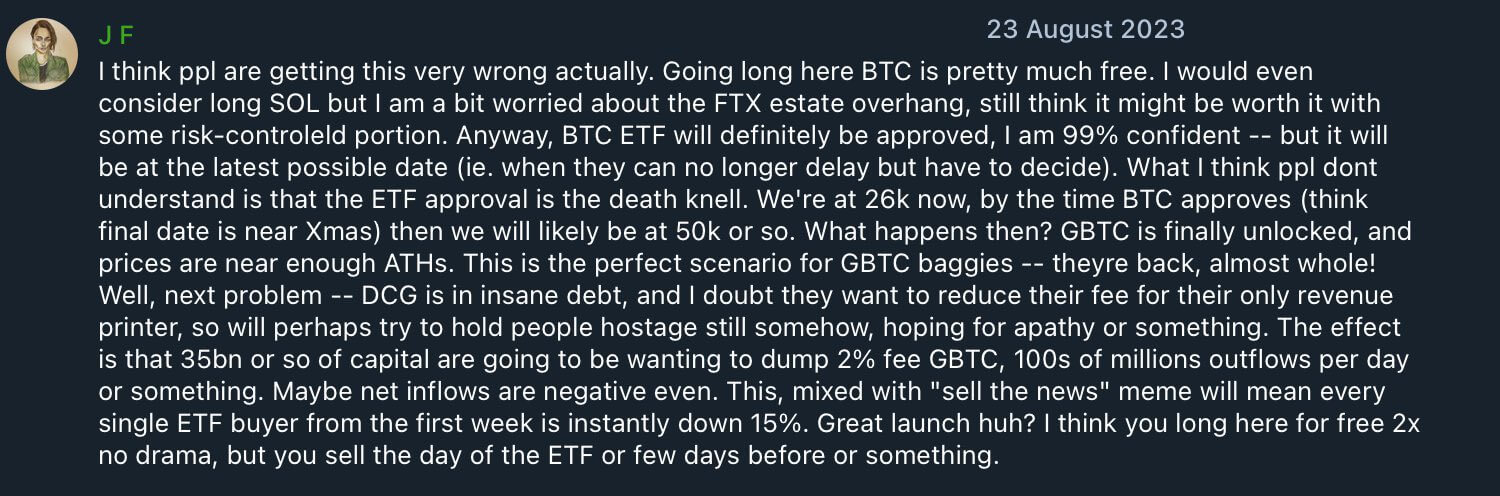

Cobie, a prominent figure in the crypto trading circles known for his insightful and often accurate predictions, made a post on Aug. 23, 2023, that outlined the spot Bitcoin ETF scenario to a frighteningly accurate degree.

Cobie’s post, which delved into the intricacies of Bitcoin (BTC) and the anticipated approval of a Bitcoin ETF, showcased his deep understanding of the market dynamics.

His prediction of a significant rise in BTC’s price, potentially reaching $50,000 by the year’s end, alongside a detailed analysis of the potential impact of the ETF approval, reflects a level of analysis that few in the field can match.

Foresight

The trader also predicted when the SEC would approve the ETFs and said at the time that it was basically “free” to long Bitcoin until then and recommended selling once the approval came in, or shortly before that.

Cobie wrote:

“Anyway, BTC ETF will definitely be approved, I am 99% confident but it will be at the latest possible date (ie. when they can no longer delay but have to decide).”

He added that once the ETFs were approved, it would be a “death knell” which would likely drive the price down due to high levels of sell pressure coming in from Grayscale’s GBTC holders, who have been waiting for an opportunity to sell once they are close to being whole again.

Considering the price action, following that advice would have been the best move in hindsight. This has drawn widespread admiration from crypto Twitter. However, Cobie feels the admiration is undue.

Cobie’s reflective response

In a candid response to the social media ruckus, Cobie emphasized financial predictions’ dynamic and often uncertain nature.

“I can’t even remember, man,” he began, highlighting the challenge of keeping track of ever-changing market views. He pointed out how easy it is to find past predictions that seem accurate in hindsight, given the frequent shifts in opinions and market conditions.

He cautioned against over-reliance on isolated predictions, stating:

“The screenshot in isolation ‘looks cool’ but doesn’t mean very much in reality, you know, misses basically half a year of shit and other factors that pollute the thinking.”

His comments offer a humble reminder of the transient nature of market analysis. Despite his analysis, he said he did not stick to that thesis in the ensuing months. Cobie added:

“The reality (at least for me) is that it’s pretty easy for me to void my own opinions 3 weeks later, come up with new ideas that I feel counter them, etc., so it’s just a whole mess of doubt and indecision and stuff along the way.”

This perspective resonates deeply in the cryptocurrency community, where rapid changes and volatility are the norms. Cobie’s reflection on the process of forming and reforming opinions in response to new information and market shifts highlights the complex, non-linear nature of financial forecasting.

Cobie’s full post is available to read below:

CoinGlass

CoinGlass

Farside Investors

Farside Investors