CME Bitcoin futures volume spikes to $70B amid shifting market dynamics

CME Bitcoin futures volume spikes to $70B amid shifting market dynamics Quick Take

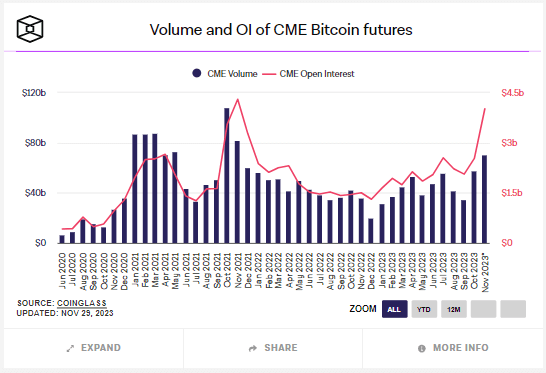

This November, the aggregated monthly trading volumes of CME Bitcoin futures have spiked to an impressive $70 billion. This considerable surge, denoting a heightened investor interest, parallels the top of the bull market for Bitcoin observed in Nov. 2021 when the trading volume touched $80 billion.

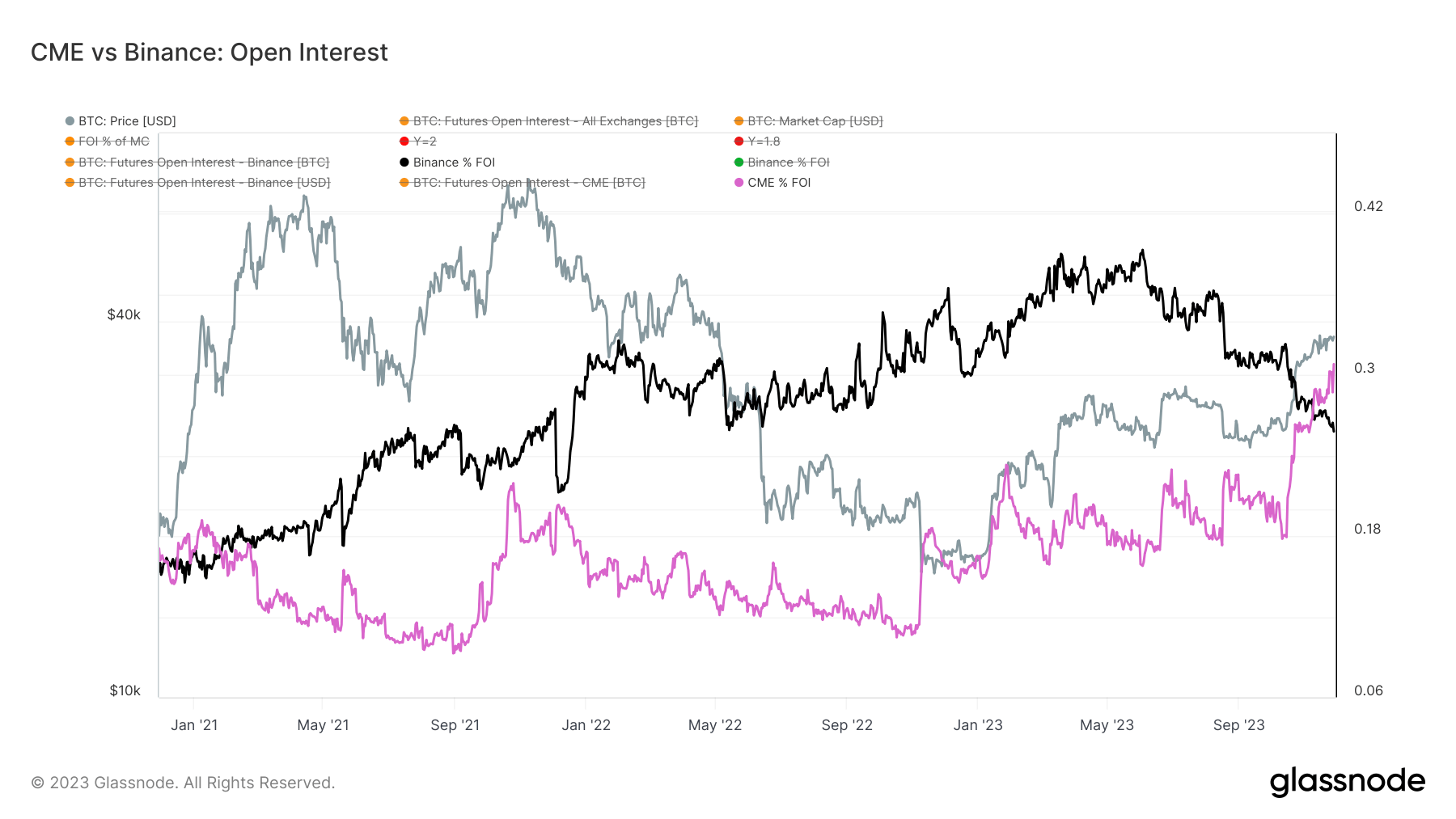

As per the analysis, CME currently commands roughly 31% of the futures market with 116,000 BTC in open interest contracts—an increase of 7% within the past 24 hours. This notable growth in open interest is occurring concurrently with a decline in Binance’s market share. The dominant cryptocurrency exchange has seen its market share plummet to an all-time low since Dec. 2021, nearing 25%.

Curiously, a significant premium to Bitcoin futures CME price over the spot has been observed, signaling potential market anticipations of an upward trajectory.