Bitcoin sees first outflows in a month as Ethereum, XRP enjoy investors’ confidence

Bitcoin sees first outflows in a month as Ethereum, XRP enjoy investors’ confidence Bitcoin sees first outflows in a month as Ethereum, XRP enjoy investors’ confidence

Market sentiments surrounding XRP and Ethereum appears to have improved over the past week.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

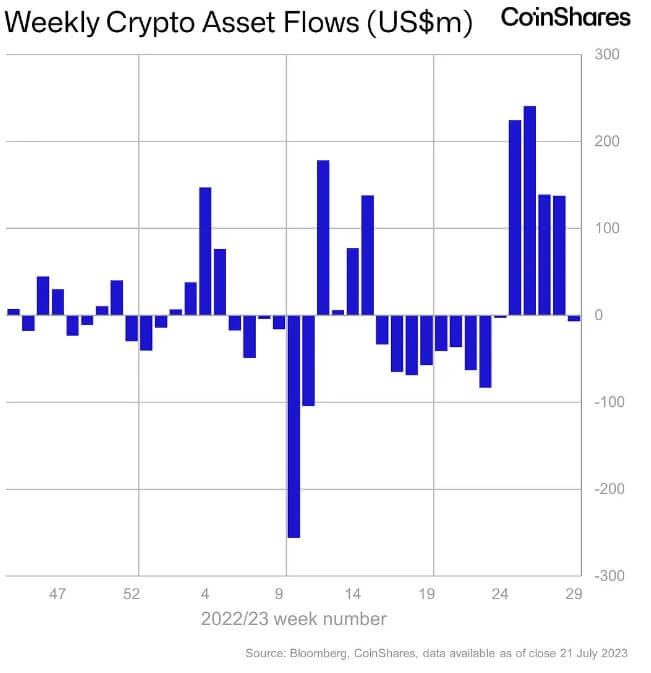

Digital assets investment products recorded $6.5 million in outflows this week after four consecutive weeks of inflows totaling $742 million, Coinshares reported on July 24.

This week’s outflows break the longest streak of inflows since late 2021, coinciding with the recent market downturn that saw Bitcoin’s (BTC) price dump to its lowest value since June 21.

Coinshares further reported that the trading volume for the week ending July 21 was $1.2 billion, below the year’s weekly average of $1.4 billion and significantly lower than the $2.4 billion recorded in the week ending July 14.

Ethereum, and XRP see inflows.

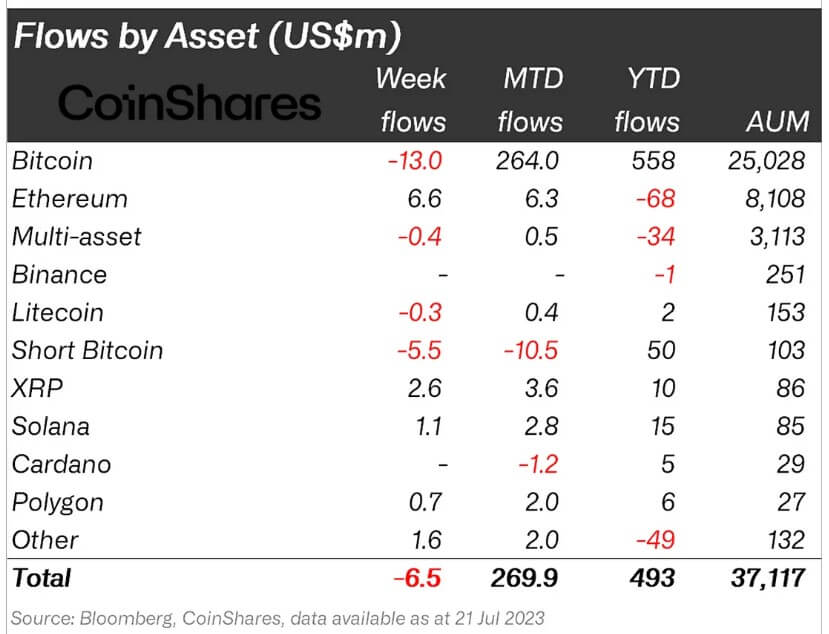

During the past week, Ethereum (ETH) investment products topped the leaderboard for inflows seeing $6.5 million in inflow.

James Butterfill, the head of Coinshares research, wrote that the inflows suggest that sentiments surrounding the asset might change. Since the beginning of the year, ETH has seen outflows of $68 million on the year-to-date metric.

Meanwhile, XRP saw inflows of $2.6 million during the period, taking its year-to-date inflow to $10 million.

Coinshares noted that investors’ confidence in XRP has grown following Ripple’s partial victory against the U.S. Securities and Exchange Commission (SEC). According to the firm, the digital asset investment products saw a $6.8 million inflow over 11 weeks.

Other altcoins, including Solana (SOL), Polygon (MATIC), and Uniswap (UNI), recorded minor inflows at $1.1 million, $0.7 million, and $0.7 million, respectively.

Bitcoin dominates outflows

After weeks of dominating inflows, investors withdrew $13 million from Bitcoin investment products. In comparison, the short BTC investment product continued its streak of outflows with $5.5 million flows to mark the 13th consecutive week.

The assets under management for short bitcoin investments now stand at $103 million. At its peak, it accounted for 1.4% of all Bitcoin investment products. It has now dropped to 0.4%.

Coinshares stated that the outflows were primarily due to negative sentiment in the North American market, where 99% of the $21 million outflows came from. But inflows of $12 million in Switzerland and $1.9 million in Germany were able to offset the impact.

Farside Investors

Farside Investors

CoinGlass

CoinGlass