Coinbase’s market share is on the rise in spite of SEC actions

Coinbase’s market share is on the rise in spite of SEC actions Coinbase’s market share is on the rise in spite of SEC actions

Several global asset manager signed an SSA agreement with Coinbase in spite of the SEC's litigation against the firm.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Coinbase’s market share climbed to its highest point since January 2023 in June despite the U.S. Securities and Exchange Commission lawsuit against the firm, according to Kaiko data.

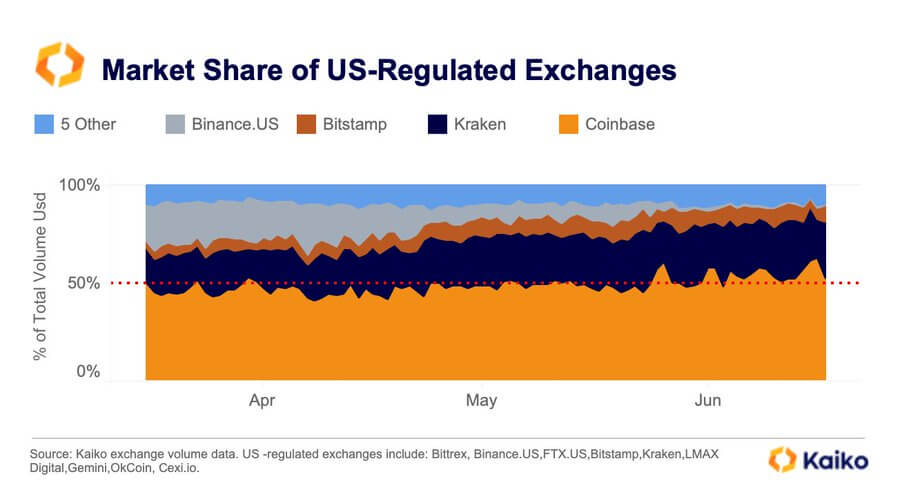

According to the chart below, Coinbase has consistently controlled around 50% of trading activities in U.S.-regulated exchanges since the beginning of the year. However, its market dominance witnessed a quick uptick in June, peaking at 64%, as the SEC filed charges against it and Binance over federal securities law violations.

Meanwhile, other U.S. platforms like Kraken and Bitstamp also increased their market share during this period.

Traditional financial institutions still in business with Coinbase

Despite the SEC’s lawsuit, several traditional financial institutions, including BlackRock, Fidelity, and ARK Investments, signed a surveillance-sharing agreement with Coinbase for their spot-Bitcoin exchange-traded fund (ETF) filing.

BlackRock, the world’s largest asset manager, chose Coinbase Custody as the custodian for its trust’s BTC holdings.

Messari founder Ryan Selkis suggested that these partnerships underscore Coinbase’s legitimacy as a U.S. financial institution, signaling a growing acceptance of cryptocurrency enterprises in the traditional financial sector

Pro-XRP lawyer John Deaton corroborated Selkis’s view, adding that over 2,000 Coinbase users have “joined to potentially be heard as amici curiae” in the SEC’s lawsuit against the crypto firm.

An amicus brief, commonly known as a “friend of the court” brief, is a written submission made by an individual or organization that is not directly involved as the plaintiff or defendant in a legal case but holds a substantial interest in the matter. The purpose of an amicus brief is to provide the court with additional perspectives and opinions that can potentially impact the final legal decision.

Binance US market share evaporates

The SEC lawsuit appears to have impacted Binance US severely as its market share plunged to less than 1% from a peak of 20% recorded in April.

Binance US, transitioning to a crypto-only platform, has faced significant liquidity issues after its banking partners halted their USD payment channels, posing challenges to its operations and affecting its market position.

On June 21, BTC flash-pumped to $138,000 due to its low market depth. Before then, the flagship digital asset traded at a 3% discount on the platform compared to other rival exchanges.

CoinGlass

CoinGlass

Farside Investors

Farside Investors