BNB, BUSD ‘not securities’ – Binance rejects SEC’s security labels

BNB, BUSD ‘not securities’ – Binance rejects SEC’s security labels BNB, BUSD ‘not securities’ – Binance rejects SEC’s security labels

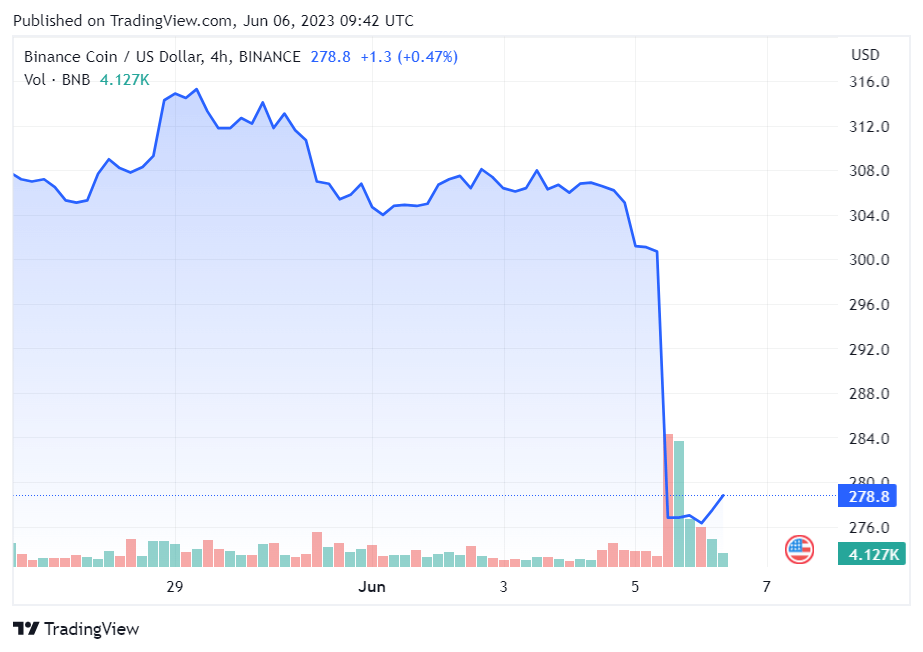

BNB market cap crashed by around $4 billion despite Binance insistence that the token is not a security.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto exchange Binance has refuted the U.S. Securities and Exchange Commission’s (SEC) assertion that its BNB token is a security, according to a statement shared with CryptoSlate.

On June 5, the SEC labeled the BNB token, alongside digital assets like BUSD, ADA, ALGO, FIL, and others, as securities in its lawsuit against Binance.

Binance refutes SEC’s claims.

In an e-mailed response to CryptoSlate, a Binance spokesperson said BNB is a native token designed to create an internal economy, adding that its value derives from its participants.

Binance said:

“BNB allows users who want to engage with projects (such as gaming, social, financial, or other utilities) built on those chains to transact with BNB, creating user demand for BNB as a reflection of community-built projects. The coins do not represent an investment contract of any sort and as such are not securities.”

Additionally, the crypto exchange faulted the Commission’s classification of BUSD as security. According to the firm, BUSD is a fiat-backed stablecoin that another independent financial agency in the U.S., the Commodities Futures Trading Commission (CFTC), has described as “a non-security commodity” through court action.

Meanwhile, this is not the first time the SEC would describe a crypto project as a security. In April, the Algorand Foundation refuted the Commission’s classification of its ALGO token as a security.

SEC chair Gary Gensler has maintained that all digital assets except Bitcoin (BTC) are securities and highlighted the noncompliance of crypto firms.

SEC action wiped over $4B from BNB market cap

News of the SEC’s lawsuit and its security classification of BNB wiped more than $4 billion from the asset market cap during the last 24 hours, according to CryptoSlate data. BNB’s market cap dropped to as low as $42.54 billion from a peak of $46.93 billion.

It has since retraced to $43.35 billion as of press time.

Additionally, the exchange’s native token declined more than 10% to a low of $272.89

BNB’s crash reflects the performance of the broader crypto market during the last 24 hours. CryptoSlate reported that the SEC action wiped off $53 billion from the total crypto market cap.

CoinGlass

CoinGlass

Farside Investors

Farside Investors