Coinbase and Bitfinex Announce SegWit Adoption

Coinbase and Bitfinex Announce SegWit Adoption Coinbase and Bitfinex Announce SegWit Adoption

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

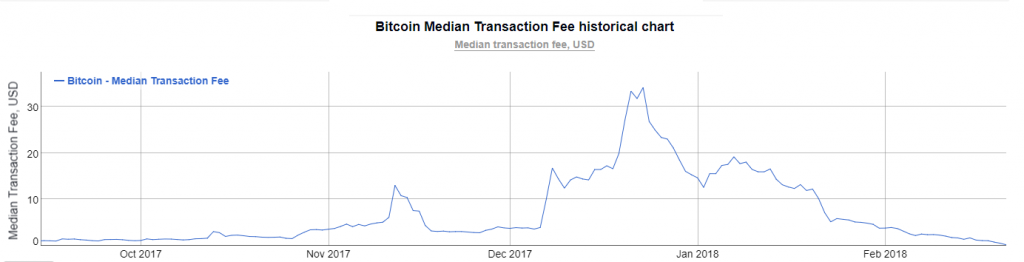

Two of the largest cryptocurrency exchanges in the world, Coinbase and Bitfinex, have simultaneously announced their support of Segregated Witness (SegWit) protocols. The launch promises Bitcoin investors faster transaction times and lower transactions fees, which have recently dropped from over $35 to less than $1.

Highly popular trading platform Bitfinex announced the implementation via Medium:

“Today Bitfinex is delighted to announce support for bitcoin deposit and withdrawals using P2SH Segregated Witness (SegWit) addresses… The SegWit implementation means Bitfinex users can benefit from lower BTC withdrawal fees (approximately 15%) and improved processing times on transactions across the Bitcoin network.

Bitfinex noted in the announcement that SegWit is now implemented for Bitcoin only, and not for Bitcoin Cash. This is an important distinction, as any Bitcoin Cash sent to a Bitfinex SegWit address will be lost. The Bitfinex platform processes more than $1 billion in daily trading volume, and is one of the largest exchanges by volume online.

Bitfinex CEO Paolo Ardoino released a statement on the implementation:

“SegWit provides not only an immediate benefit for users, but also a foundation for future Bitcoin development. By supporting SegWit addresses, Bitfinex is tackling three of the biggest crypto-enthusiast concerns: transaction fees, transaction speed, and total network capacity.”

Coinbase has not yet completed the rollout of SegWit, announcing a phased implementation over the next week with a 100% launch finalized by the end of February:

Our engineering team has finished testing of SegWit for Bitcoin on Coinbase.

We will be starting a phased launch to customers over the next few days and are targeting a 100% launch to all customers by mid next week.

— Coinbase (@coinbase) February 20, 2018

Wait — What’s SegWit?

For the uninitiated, SegWit (Segregated Witness) is a solution to the Bitcoin scalability problem. Block sizes on the Bitcoin blockchain are limited to 1 MB. This limits the number of transactions that can be processed on the Bitcoin blockchain to between 5 and 7 transactions per second. Bitcoin’s block size limit has caused significant issues over recent months as user adoption rates increase, with transaction fees inflating to over $35 and transactions taking days to process.

Bitcoin Cash, a “hard fork” of the Bitcoin blockchain, was created on August 1, 2017, and was designed to solve the scalability problem by increasing the block size to 8 MB, thereby speeding up transaction processing rates and lowering fees.

The SegWit solution, however, is more of a “hack” than a complete solution to the issue. SegWit works around block size by splitting a transaction into two segments—appending signature, or “witness” data from the original transaction and attaching it.

An End to High Transaction Fees

Bitfinex and Coinbase, together with Coinbase’s GDAX exchange, account for almost 10% of all international Bitcoin trades, with both platforms ranked in the top 10 exchanges worldwide. Although many wallet solutions already support SegWit, the integration of the solution by two of the biggest industry players is likely to spark increased adoption of the workaround.

The announcements follow the release of the latest major Bitcoin Core Client update, which includes, for the first time, full SegWit support. SegWit adoption isn’t the only factor driving down Bitcoin transaction costs, however. A reduction in user activity has recently seen Bitcoin transaction fees drop significantly from over $35 to under $1.

CoinGlass

CoinGlass

Farside Investors

Farside Investors