Crypto.com gives ambitious 1 billion crypto users prediction by the end of 2022

Crypto.com gives ambitious 1 billion crypto users prediction by the end of 2022 Crypto.com gives ambitious 1 billion crypto users prediction by the end of 2022

What are the reasons for Crypto.com's lofty crypto adoption figures? And, which other areas do they see exploding next year?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto.com has published a report highlighting key developments this year while also giving predictions for 2022.

The predictions touch on several burgeoning areas. But perhaps most interesting is a call that the number of global crypto users will hit 1 billion by the end of 2022. Many experts agree that adoption is headed in only one direction, but this call is still an ambitious one.

With that in mind, what is the justification behind Crypto.com’s reasoning?

Is 1 billion users by the end of 2022 too ambitious?

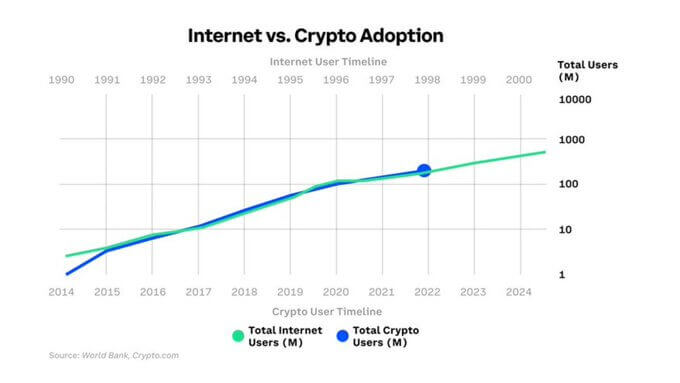

Last week, YouTuber Lark Davies tweeted a chart showing internet vs. crypto adoption rates. The chart, when superimposed, taking account of different timelines (because the internet started long before cryptocurrency), shows a high degree of symmetry.

Based on what is known about internet adoption, analysts predict global crypto users will hit 1 billion within the next five years. Based on an estimated 200 million current users, this represents an approximate 5x increase by 2026.

As such, to hit 1 billion users by the end of next year is a spirited call. Based on the above chart, the end of 2022 should see around 400-500 million users.

Nonetheless, in justifying its position, the exchange says 2022 will see an overall friendlier stance towards cryptocurrency – in turn, driving adoption skywards.

This is because they expect developed nations to finally get their act together with explicit legal and tax cryptocurrency frameworks. They also see rising inflation as a tailwind for digital asset adoption.

Other Crypto.com 2022 predictions

Crypto.com also gives several other predictions for next year, all of which support the idea of increased adoption or advancing developments in the cryptocurrency sector.

Considering the first (U.S) crypto ETFs were approved in 2021, the firm sees greater integration of cryptocurrency, with traditional finance, under the alternative asset class. Legacy firms will strengthen their ties to crypto exchanges as a result.

“Traditional banks and financial houses like Morgan Stanley, Citi, Goldman Sachs, JP Morgan, E&Y, Bank of America, and Credit Suisse are seeking partnerships with crypto exchanges to integrate crypto into their main services from payments to transfers and investment.”

Although some have doubts about the Metaverse and Web3, Crypto.com sees this area, particularly GameFi, Play-to-Earn, and NFTs, continuing to perform strongly.

Interoperability and cross-chain DeFi protocols are set to take off, ending Ethereum’s dominance of decentralized finance.

And the final prediction sees decentralized autonomous organizations (DAOs) expand beyond crypto. In effect becoming recognized as a way to implement governance protocols in a Web3 world.

Disclaimer: Crypto.com is an advertising partner of CryptoSlate.

Farside Investors

Farside Investors

CoinGlass

CoinGlass