Ethereum futures daily trading volume on CME doubles since last week

Ethereum futures daily trading volume on CME doubles since last week Ethereum futures daily trading volume on CME doubles since last week

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The daily trading volume of Ethereum (ETH) futures on the Chicago Mercantile Exchange (CME) has exceeded $75 million, crypto metrics platform Glassnode reported today.

Institutional demand: One week after #Ethereum futures launched on CME, daily trading volume reached a total of $75.8M yesterday – almost doubling Friday's volume of $40M.

Meanwhile, open interest has increased to $62 million.

Chart ? https://t.co/Z8KDbU2Gez pic.twitter.com/3pawCRnxjR

— glassnode (@glassnode) February 17, 2021

“Institutional demand: One week after Ethereum futures launched on CME, daily trading volume reached a total of $75.8M yesterday – almost doubling Friday’s volume of $40M,” Glassnode pointed out.

As CryptoSlate reported, CME’s much-anticipated ETH futures launched on February 8. At the end of the first trading week, their daily volume amounted to $40 million—and nearly doubled today.

Futures are a type of derivatives contract where two parties agree to trade an asset at a specific price on a certain date. Unlike options, futures are binding, meaning that the contracts must be fulfilled regardless of the asset’s market price at the expiration date.

ETH futures’ total open interest on CME—the combined value of all outstanding contracts—also increased to $62 million today, the researchers added.

There has never been so much sustained activity of addresses interacting with Ethereum.

The 3-month average of aa's has broken over its previous ATH and it doesn't look like it wants to go back! pic.twitter.com/Zmapg4Ah3l

— Elias Simos (@eliasimos) February 17, 2021

Per Galssnode’s data, the Ethereum blockchain as a whole is also seeing a surge of activity, as pointed out by Elias Simos, a protocol specialist at blockchain infrastructure company Bison Trails

“There has never been so much sustained activity of addresses interacting with Ethereum,” Simos noted, adding, ”The 3-month average of [active addresses] has broken over its previous ATH and it doesn’t look like it wants to go back!”

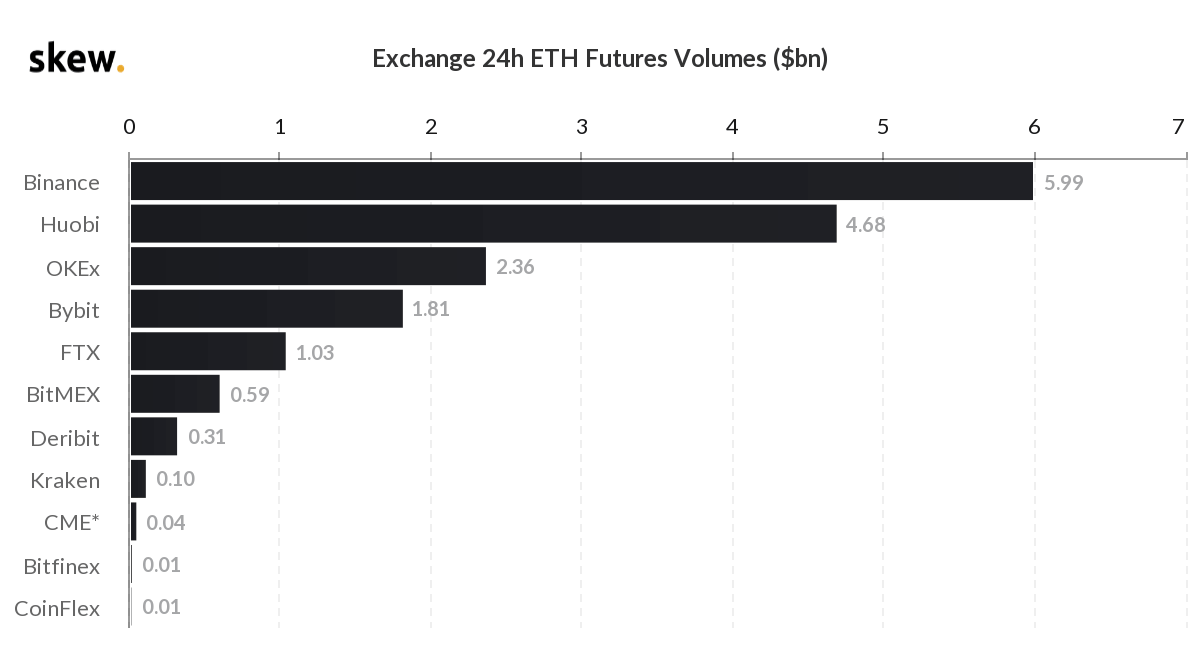

According to crypto derivatives charting platform Skew, however, CME’s trading volumes are still a drop in the crypto ocean. For example, major exchange Binance is currently generating $5.99 billion in Etherum futures volume every day. Similarly, the corresponding open interest on Binance amounts to $1.47 billion.

This is partly because CME is geared primarily towards institutional traders and not retail ones—unlike Binance and other crypto exchanges. Still, such a rapid growth of ETH futures trading volumes indicates that there is clearly demand from financial institutions as well.

Farside Investors

Farside Investors

CoinGlass

CoinGlass