Uniswap traders have spent nearly $7 million in Ethereum fees

Uniswap traders have spent nearly $7 million in Ethereum fees Uniswap traders have spent nearly $7 million in Ethereum fees

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

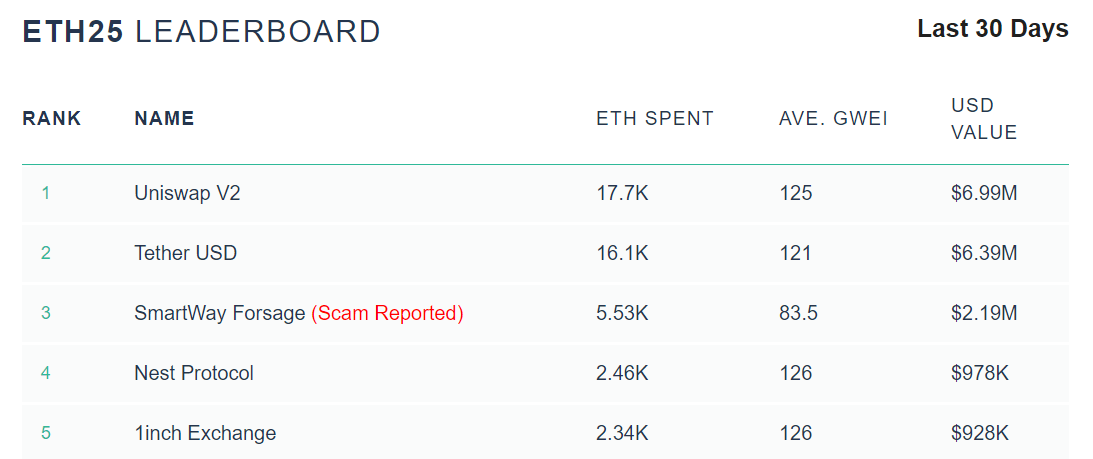

Ethereum DeFi fanatics on Uniswap, a decentralized exchange, have paid nearly $7 million in fees in the past month, as per data on Gas tracking site ETH Gas Station.

$6.99 million in Ethereum fees

The average GWEI, a unit of Gas, was around 125 with over 17,700 ETH spent by investors and users. Other DEXs, like 1Inch and Khyber network, accounted for $968,000 and $336,000 in fees, with the average GWEI values at 126 and 100 respectively.

Uniswap has emerged as the DEX of choice for new projects, scams, and traders alike. Anyone can list an erc20 token on the 2018-founded protocol, and so far, demand is booming, as the fees evidently show.

Its accessibility — coupled with the yield farming hype — has spurred massive speculative activity and the rise of dubious tokens like $SHRIMP, $PASTA, and $DEGEN.

But despite the funny-sounding names, investors are lapping the tokens up. Last month, trading on $TEND, the native token for so-touted deflationary project Tendies, reached over $7 million in a single day as investors flooded in. $YAM, the token for Yam Finance, saw similar volumes as well before a smart contract vulnerability took the project down.

Meanwhile, Tether, the stablecoin said to be pegged on a 1:1 basis with the US dollar, was the second-highest gas guzzler on Ethereum. Its users spent over $6.3 million in fees.

Interestingly, the third-largest gas user was Forsage, a controversial project marked as “scam” on ETH Gas Station. The project came under the scanner of the Philippines government last month after ties to a broader Ponzi scheme were exposed.

DeFi sector takes a breather

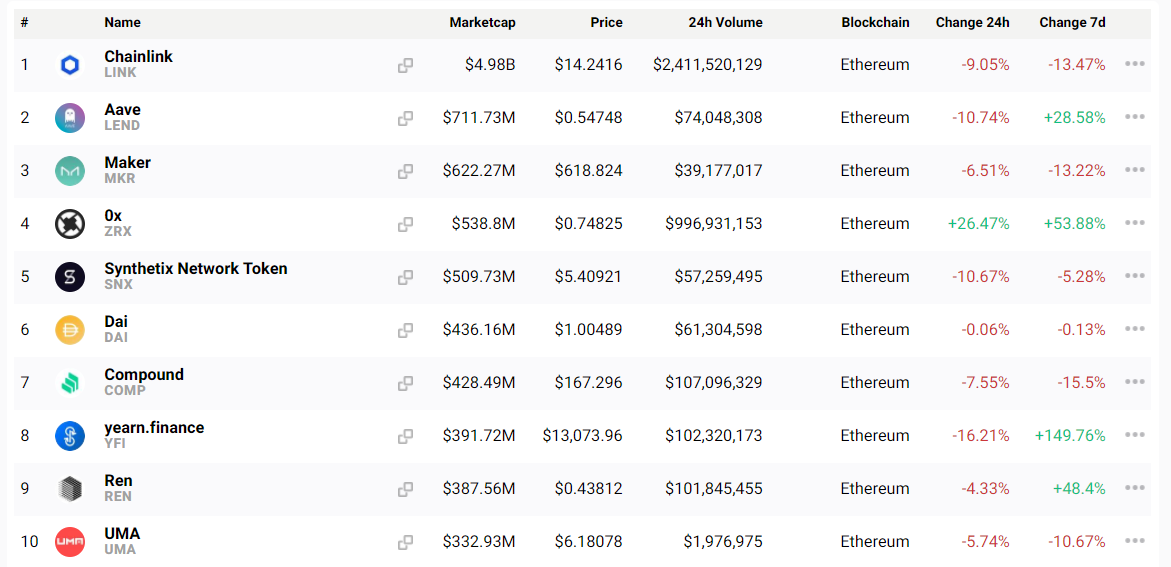

As CryptoSlate data tools show, Ethereum is the network of choice for developers and new tokens (as it has been since inception).

All ten of the top DeFi tokens on this site’s proprietary tracker shows they are built on Ethereum, with Terra, a South Korean project, coming in at 14th place on the list.

The DeFi sector is currently down by 6.7% in the past 24 hours and 2.98% in the past week, after an impressive surge of over 100% from July to August. Sector volume is $5.08 billion, representing over 3.58% percent of the total cryptocurrency market.

For now, the macro sentiment in the crypto market is currently bullish, with the DeFi sub-sector leading gains. However — the Ethereum network is strained as a result, with traders paying a record amount in fees in the past few weeks, as data shows.

CoinGlass

CoinGlass

Farside Investors

Farside Investors