This data suggests Ethereum’s intense uptrend may stall as it reaches $450

This data suggests Ethereum’s intense uptrend may stall as it reaches $450 This data suggests Ethereum’s intense uptrend may stall as it reaches $450

Photo by Šárka Krňávková on Unsplash

Ethereum has been caught in a parabolic uptrend throughout the past several weeks, and its momentum isn’t showing any signs of slowing down.

Throughout the past week, the cryptocurrency had been consolidating below $400 in tandem with Bitcoin’s bout of sideways trading below $12,000.

Although the benchmark cryptocurrency remains below this key resistance level, Ethereum has been able to incur some intense momentum over the past 24-hours that has sent it surging towards $450.

This massive upswing came about rather unexpectedly and has not yet created enough of a tailwind to pull Bitcoin past $12,000.

There are still some signs that ETH’s intense momentum may begin slowing in the near-term, as on-chain data shows that it has failed to build any significant support just below its current price region.

One analyst is also observing that Ethereum is pushing up against a major supply zone and that it may not be able to sustain its momentum so long as Bitcoin’s price remains stagnant.

Ethereum pushes against major supply zone following its unexpected rally

At the time of writing, Ethereum is trading up over 4 percent at its current price of $443.

Earlier today, the crypto’s price had stabilized around $420 following the overnight movement that allowed it to climb from daily lows of $380.

The strength of this uptrend is coming about in the absence of any overt bullishness seen by Bitcoin, making it the likely result of investors cycling some of their DeFi token profits into ETH.

One analyst who goes by the name “RJ” explained that the area surrounding $450 is a supply zone for the cryptocurrency and that it may prove to be insurmountable unless Bitcoin pushes higher.

“ETH facing major supply here, it has been outperforming the rest but I don’t think it will keep up at this rate. Either BTC breaks 12k and starts catching up or the market pulls back for prolonged consolidation. If 12k+ better hide your alts.”

On-chain data shows ETH has failed to build significant support between $390 and $440

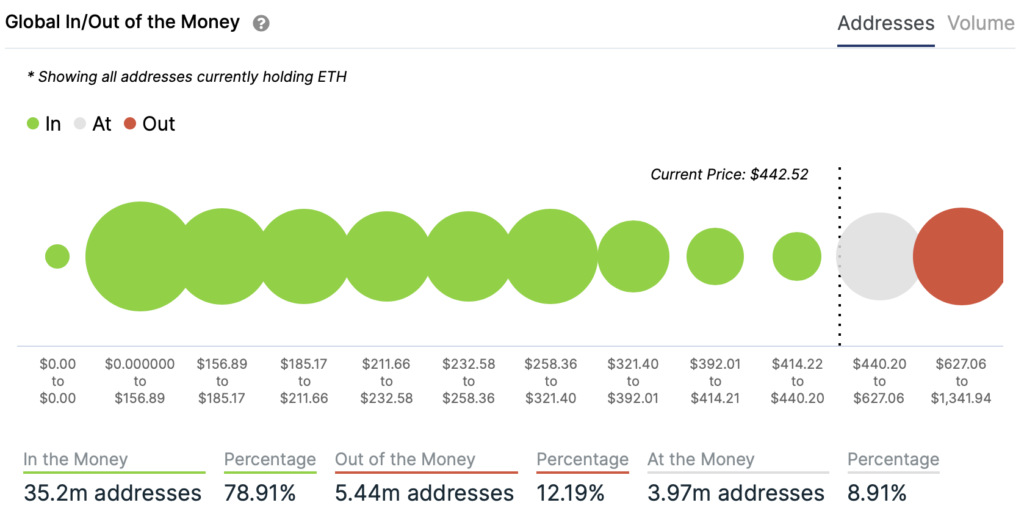

Despite Ethereum’s strong uptrend, the “Global In/Out of the Money” indicator from the analytics platform IntoTheBlock reveals two somewhat bearish trends for the cryptocurrency.

As seen in the below chart, while the crypto has yet to establish any heavy support between $390 and $440, it is currently pushing up against resistance.

This seems to confirm the notion that Ethereum’s uptrend will only be able to take place if Bitcoin can also push higher in the coming days.

Ethereum Market Data

At the time of press 8:22 pm UTC on Aug. 15, 2020, Ethereum is ranked #2 by market cap and the price is down 1.36% over the past 24 hours. Ethereum has a market capitalization of $48.87 billion with a 24-hour trading volume of $12.67 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 8:22 pm UTC on Aug. 15, 2020, the total crypto market is valued at at $374.04 billion with a 24-hour volume of $101.81 billion. Bitcoin dominance is currently at 58.62%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass