Bitcoin exchange withdraws dive as traders prepare for massive volatility

Bitcoin exchange withdraws dive as traders prepare for massive volatility Bitcoin exchange withdraws dive as traders prepare for massive volatility

Photo by Priscilla Du Preez on Unsplash

Bitcoin has seen heightened volatility throughout the past several hours, as it recently broke below the key support it had at $9,000 as buyers struggle to maintain the cryptocurrency’s mid-term uptrend.

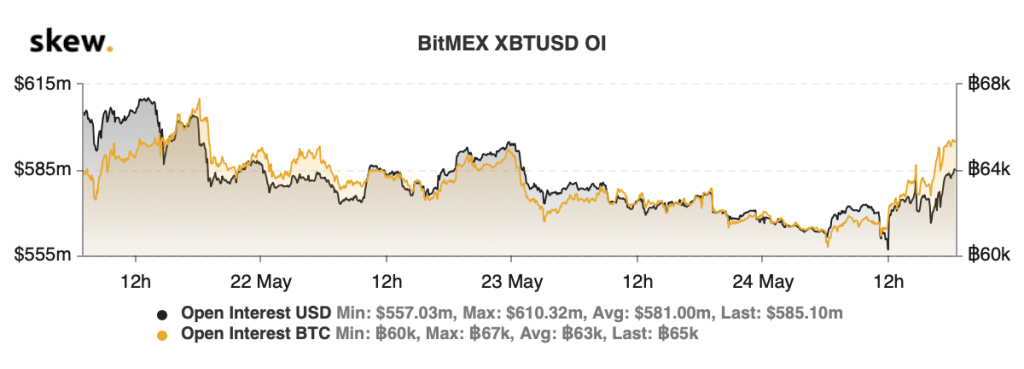

BTC’s decline has led investors to grow increasingly fearful as to what could come next and has created a resurgence of trading activity on margin platforms like BitMEX.

This is indicated while looking towards the open interest on the platform, which has risen by roughly $30 million over the past several hours.

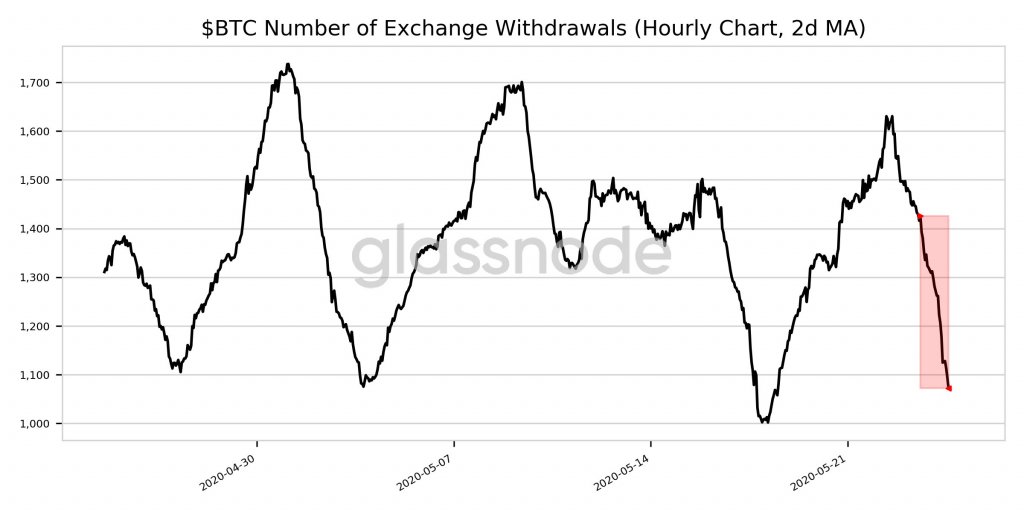

It now appears that retail investors may be preparing to sell their Bitcoin in order to hedge against further downside, as the number of exchange withdraws has decreased significantly as of late.

Bitcoin’s decline below $9,000 sparks fear, leads to a resurgence in trading activity

Over the past couple of days, Bitcoin has been trading sideways within the lower-$9,000 region, struggling to garner any decisive momentum following its recent rejection at $10,000.

The cryptocurrency now appears to be at risk of seeing further downside as $9,000 begins flipping into a resistance level. If it sustains below this level for an extended period of time, it could open the gates for the crypto to see further downside.

It also seems as though that traders are preparing for it to see even further volatility in the near-term, as Bitcoin’s open interest on BitMEX has rocketed by over $30 million throughout the past 12 hours, per data from Skew.

This coincides closely with a trend of growing fear amongst investors – as discussed within a recent CryptoSlate report.

This fear could perpetuate a selloff if nervous retail investors begin offloading their Bitcoin in anticipation of it seeing further downwards momentum in the days and weeks ahead.

Exchange withdraws see significant decrease as investors watch for further volatility

Cryptocurrency exchanges have been seeing massive outflows in recent times, with investors moving their BTC to cold storage as they begin adopting a long-term investment strategy.

This trend is shifting on a lower time frame, however, as data from research platform Glassnode indicates that exchange withdraws have declined by 25% over the past 24 hours.

Glassnode Alerts spoke about this in a recent tweet:

“BTC Number of Exchange Withdrawals (2d MA) decreased significantly in the last 24 hours. Current value is 1,072.375 (down 24.8% from 1,425.708).”

This may indicate that investors are leaving their Bitcoin on exchanges in order to have the ability to readily sell it if its price declines further in the near-term.

Farside Investors

Farside Investors

CoinGlass

CoinGlass

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)