Japanese senator says cryptocurrency and blockchain will be “more important” in a post-COVID world, here’s why

Japanese senator says cryptocurrency and blockchain will be “more important” in a post-COVID world, here’s why Japanese senator says cryptocurrency and blockchain will be “more important” in a post-COVID world, here’s why

Photo by Jérémy Stenuit on Unsplash

In a world ravaged by the ongoing coronavirus pandemic, regulators around the are increasingly looking into cryptocurrencies and blockchain technology.

Lapses in data reporting, halt of international trade, and non-verifiability of medical supplies are some factors contributing towards gravitation towards distributed networks.

Increasing Importance

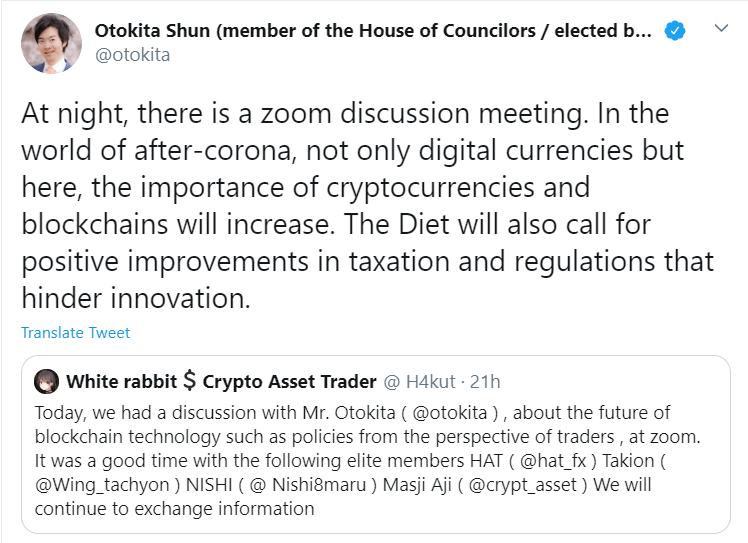

Japanese officials are the latest to join the crypto-narrative. Senator Otokita Shun, member of Tokyo Nippon Ishin’s Committee on Financial Affairs revealed his view on the role of cryptocurrencies:

Shun spoke with cryptocurrency traders in Japan, as the original post’s translation to English shows. He noted obstacles for financial and tax, that impede progress, will be worked and improved upon.

As an “inbuilt” feature, public blockchains provide verifiably and authenticity of data and any trackable assets. Cryptocurrencies, as an extension, help in incentivizing the individual operators of such networks and, in theory, promote trust and fair governance.

Carlo De Meijer, the chief economist at MIFSA, wrote at Finextra about his views on blockchain and its inclusion in a post-pandemic environment. He believes Chinese organization is leveraging the technology to help reduce COVID’s economic impact in the country.

“They have rolled out a number of applications for immediate and emergency use to fight the spread of the coronavirus in public institutions, hospitals, universities, and the financial sector,” notes De Meijer.

Trackability and Value

Distributed computing systems can provide increased transparency during times of disease outbreaks, alongside global sharing of patient data, history, and information of infection. Countries like the UAE are already developing corona-tracking applications for patients and citizens, using blockchain-based frameworks.

Public blockchain can help to share data instantly and verifiably, cutting down on underreporting of cases which, in turn, causes worldwide spread. The Chinese government is currently facing flak for its poor reporting of data.

Cryptocurrencies like Bitcoin and Ethereum have served as a global hedge in volatile global markets, save the “Black Thursday” event in mid-March. Reports show a minority of Americans have spent their stimulus checks on crypto purchases, while Bitcoin options data is reaching new highs.

People in Myanmar and Lebanon, despite the governments’ reluctance, are using cryptocurrencies for remittances and storage. Such examples amplify the value that cryptocurrencies can potentially provide in “underdeveloped” nations.

Traditional investors like Paul Tudor Jones II have also jumped on the bandwagon, calling Bitcoin the “fastest horse” in a time when governments are artificially pumping fiat currency to save economies.

CoinGlass

CoinGlass

Farside Investors

Farside Investors