Data shows retail investors are frantically accumulating Bitcoin

Data shows retail investors are frantically accumulating Bitcoin Data shows retail investors are frantically accumulating Bitcoin

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s firm 2020 uptrend has sparked a sense of “FOMO” amongst cryptocurrency investors who are keeping their eyes on a plethora of different fundamental factors that could catalyze an intense BTC bull rally in the year ahead.

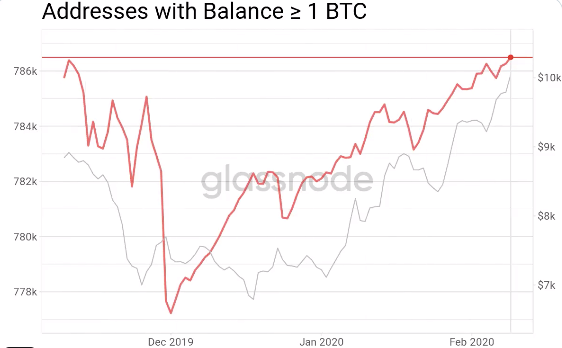

The FOMO induced by these factors — which include the cryptocurrency’s upcoming mining rewards halving among other things — is elucidated while looking at the amount of BTC wallet addresses holding over 1 BTC.

This number has been rapidly rising as of late, suggesting that retail investors are engaged in heavy accumulation, which could provide the crypto with significant momentum.

Bitcoin’s fundamentals shape up as the crypto incurs a notable rally

Currently, Bitcoin is trading down slightly from its recent highs of $10,200 which were set yesterday at the peak of the cryptocurrency’s rally.

Although BTC has been unable to stabilize above $10,000, its market structure still remains firmly bullish, and investors appear to be increasingly engaged with the market due to its strong uptrend.

This heightened engagement is elucidated while looking at Bitcoin’s open interest, which has been hovering at over $1 billion for the past week on BitMEX, showing that traders are widely anticipating the crypto to see further volatility.

Bitcoin’s upcoming mining rewards halving, which is slated to occur in May, is one event that could be leading investors to grow increasingly engaged in the markets, as the event typically translates into notable volatility.

Investor’s current engagement in the markets couple with BTC’s strong hash rate, heightened network activity, and strong 2020 price action all suggests that the crypto is fundamentally strong at the moment.

Data shows investors are engaged in heavy BTC accumulation

It appears that investors are carefully considering all these bullish fundamentals at the moment, as data from Glassnode shows that the amount of Bitcoin addresses holding over 1 BTC is growing quickly and is showing few signs of slowing down any time soon.

“The number of Bitcoin addresses holding over 1 BTC is growing quickly, showing no signs of slowing down. After a sharp drop 3 months ago, we’ve surpassed the highs of November and an all time high is just ~2000 addresses away.”

While considering the heavy accumulation that investors are currently engaged in, it is highly likely that this will provide BTC with a steady stream of buying pressure that allows it to continue climbing higher.

Farside Investors

Farside Investors

CoinGlass

CoinGlass