3 reasons Stellar (XLM) saw a 166% rally within five days

3 reasons Stellar (XLM) saw a 166% rally within five days 3 reasons Stellar (XLM) saw a 166% rally within five days

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

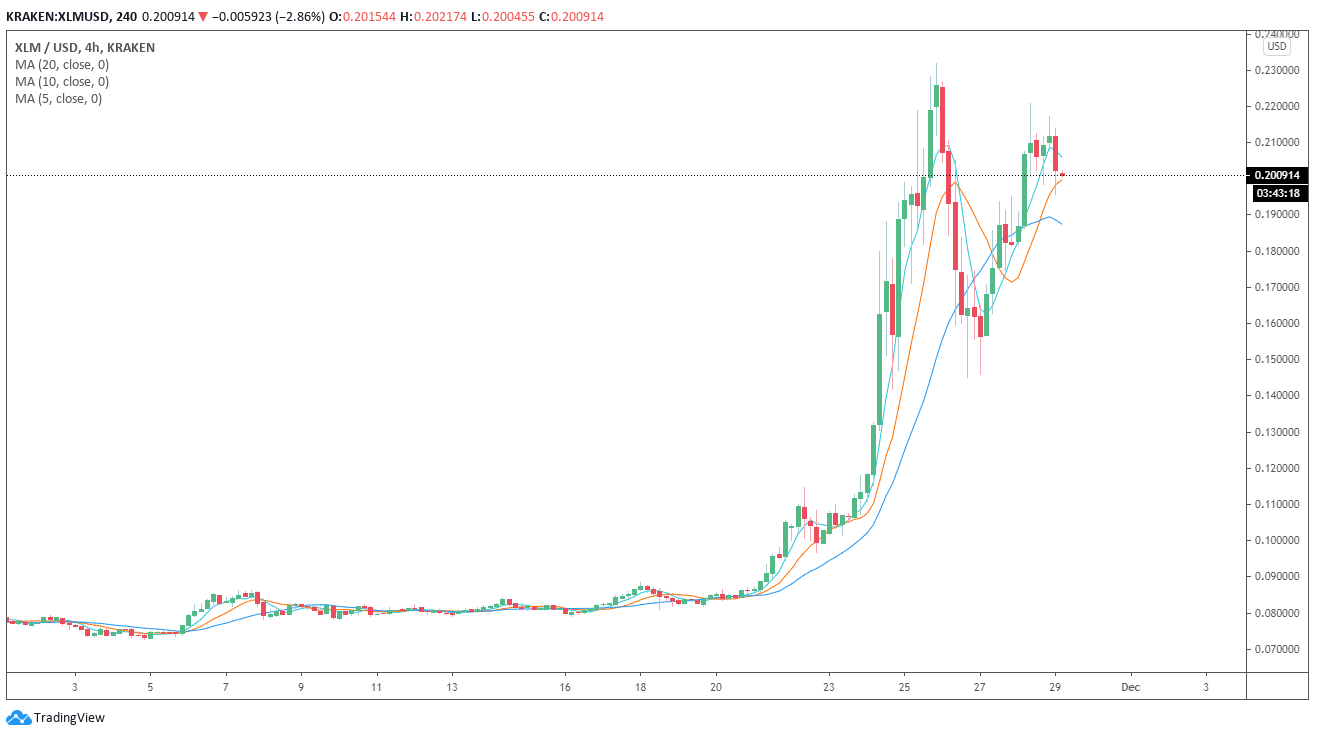

The price of XLM, the native cryptocurrency of the Stellar blockchain, has been showing strong momentum. There are three reasons why XLM saw a 166% rally in the past week.

The potential reasons are the consolidation of Bitcoin, technicals showing overbought conditions, and social media traction.

Bitcoin is consolidating, alts gain momentum

When the price of Bitcoin broke above $17,000, altcoins began to rally. Based on market trends seen in January 2018, when altcoins spiked after BTC peaked, traders likely saw limited upside on BTC and began trading altcoins.

The altcoins that led the 2018 altcoin mania began to see major rallies first. XRP, for instance, suddenly increased from sub-$0.40 to as high as $0.9 on Coinbase. This allowed XLM and other large market cap altcoins to increase.

But, in the near term, altcoins face a roadblock. The price of Bitcoin is consolidating after a relief rally to $17,800 across major exchanges. Considering that the $18,000 level remains a heavy resistance level, altcoins could demonstrate lower momentum in the short term.

Altcoins would likely see a resurgence in upside momentum if BTC connivingly breaks out of the $18,000 level. Until that happens, altcoins, which generally have lower liquidity and thinner order books than BTC, could stagnate.

In the foreseeable future, analysts anticipate the price of BTC to remain under $18,000. Unless a strong breakout occurs, technical analysts believe the lack of volume during the weekend makes the rally questionable.

XLM technicals show overbought conditions

According to Cryptowat.ch, a cryptocurrency market data provider, XLM’s daily Relative Strength Index (RSI) is showing overbought levels.

Analysts at Cryptowat.ch said:

“Despite #Stellar correcting lower 37% from it’s $0.23 top, #XLM has bounced back over 11% today & 30% since its recent $0.145 low. $XLM’s daily-RSI is still ‘overbought’ and now rising.”

This indicates that the buyer demand for XLM has been high for an extended period. The frenzy around altcoins and the demand for assets with thinner order books than BTC likely led XLM to rise.

XLM has also historically seen a trend where it rallies in tandem with XRP. The recent cycle saw a similar trend, as the two assets simultaneously rallied. Some traders, including the pseudonymous technical analyst “Squeeze,” pinpointed this trend. The trader said:

“$XLM is in a bull market on its own and unfazed by $BTC. Previously $XRP was leading $XLM was the laggard. This time $XRP’s the laggard? Still holding spot anyways.”

Social volume was high

Santiment, an on-chain analysis firm, said that the social media traction of XRP, XLM, XVG, and ADA has been high. The firm said:

“$XRP is somewhat cooling off after its fantastic +160% rally, but that hasn’t slowed it down from continuing to be the #1 #crypto topic, according to @santimentfeed metrics. $XLM, $XVG, and $ADA are also getting a significant uptick in discourse.”

The combination of an abrupt rise in social media popularity and the overall uptick in the altcoin market’s trading volume likely cause XLM and other large altcoins to rally.

Stellar Market Data

At the time of press 1:52 am UTC on Nov. 30, 2020, Stellar is ranked #11 by market cap and the price is up 3.95% over the past 24 hours. Stellar has a market capitalization of $4.36 billion with a 24-hour trading volume of $1.03 billion. Learn more about Stellar ›

Crypto Market Summary

At the time of press 1:52 am UTC on Nov. 30, 2020, the total crypto market is valued at at $552.39 billion with a 24-hour volume of $152.59 billion. Bitcoin dominance is currently at 61.75%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass

Blockchain.com

Blockchain.com

Farside Investors

Farside Investors