Why Bitcoin traders are considering a bigger drop as BTC price falls 30% in past month

Why Bitcoin traders are considering a bigger drop as BTC price falls 30% in past month Why Bitcoin traders are considering a bigger drop as BTC price falls 30% in past month

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Bitcoin price has fallen by nearly 30 percent since rising to as high as $10,600 in October. Technical analysts have started to consider a further pullback to the high $6,000 region.

On Oct. 21, due to a cascade of short liquidations on major margin trading platforms like BitMEX, the Bitcoin price spiked above the key psychological level of $10,000.

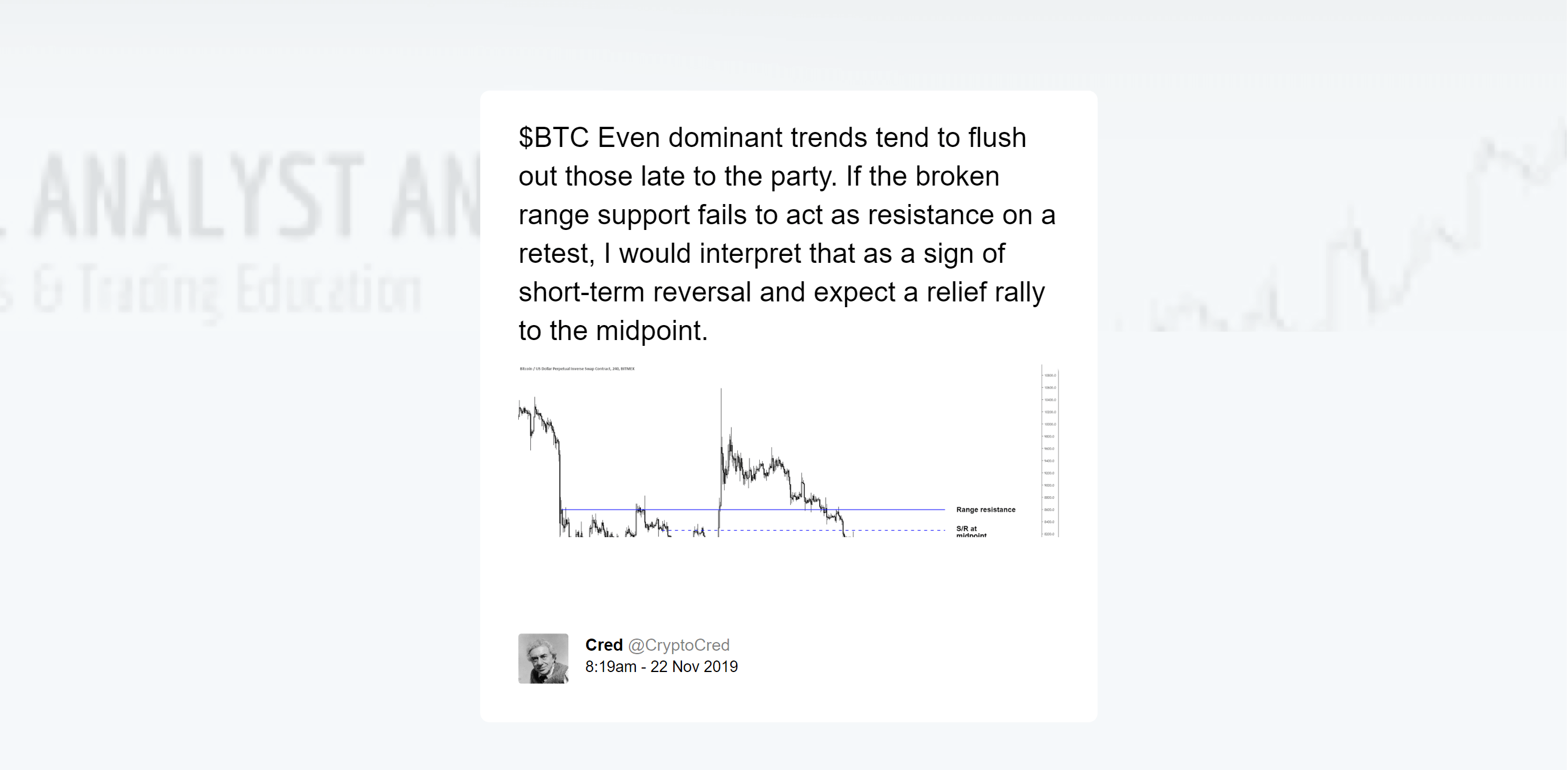

Since then, Bitcoin has struggled to regain momentum, dropping below an important support level of $7,700 in the past two days and becoming vulnerable to a larger correction to the $6,300 to $6,800 range.

Is a drop below $7,000 for Bitcoin likely at this point?

When the volume in the cryptocurrency exchange market fails to rebound and sell pressure continues to build, it leaves Bitcoin with a greater risk of a short term slump.

Throughout the past week, the bulls have been unable to respond to the growing sell pressure, despite the growing number of shorts on margin trading platforms.

Historically, when the funding rate on BitMEX turned negative, which indicates that there are more short contracts open on the exchange than longs, it has led to frequent so-called stop hunts, causing the price to spike by “hunting” for short contract liquidations or stops.

However, possibly due to the low volume and the intensity of the selling pressure, the Bitcoin price has not shown substantial short term spikes to the upside to test key resistance levels.

In the near future, as said by technical analysts like Josh Rager, the failure of Bitcoin to maintain a crucial level at $7,700 is likely to cause a drop to the $6,000 region, with traders considering $6,800 as an imminent target.

Rager said:

“Bitcoin price at a key area with monthly support area at $7725 and the current VWAP (Volume weighted average price) is at $7717 This marks more of a realistic value for Bitcoin & I’m hopeful as long as price stays above $7700 – if not, I see price hitting $6ks.”

As factors of the decline and the potential drop of bitcoin, analysts point towards BTC dropping below the breakeven price of mining that is said to be above $8,000 and the noticeable decline in volume in the market in general.

Altcoin market takes a bigger hit

Following the plunge of the Bitcoin price almost overnight, the price of Ethereum has dropped from $180 to $155, by around 14 percent against the U.S. dollar.

Both against Bitcoin and the U.S. dollar, most major alternative cryptocurrencies like XRP, ETH, and Bitcoin Cash have performed poorly in the past several days.

Bitcoin Market Data

At the time of press 4:09 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is down 6.8% over the past 24 hours. Bitcoin has a market capitalization of $135.16 billion with a 24-hour trading volume of $25.28 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:09 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $204.24 billion with a 24-hour volume of $87 billion. Bitcoin dominance is currently at 66.33%. Learn more about the crypto market ›