What does Yearn.finance’s merger spree mean for DeFi?

What does Yearn.finance’s merger spree mean for DeFi? What does Yearn.finance’s merger spree mean for DeFi?

Photo by Cytonn Photography on Unsplash

Just ahead of the long-awaited Ethereum 2.0 upgrade, Andre Cronje of Yearn Finance prepares for the next phase of DeFi growth with a flurry of mergers. What does it say about the state of DeFi?

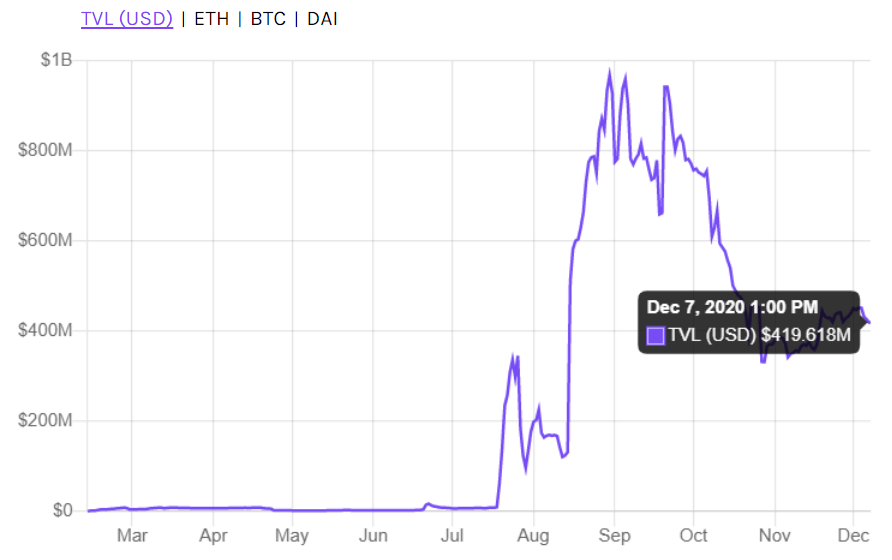

Since its launch on July 17th, 2020, Yearn Finance had been envisioned as an aggregator platform encompassing various lending protocols, with the most popular being Aave and Compound. However, recent events suggest Yearn is on a fast-track to become the go-to, one-stop DeFi platform thanks to a slew of recent mergers. These involve a total of five DeFi platforms:

- SushiSwap (SUSHI) – TVL at $983 million. As a Uniswap fork, SushiSwap provides an automated market maker (AMM) – a decentralized exchange powered by smart contracts. AMM is effectively a synonym for DeFi from its initial stage when Uniswap launched in November 2018.

- Pickle Finance (PICKLE) – TVL at $23 million. With its Pickle Jars, it provides liquidity pools for top stablecoins: USDC, DAI, sUSD, and USDT.

- C.R.E.A.M.Finance (CREAM) – TVL at $145 million. CREAM stands for Crypto Runs Everything Around Mea. This Compound fork provides token swap, payment, borrowing, lending, and tokenization.

- Cover Protocol (COVER) – TVL at $35.8 million. Cover provides insurance/coverage against smart contract risk.

- Akropolis (AKRO) – TVL at $30.3 million. This protocol provides saving, borrowing, and lending. Its AkropolistOS creates for-profit DAOs (decentralized autonomous organizations), Sparta supports uncollateralized lending, and its Delphi provides a yield farming aggregator.

Moreover, Yearn made a deal with the Argent crypto wallet provider, allowing users to more easily access Yearn Vaults. Further details of each announced merger can be found on Andre Cronje’s official blog, the South African blockchain entrepreneur who created Yearn Finance, which has a current TVL of $419.6 million.

As you can just tell at a glance from the type of protocols to be merged with Yearn Finance, these deals serve to eliminate a lot of overlap. In turn, developers from varying DeFi projects will be left free to focus on their special strengths and services, while continuing to bring innovation into the DeFi space at a more productive pace. Given that the developers’ job market is set to increase by 15% before 2026, this will likely spur even more infusion of talent into DeFi projects.

Yearn Finance to Become the PayPal of DeFi?

Although Yearn is still in beta and these mergers await its V2 upgrade, the aggregator DeFi platform is poised to cover everything one would need from DeFi, from convenience and access to all DeFi services to peace of mind in the form of insurance. Creating Yearn Finance as a DeFi aggregator itself was a very clever move.

After all, aggregator sites tend to be the ones that are the most likely to be bookmarked. This holds true for all kinds of sites, from ones where you select PC components to ones where you can catch up on news, launches of movies and video games. Therefore, if all goes well with the integrations, Andre may just become the second most famous entrepreneur from South Africa, right after Elon Musk.

In addition to these mergers and the aggregative nature of Yearn Finance, let us not look past an admirable play by Andre. He limited the pool of YFI tokens to merely 30,000, which boosted the value of its YFI tokens to one that surpasses even Bitcoin (BTC). All of these factors are likely to converge to create a powerful network effect – more people participating in the platform’s services, which then attracts even more people.

This is how many platforms started and entrenched their market position, from PayPal to Twitter and Facebook, withstanding the later influx of competitors. Even if that doesn’t happen for Yearn Finance, these mergers show that we are entering a period of DeFi consolidation, just as we have left the period in which thousands of altcoins are delegated to the bin of digital history.

It is only likely that other developers in the DeFi space will come to the same conclusion. Therefore, as soon as the upcoming year, it’s possible to see a frenzy of mergers, spurred by Yearn Finance. However, as almost all DeFi platforms are based on the Ethereum blockchain, they will have to face the ongoing obstacle of Ethereum’s congestion due to its much-belated upgrade. Hopefully, Ethereum 2.0 will be fully deployed next year, but the process will likely cause some hiccups along the way.

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass