UNI, SNX, and DeFi tokens recover on Yearn.finance (YFI) lead: what’s next?

UNI, SNX, and DeFi tokens recover on Yearn.finance (YFI) lead: what’s next? UNI, SNX, and DeFi tokens recover on Yearn.finance (YFI) lead: what’s next?

Photo by Bruno Nascimento on Unsplash

Decentralized finance (DeFi) tokens, including Uniswap (UNI) and Synthetix Network (SNX) are recovering with the lead of Yearn.finance (YFI). Following brutal 40% to 50% corrections across the market, the DeFi space is taking a breather.

Since its peak on September 13 at $43,390, YFI dropped by more than 50% to as low as $21,640. Since its bottom on September 21, YFI rebounded by 13% to $24,500, posting a solid recovery.

With YFI’s lead, other DeFi tokens recorded 10% to 20% gains in the last 12 hours.

UNI, in particular, rose by nearly 20% within a four-hour span, the spot market stabilized and futures contracts neutralized.

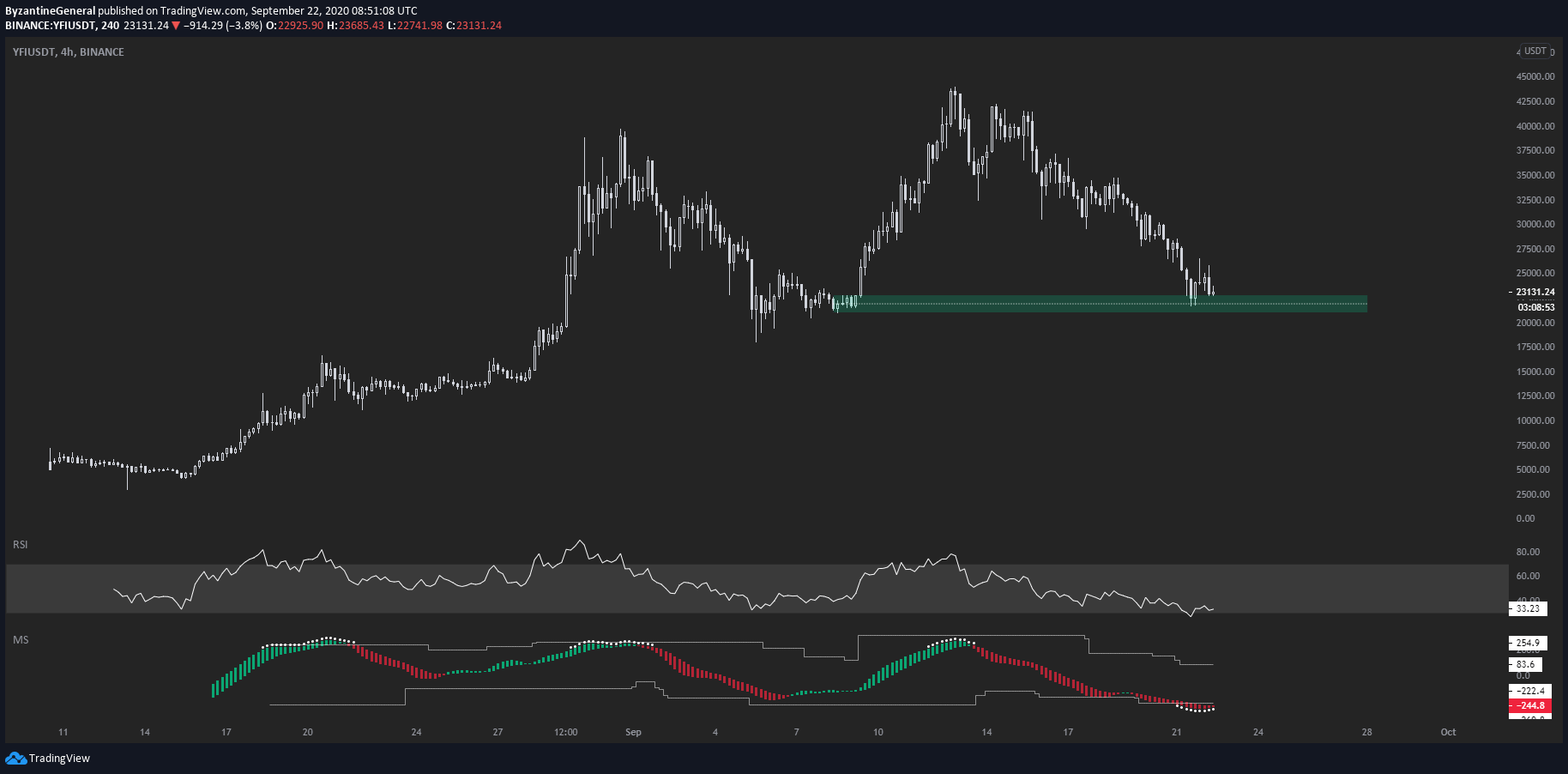

On-chain indicators show that DeFi tokens, especially YFI, are heavily oversold. According to the pseudonymous trader known as “Byzantine General,” YFI has nevern been this oversold since its Binance listing on August 11.

YFI has climbed from $5,010 to over $43,000 within 33 days since the listing on Binance. The recent YFI pullback marks the asset’s steepest fall to date.

But after a 50% drop, on-chain indicators show YFI is massively oversold. The trader explained, “YFI hasn’t been this oversold since it got listed on Binance.”

The market seems to be reacting to the strong recovery of DeFi tokens in the last 72 hours. Following YFI’s 10% recovery at a critical support area, UNI and SNX both surged in tandem.

What happens next to Yearn.finance and Ethereum?

Due to the sheer intensity of the rally of DeFi tokens, a pullback was widely expected. The magnitude of the recent correction surprised many traders, but it was necessary to neutralize the markets.

The correction also coincided with the end of a minor DeFi cycle. Primitive Crypto founding partner Dovey Wan explained:

“UNI airdrop is the last drop of the unsustainable money printing in Defi world. Others were simply selling unrealistic story of Uni killer for an over-expected token price via noobs market buy. When Uni slayed them, it’s when all are back to the natural process of hype cycle.”

As such, a pullback at the time DeFi tokens plunged was healthy, as long as another major drop does not occur. As an example, YFI has stayed above the key $20,000 support level convincingly, and that could be critical in supplementing the next rally.

Prior to the drop, a cryptocurrency trader known as “Flood” suggested an ETH drop below $350 would cause another 20% drop for DeFi tokens. The DeFi market is coming off a large drop within a short period, raising the probability of a strong recovery.

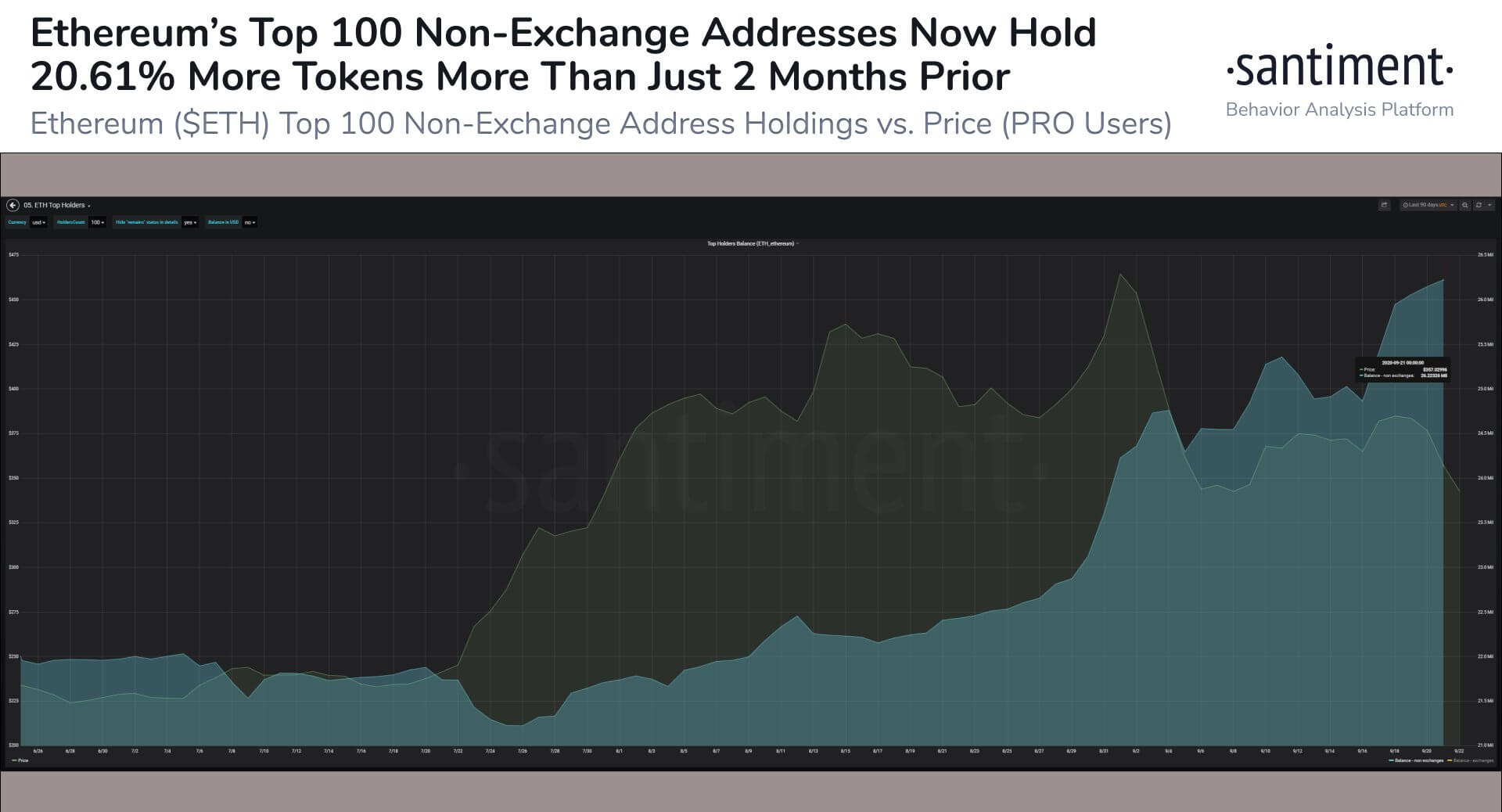

The on-chain market data provider Santiment reported that the fundamentals of Ethereum also remain strong. For DeFi tokens, the resilience of Ethereum would provide a favorable backdrop for recovery.

The researchers at Santiment found that non-exchange addresses on Ethereum are not slowing down. They said:

“The top 100 Ethereum non-exchange addresses are not slowing down one bit on their accumulation. Santiment data indicates these whales now hold 26.22M ETH combined, a +20.61% increase in cumulative holdings, compared to 21.74M held 2 months ago.”

The data shows that both ETH and DeFi tokens are seemingly recovering simultaneously, backed by oversold indicators and growing user activity.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass